Research Summary

This report from Markets & Mayhem provides a comprehensive analysis of various economic indicators and trends. It covers topics such as the performance of stocks, the surge in housing prices, the widespread inflation, wealth disparities, the impact of taxes on population migration, the tightening of consumer loans, and the potential for further firming of oil and gold prices. The report also highlights the economic troubles in China.

Key Takeaways

Stock Market Performance

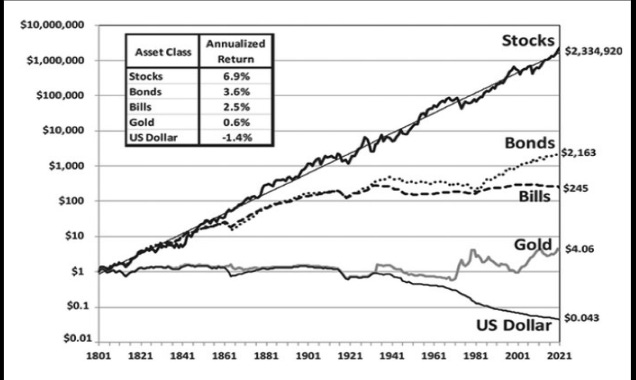

- Long-term Outperformance: Over the last 222 years, stocks have outperformed every other asset class with an average annualized return of 6.9%.

- Current Valuations: Recently, stock valuations seem stretched and less sensitive to rates, with a concentrated set of large companies leading the market performance.

- September Trends: Historically, September tends to be a difficult month for stocks, with the market closing down 55% of the time since 1928.

Housing Market Trends

- Surge in Prices: Housing prices, particularly in Canadian real estate, have surged, making the cost of buying a home in America expensive.

- Affordability Index: The surge in housing costs has brought the Goldman Sachs Housing Affordability index to all-time lows.

- Realtors vs. Availability: The level of Realtors in the US is near an all-time high, despite the lack of affordable homes.

Wealth Disparities

- Inflation and Millionaires: With inflation, the number of millionaires has risen in the US, but being a millionaire means less in 2022 than it did in 2000 due to reduced purchasing power.

- Generational Wealth Division: Baby boomers are the most wealthy generation, while millennials are not amassing wealth the same way that GenX had at the same age.

- Concentration of Wealth: The top 10% own 70% of US wealth, a level of concentration that has continued to rise over the last 23 years.

Actionable Insights

- Investigate the Potential of Gold: Gold has been surprisingly resilient with rates and the dollar rising, suggesting a potential de-risking scenario in broader markets.

- Monitor Consumer Lending: As consumer loans tighten and delinquencies rise, it suggests potential increases in unemployment claims and impacts on the economy.

- Consider the Impact of Wealth Disparities: The growing wealth disparity in the US, with 40% of adults having less than $1,000 in savings, could have significant social and economic implications.