Research Summary

This report offers insights into diverse economic and financial trends. Topics covered include government interest spending, increasing interest in TIPS, the relationship between the S&P 500 and 10-year note yields, consumer loans, global manufacturing PMI, youth unemployment in China, and wealth disparity within OECD nations. Further insights touch on bankruptcies in England & Wales, interventions by Japan’s central bank, consumer patterns on Amazon, Spotify’s lead in music streaming, and potential recession indicators in England & Wales.

Actionable Insights

- Government Spending: Interest spending is nearing $1T/year, with government debt set to rise by approximately $5.2b per day over the next 10 years.

- Inflation Concerns: Interest in TIPS is on the rise for the first time since August 2022, reflecting renewed inflation concerns.

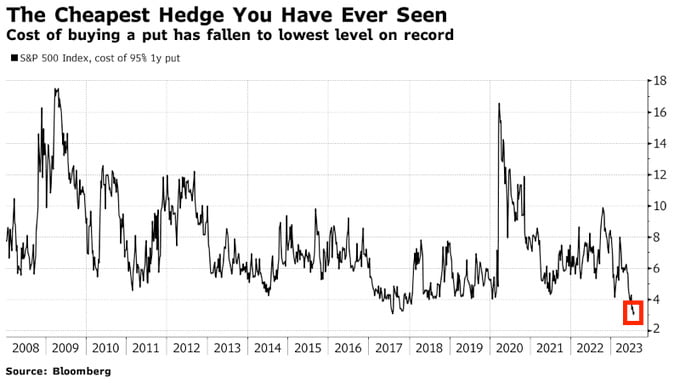

- Hedging Opportunities: Hedges have become quite cheap in both the S&P 500 and many single stock options, indicating a good time to consider hedging long positions.

- Consumer Behavior: Signs of slowing consumer activity are evident, with Amazon taking measures to improve margins.

- Global Manufacturing: A meaningful multi-month contraction in global manufacturing PMI has been observed.

- Youth Unemployment in China: Record-high youth unemployment in China signals troubling economic signs.

- Wealth Inequality: The US has the worst wealth inequality within OECD countries, the worst since the Roaring 20s.

- Bankruptcies in England & Wales: Bankruptcies are surging close to the Great Financial Crisis peak, indicating potential economic dislocation.

- Japan’s Central Bank Actions: The central bank is attempting to increase the cap on its yield curve, intervening to prevent rapid yield rises.