Podcast Summary

In this podcast, Rune Christensen, the founder of MakerDAO, shares his audacious plan to transform DAO governance. He introduces the concept of “End Game,” focusing on strong rules, boundaries, and AI tools. The discussion also covers the Spark Lending Protocol, the enhanced DAI savings rate, regulatory challenges in the U.S., and strategies to reduce Rune’s ownership in MakerDAO. The conversation emphasizes stability, growth, innovation, and legal resilience in the crypto space.

Key Takeaways

Rune Christensen’s Vision for DAO Governance

- Introduction of End Game: The podcast discusses the introduction of “End Game” in DAO governance, focusing on creating strong rules, boundaries, and AI tools to enable a more streamlined and gamified process.

- Delegates and Decision Making: The system emphasizes the role of delegates, providing them with tools and data to make informed decisions, while ensuring alignment with the overall objectives of stability and mitigating tail risk.

- Focus on Stability: The core needs to remain stable, focusing on basic objectives, while experimental aspects are handled in sub-DAOs, ensuring that the main system remains uncorrupted.

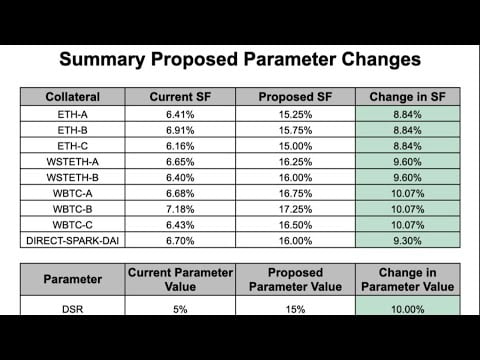

Spark Lending Protocol and Enhanced DAI Savings Rate

- Introduction of Spark Protocol: The first sub-DAO, Spark Protocol, aims to experiment with collateral types and mitigate losses, focusing on growth and demand for DAI.

- Enhanced DAI Savings Rate: The enhanced DAI savings rate initiative aims to grow the demand for DAI by offering yield, investing in growth, and signaling that DAI is about stability and yield.

- Focus on Growth: The strategy emphasizes growth and innovation, breaking stagnation in the space, and attracting a new wave of users without resorting to scams or hacks.

Regulatory Challenges and Compliance

- Uncertainty in the US: The podcast highlights the uncertainty and lack of clarity in US regulation, leading to the blocking of Americans from yield farming in the new system.

- Embracing Crypto in Other Jurisdictions: Countries like South Korea and Japan are praised for embracing crypto and providing stable environments, signaling a positive direction for global crypto regulation.

- Legal Resilience: The system includes legal resilience funds and research to adapt and predict future regulatory actions, ensuring protection for users and the system.

Ownership and Mitigation of Concentration

- Reduction of Rune’s Ownership: The plan includes reducing Rune’s ownership to under 10% of the supply of MKR, ensuring that the system can operate without reliance on major stakeholders.

- Incentivizing Voter Participation: The system aims to incentivize voter participation, targeting 30-40% of all tokens voting, to reduce the influence of individual whales.

- Protection and Coordination: The system includes minority token holder protection and coordination mechanisms to handle potential abuses of voting power, ensuring resilience and integrity.

Sentiment Analysis

- Bullish: The podcast exhibits a bullish sentiment towards the future of DAO governance, with the introduction of innovative concepts like “End Game,” Spark Protocol, and enhanced DAI savings rate. The focus on growth, stability, and legal resilience reflects optimism in the crypto space.

- Bearish: There is a bearish sentiment regarding the regulatory challenges in the U.S., reflecting concerns and uncertainties in the current regulatory environment.

- Neutral: The discussion maintains a neutral stance on certain aspects, such as the complexities of hacking and the nuanced case of Tornado Cash, without expressing a definitive sentiment.