Research Summary

The report discusses the likelihood of a recession in the U.S. economy, despite the Federal Reserve’s reluctance to lower interest rates in the short term. It emphasizes the importance of Treasury Notes yields, unemployment rates, savings, loans, and oil prices as indicators of economic conditions. The report also highlights the non-linear nature of recessions and the need for distribution predictions for future data.

Key Takeaways

Understanding Recession Indicators

- Non-linear nature of recessions: The report emphasizes that recessions are non-linear events, and linear thinking logic using current data may not accurately predict them. It suggests that Treasury Notes yields, unemployment rates, savings, and loans are more reliable indicators of economic conditions.

- Unemployment rate predictions: The Federal Reserve predicts the unemployment rate will rise from 3.8% in 2023 to 4.1% in 2024. However, the report suggests there is a one-third probability that the unemployment rate will spike to over 7%.

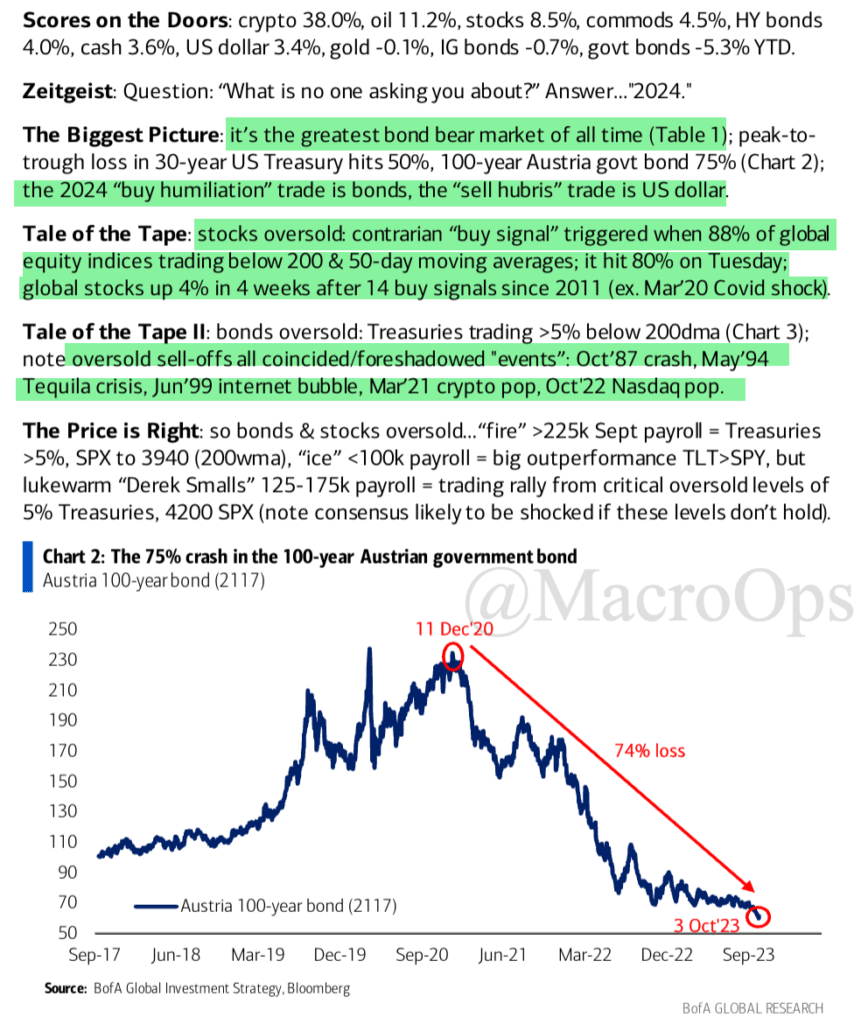

- Impact of oil prices and Treasury Notes yields: Rising oil prices and higher borrowing costs, indicated by the yield on 10-year Treasury Notes reaching 4.6%, are seen as warning signs of a recession. These factors suppress resident spending and push the stock market into a downward channel.

- Deposits and loans: The report suggests that robust household spending, a key argument for a soft landing, may not hold as consumers typically continue to purchase strongly until the point of recession. Current data shows that the poorest 80% of the population now have less cash on hand than before Covid, while loan default rates are soaring.

Interpreting the Inevitability of Recession

- Public sentiment and recession: The report discusses the role of public sentiment in predicting a recession. It suggests that overwhelming optimism does not guarantee an impending recession. Instead, it argues that the more confidence the public has in the future, the more likely consumption will remain robust, reducing the likelihood of an economic recession.

- Underlying logic leading to recession: The report argues that the unemployment rate, deposits, and loans can genuinely predict future consumption levels. It suggests that if all three sources are diminishing, consumption is unlikely to remain strong, leading to a recession.

- Role of Treasury Notes yields: The report highlights the yield spread between 10-year and 2-year Treasury Notes as a leading indicator of recession. It suggests that the current economic situation during this inversion reversal is worse than in the past, with the U.S.’s fiscal situation deteriorating and the fiscal deficit reaching $1.5 trillion in the first 11 months of the 2023 fiscal year.

Actionable Insights

- Investigate the Potential of Treasury Notes yields: The report suggests that the yield spread between 10-year and 2-year Treasury Notes is a leading indicator of recession. This could be a key area for further investigation and analysis.

- Consider the Impact of Unemployment Rates, Deposits, and Loans: These factors are highlighted as key predictors of future consumption levels. Understanding their current trends and potential future trajectories could provide valuable insights into the likelihood of a recession.

- Assess the Role of Public Sentiment: The report discusses the role of public sentiment in predicting a recession. Evaluating current public sentiment and its potential impact on consumption could be a useful exercise.