Research Summary

The report provides an in-depth analysis of Rollbit, a gaming and gambling platform that offers a casino, sportsbook, and futures trading platform. It discusses the platform’s revenue generation, tokenomics, game offerings, and potential growth catalysts. The report also highlights the risks and challenges Rollbit may face, including regulatory issues and market competition.

Key Takeaways

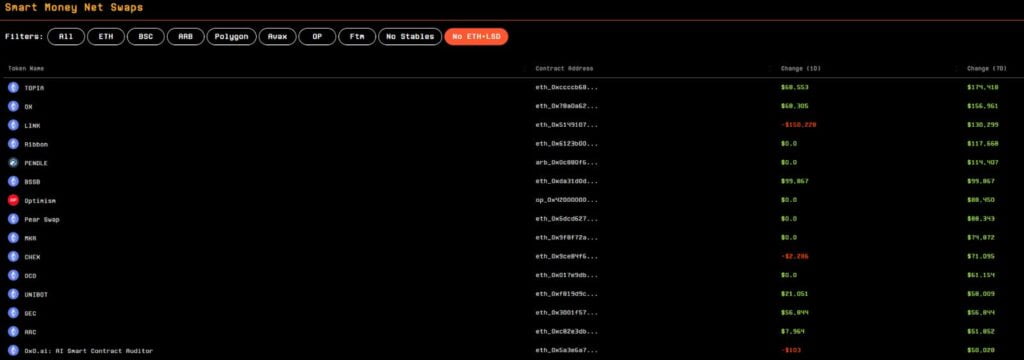

Rollbit’s Revenue Streams and Tokenomics

- Revenue Generation: Rollbit generates revenue through its casino, sportsbook, and futures trading platform. The casino generates a daily average revenue of $912,166, the sportsbook $174,812, and the futures trading platform $280,720.

- Token Burn: Rollbit burns a portion of its revenue, leading to a daily burn of $91,216.6 from the casino, $34,962.4 from the sportsbook, and a significant amount from the futures trading platform.

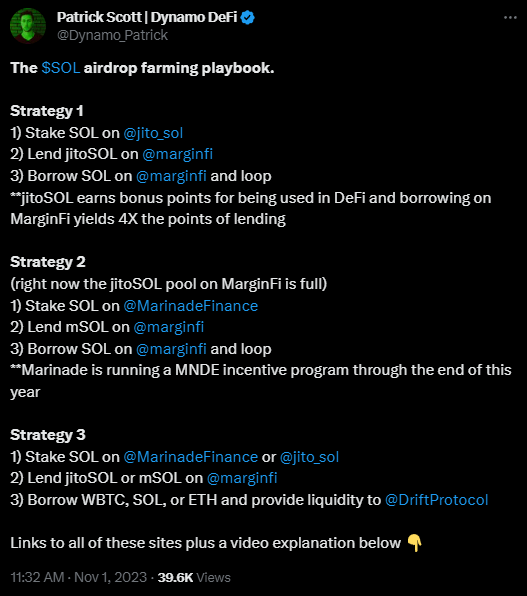

- RLB Token: The RLB token was launched on Solana with an initial supply of 5 billion tokens. The token plays a crucial role in the platform, offering benefits such as rakeback and reduced trading fees for holders.

Rollbit’s Game Offerings

- Variety of Games: Rollbit offers a wide range of games, including Plinko, X Flip, Rollbit Bonanza, X-Roulette, X-Crash, RollerCoaster, Sidebets, NFT Lootboxes, NFT Jackpot, and more.

- Unique Betting Mechanics: Each game on Rollbit has different betting mechanics, risk levels, and rewards, allowing players to strategically choose where to place their bets.

- Provable Fairness: Games like Plinko are provably fair, with a randomly-generated secret seed and the option for players to provide their own seed. The results can be verified for transparency and fairness.

Rollbit’s Growth Prospects

- Market Position: Rollbit has gained 7.8 million new users since January 1st, 2023, and ranks 6th in terms of page views and monthly visits among similar platforms.

- Valuation: Based on discounted cash flow analysis, the projected value of RLB is $0.247, a 52% increase from current prices. Rollbit is relatively undervalued compared to competitors like Flutter and DraftKings.

- Growth Catalysts: The introduction of new products, effective marketing strategies, and the development of a mobile app could boost Rollbit’s visibility and user acquisition efforts.

Rollbit’s Risks and Challenges

- Regulatory Risks: Rollbit faces potential regulatory challenges in the casino sector and with its crypto trading site. The RLB token could potentially be considered an unregistered security by regulators.

- Market Competition: The online gambling market is highly competitive, with numerous established players and new entrants. Market saturation may limit growth opportunities and lead to pricing pressures.

- Smart Contract Risks: As with all decentralized applications, Rollbit faces the potential for exploitation or malfunctioning of smart contracts.

Actionable Insights

- Mobile App Development: Rollbit could enhance its accessibility and user experience by developing a mobile app, especially a Progressive Web App (PWA), which functions like native mobile apps and can be added to users’ home screens without paying Apple’s revenue fee.

- Strategic Token Burns: Rollbit could use token burns for marketing purposes to increase demand and create a sense of scarcity around its native tokens. Transparent communication about token burns to its user base could emphasize potential token value appreciation and long-term sustainability.

- Regulatory Compliance: Rollbit should stay abreast of changing and evolving gambling regulations to avoid non-compliance, which could result in fines, penalties, or shutdowns. It should also consider the potential classification of the RLB token as an unregistered security due to the material benefits flowing back to RLB holders through buyback and burn actions.