Research Summary

The report provides a comprehensive review of the third quarter in the DeFi sector, highlighting key narratives, top projects, and future trends. It discusses the impact of Real World Assets (RWAs), SocialFi, and Telegram Bots on the DeFi landscape. The report also identifies Base, EigenLayer, and Solana as significant projects in Q3 and provides insights into potential future developments in the sector.

Key Takeaways

Real World Assets (RWAs) in DeFi

- Increasing Role of RWAs: The report highlights the growing importance of RWAs in the DeFi sector. RWAs, which involve tokenizing traditional assets, have been on the rise while other DeFi metrics have been trending downwards. Top protocols like stUSDT and Ondo have shown significant growth.

- Impact on Yield: The introduction of RWAs could serve as a new source of yield in the DeFi space. For instance, MakerDAO has been successful in bringing treasury yield on-chain, leading to a rise in its price from $830 to $1,530 in Q3.

SocialFi’s Emergence

- Surprise Narrative of Q3: SocialFi, which involves tokenizing influencer accounts, has provided much-needed activity and interest in the DeFi market. Friend.tech, a leading platform in this sector, has seen significant user engagement and transaction volume.

- Competitive Landscape: The success of Friend.tech has led to the emergence of competitors in the SocialFi space, including Post.tech on Arbitrum and StarsArena on Avalance.

Telegram Bots in DeFi

- Emerging Trend: Telegram bots, which allow users to trade crypto tokens from the Telegram interface, have been identified as a narrative with significant potential. These bots can perform advanced tasks such as copy-trading, handling airdrops, and portfolio management.

- Improving User Experience: The report suggests that Telegram bots can help overcome one of the biggest challenges in DeFi – poor user interface and user experience. By consolidating activities into the familiar interface of Telegram, these bots can make DeFi more accessible to beginners.

Top Projects of Q3

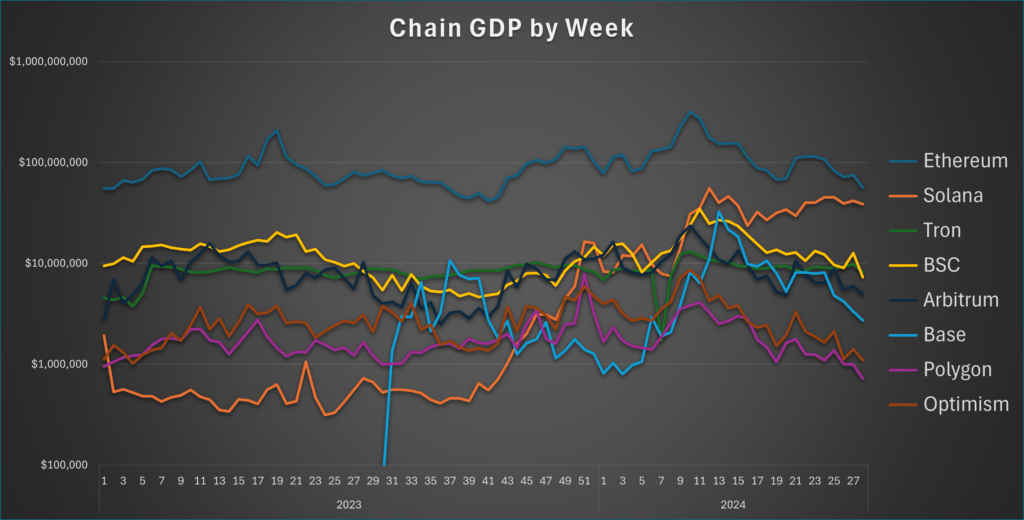

- Base: The Base chain, an Ethereum L2 powered by OP Stack, has been identified as a significant project in Q3. Despite being only two months old, it has become the third largest Ethereum rollup by Total Value Locked (TVL).

- EigenLayer: EigenLayer, a restaking protocol, has seen high demand since its launch. The protocol enables new tokenomics mechanisms and increases the rate of actual innovation.

- Solana: Despite facing challenges, Solana has shown signs of a comeback with an active developer community and green numbers on its DeFi protocols.

Future Trends

- Arbitrum Ecosystem: The report suggests that the Arbitrum ecosystem could see significant activity due to a $50 million incentive program.

- Canto: Canto, a Cosmos chain that has recently announced its migration to be a ZK L2 on Ethereum, is another potential trend to watch.

- Ethereum’s Dencun Upgrade: The upcoming Dencun upgrade on Ethereum, which will make it cheaper for rollups to use Ethereum, could be a catalyst for Layer2 projects.

Actionable Insights

- Investigate the Potential of RWAs: Given the increasing role of RWAs in the DeFi sector, it could be beneficial to explore opportunities related to tokenizing traditional assets.

- Monitor Developments in SocialFi: With the emergence of SocialFi as a key narrative in Q3, it would be prudent to keep an eye on developments in this space, including new platforms and competitive dynamics.

- Consider the Impact of Telegram Bots: As Telegram bots continue to gain traction, understanding their potential impact on the DeFi user experience could provide valuable insights.

- Track Progress of Top Projects: Monitoring the progress of significant projects like Base, EigenLayer, and Solana could provide insights into future trends in the DeFi sector.

- Anticipate Future Trends: Keeping an eye on potential future trends, such as the Arbitrum ecosystem, Canto, and Ethereum’s Dencun upgrade, could help in identifying new opportunities in the DeFi sector.