Research Summary

The report discusses the concept of attention as a scarce resource in the crypto economy. It highlights how attention is a currency in the modern web, with Web2 companies leveraging it to sell products or services. In the token economy, attention is even more direct, with numerous Initial DEX Offerings (IDOs) competing for user attention and investment. The report also explores how attention impacts asset valuations in the crypto market, with examples from various crypto assets like Dogecoin, Cardano, and $SOS.

Key Takeaways

Attention as a Scarce Resource

- Attention in Crypto: The report posits that attention is the only scarce resource in the crypto economy. With an ever-increasing number of crypto assets and investment opportunities, the attention of investors becomes a critical factor.

- Attention as Currency: Web2 companies have long understood the value of user attention, using it as a form of currency. In the token economy, this concept is even more direct, with numerous IDOs competing for user attention and investment.

- Attention and Scarcity: Despite the seeming abundance of crypto assets, the report argues that truly valuable crypto assets have proven to be incredibly scarce over time. Most assets that outperformed Bitcoin over more than one bull/bear cycle are limited.

Impact of Attention on Asset Valuations

- Attention and Asset Valuations: The report explores how attention impacts asset valuations in the crypto market. It suggests that attention is the only factor impacting supply and demand variables that changes on the same cadence as the players in the crypto market.

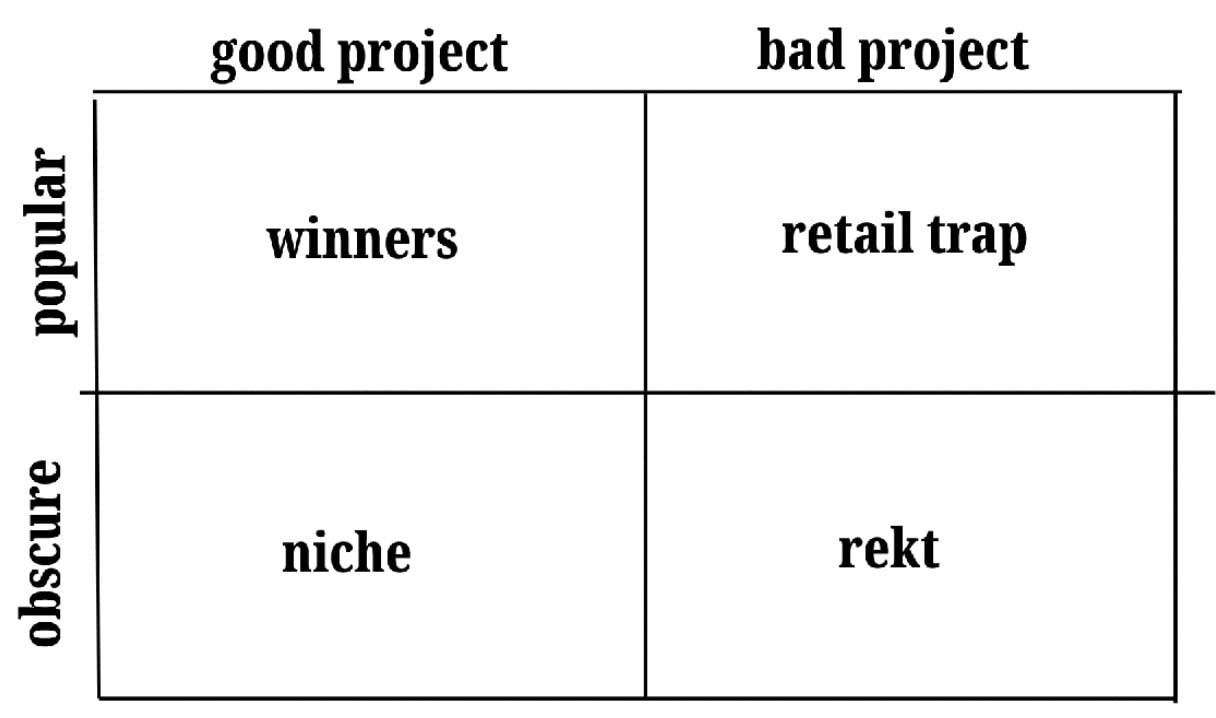

- Attention Chasm: Good traders aim to buy assets that are about to cross an “attention chasm” or realize their valuation potential. This period of “becoming favored” is where asset valuations experience the most change.

- Examples of Attention Impact: The report provides examples of how attention has impacted the valuations of various crypto assets, including Dogecoin, Cardano, and $SOS.

Actionable Insights

- Attention as a Trading Strategy: Traders and investors can leverage the concept of attention as a trading strategy. By identifying assets that are about to cross an attention chasm, they can potentially realize significant returns.

- Understanding Attention Dynamics: Understanding the dynamics of attention in the crypto market can help investors make more informed decisions. This includes understanding how attention impacts supply and demand, and how it influences asset valuations.

- Caution with Crypto Influencers: The report cautions against blindly following the advice of crypto influencers, who often turn user attention into a product for their advertising businesses. Instead, investors should conduct their own research and make informed decisions.