Research Summary

This report provides a comprehensive overview of the current economic and financial landscape, covering key areas such as China’s economic challenges, the European economic landscape, US consumer and housing trends, global market trends, and insights into energy and shadow banking. The analysis includes detailed charts and observations on various economic indicators, market behaviors, and potential future trends. The report offers valuable insights for investors, policymakers, and financial analysts, reflecting on the complex interplay of global economic forces.

Key Takeaways

China’s Economic Challenges

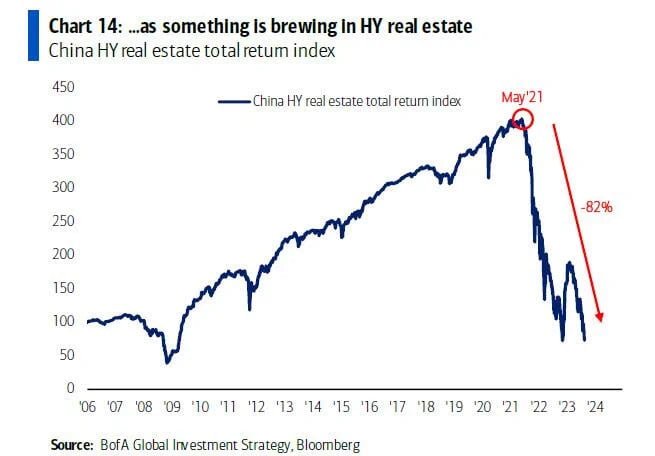

- Concerns in Real Estate: China’s real estate market is facing growing concerns with high-yield real estate debt falling and major developers facing financial difficulties.

- Slowing Economic Growth: China’s slowing economic growth is potentially the worst three-year trend since 1976, indicating a maturing economy likely to slow further.

- Corporate Debt Dynamics: Chinese corporate debt appears to be pricing deflation, with an increasingly deep inversion against US corporate 10-year debt.

European Economic Landscape

- Slowing Economy: Europe is slowing into a potential recessionary environment, with core inflationary pressures remaining a concern.

- UK Labor Market: In the UK, public sector wages soared 9.6% year-over-year, driving inflationary pressure, particularly in services.

US Consumer and Housing

- Household Savings Exhausted: US consumer’s household savings are nearly exhausted, leading to potential borrowing pressure.

- Housing Affordability: Elevated prices have created the lowest level of housing affordability on record in the US.

Global Market Trends

- Rate Dynamics: Asset managers are positioned for rates to peak, but resilience in the economy may see rates rise more.

- Equity Valuations: Equities are looking expensive, with equity risk premium at the lowest level since June 2004.

Energy and Shadow Banking

- Energy Exposure: CTAs have increased exposure to oil, with projections looking for appreciably higher prices.

- Shadow Banking Growth: The shadow banking system has become significantly larger compared to traditional banks, raising questions about systemic risk.

Actionable Insights

- Monitor China’s Real Estate: Investors should closely watch China’s real estate market for signs of further distress, as it may have broader implications for the global economy.

- Assess European Inflation: Policymakers in Europe must balance the slowing economy with inflationary pressures, potentially impacting monetary policy decisions.

- Consider US Housing Affordability: The decline in US housing affordability may have long-term effects on consumer behavior and the housing market.

- Evaluate Equity Valuations: Investors should be cautious with equity valuations at current levels, as they may be signaling overvaluation in certain markets.

- Explore Energy Opportunities: Increased exposure to oil and energy markets may offer investment opportunities as projections indicate higher prices.