Research Summary

The report discusses the current state of the stock market, comparing it to the 1987 crash. It highlights the role of circuit breakers in preventing a 20% decline, the complacency of investors, and the unpredictability of stock direction based on fundamental analysis. The report also mentions the negative price reaction to Wall Street earnings, particularly in mega cap Tech, and the lack of support for the Nasdaq.

Key Takeaways

Comparison to 1987 Crash

- Similarities to 1987: The report suggests that the current market setup is eerily similar to the 1987 crash, but circuit breakers installed after the 1987 crash make a 20% decline almost impossible.

- Role of Circuit Breakers: The report explains that circuit breakers, which pause trading at declines of -7%, -13%, and -20%, were triggered at the onset of the pandemic in March 2020, preventing a 20% decline.

Investor Complacency and Unpredictability of Stock Direction

- Investor Complacency: The report notes that investors are more complacent now than they were going into March 2020, which could potentially lead to a market drop.

- Unpredictability of Stock Direction: The report argues that fundamental analysis is not a reliable predictor of stock direction, as evidenced by the negative price reaction to Wall Street earnings “beats”, especially in mega cap Tech.

Negative Price Reaction and Lack of Support for Nasdaq

- Negative Price Reaction: The report highlights that despite earnings beats, mega cap Tech stocks have seen heavy selling, indicating that Wall Street earnings predictions are not reliable.

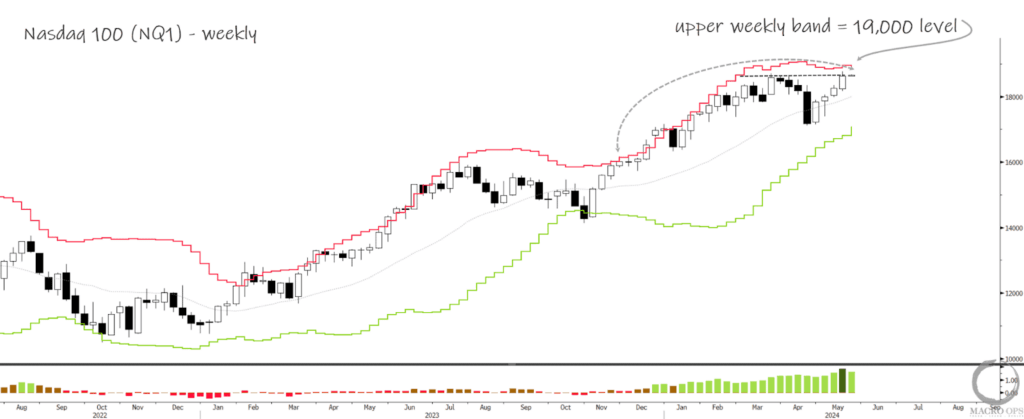

- Lack of Support for Nasdaq: The report states that the Nasdaq is now through all levels of support, suggesting potential further declines.

Actionable Insights

- Investigate the Potential: Given the current market conditions, it may be beneficial to investigate the potential for further declines, particularly in mega cap Tech stocks.

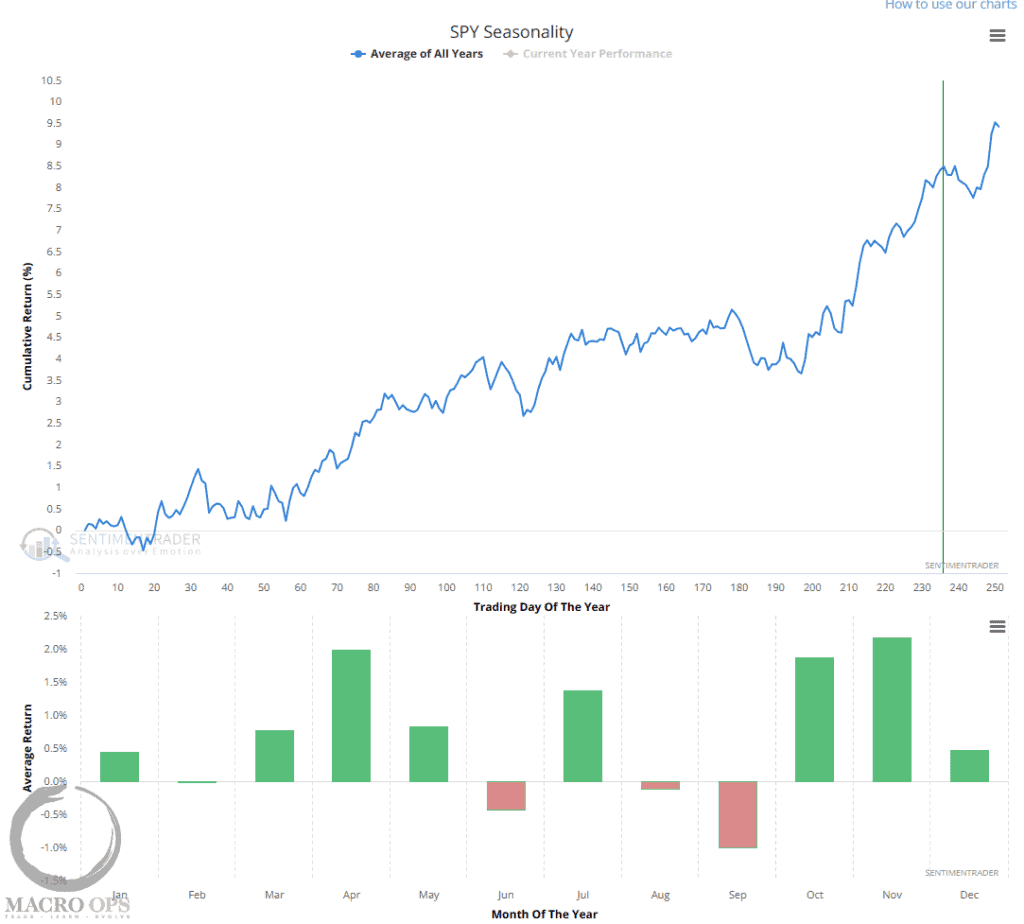

- Consider Market Sentiment: The report suggests that extreme bearishness could lead to either a bounce or a crash, indicating that market sentiment should be considered when making investment decisions.

- Assess Risk Tolerance: With the report stating that stocks have ~5% upside and -50% downside, it may be prudent to assess one’s risk tolerance and position accordingly.