Research Summary

The report discusses multiple buy signals in stocks, bonds, and USD, indicating a high chance for mean reversion. It also covers the performance of Utes and an Ag play, with a focus on technical levels, momentum, and market sentiment.

Key Takeaways

Global Equity Indices and Buy Signals

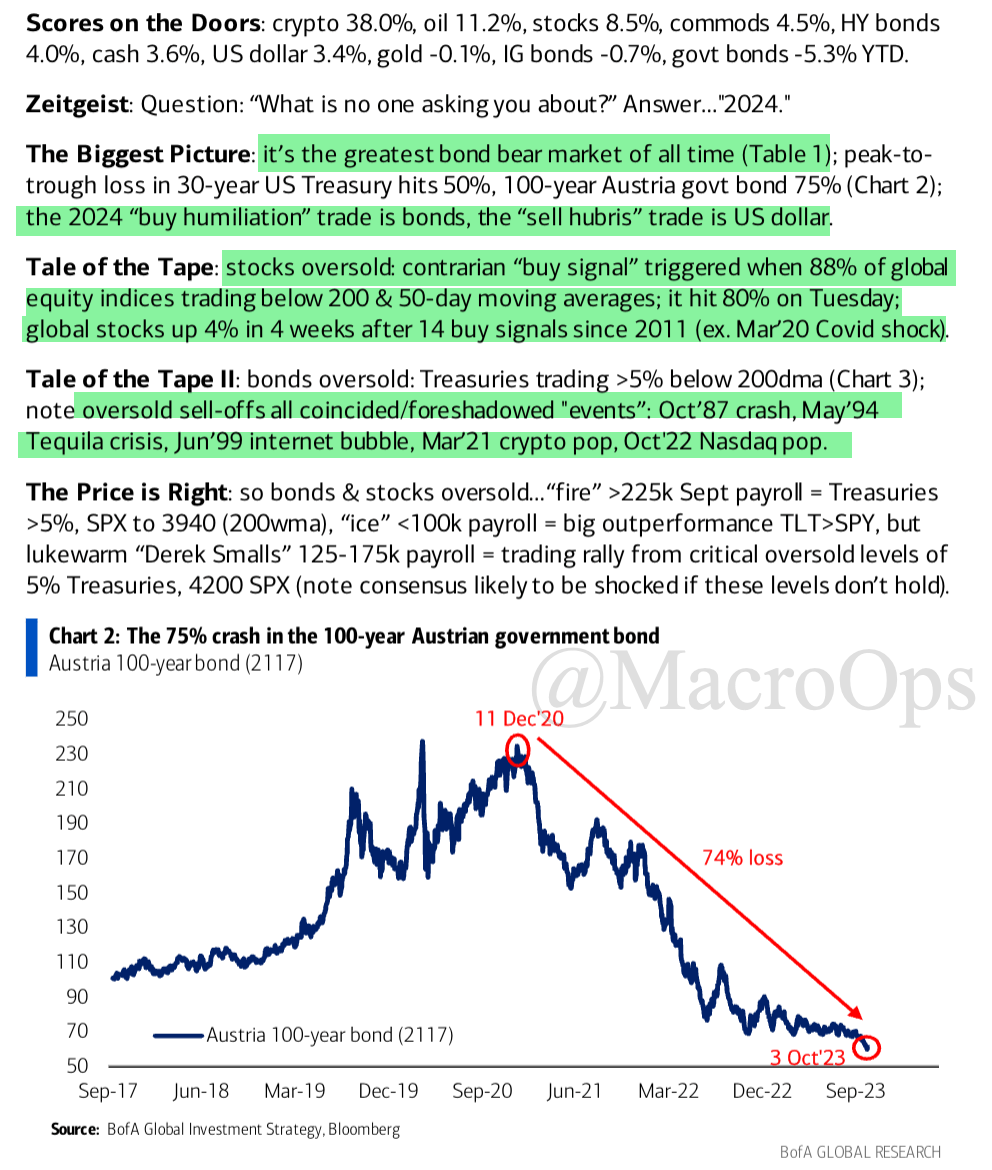

- Buy Signal Trigger: The report mentions a contrarian ‘buy signal’ triggered when 88% of global equity indices trade below their 200 & 50-day moving averages. This signal was close to being triggered as it hit 80% on a Tuesday, with global stocks up 4% in 4 weeks after 14 buy signals since 2011.

Technical Indicators and Market Momentum

- Put/Call Oscillator: The Total Put/Call oscillator triggered a buy signal as the indicator fell below 10%. This suggests a potential market reversal.

- Bonds and USD: Falling bonds (rising yields) have been driving the USD higher and stocks lower. However, the technicals suggest that bonds may have hit a near-term low, indicating a potential for mean reversion.

Employment Trends and Recession Indicators

- Employment Trends: The report highlights the trends in employment for the construction, trucking, and temporary hires relative to their 12-month moving averages. These trends correlate well with the main recession leads tracked in the report, pointing to a potential slowdown around the turn of the year.

Utility Sector Performance

- Utility Sector: The report mentions that the utility sector (Utes) is underperforming. However, when the composite score falls below -35%, the downside momentum in the S&P 500 Utility sector tends to persist over the following week but median returns, win rates, and z-scores show outstanding results across medium and long-term horizons.

Agricultural Play

- December Corn: The report highlights that December Corn is breaking out of a major volatility compression zone, suggesting a potential for higher prices. Positioning, sentiment, valuation, and seasonals are all supportive of a breakout higher.

Actionable Insights

- Monitor Global Equity Indices: Keep an eye on global equity indices trading below their 200 & 50-day moving averages as it could trigger a buy signal.

- Watch Bond and USD Movements: Pay attention to the movements in bonds and USD as they could indicate potential market reversals.

- Track Employment Trends: Follow employment trends in the construction, trucking, and temporary hires sectors as they could provide early indicators of a potential recession.

- Consider Utility Sector: Despite the current underperformance, the utility sector could offer potential returns in the medium to long-term horizon.

- Investigate December Corn: The breakout of December Corn from a major volatility compression zone could present a potential opportunity for gains.