Research Summary

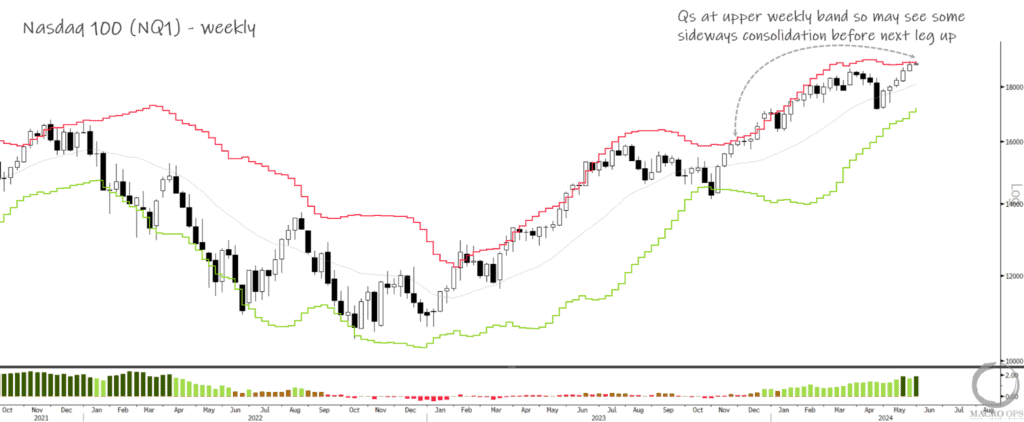

The report discusses major breakout failures and breakdown confirmations in financial markets. It highlights troubling developments in breadth, the long lag of monetary policy this cycle, and the strength in both DXY and gold. The report also provides insights into the SPX’s potential move back towards October 2022 lows and the broader market’s possible entry into a larger downtrend.

Key Takeaways

Market Trends and Breakouts

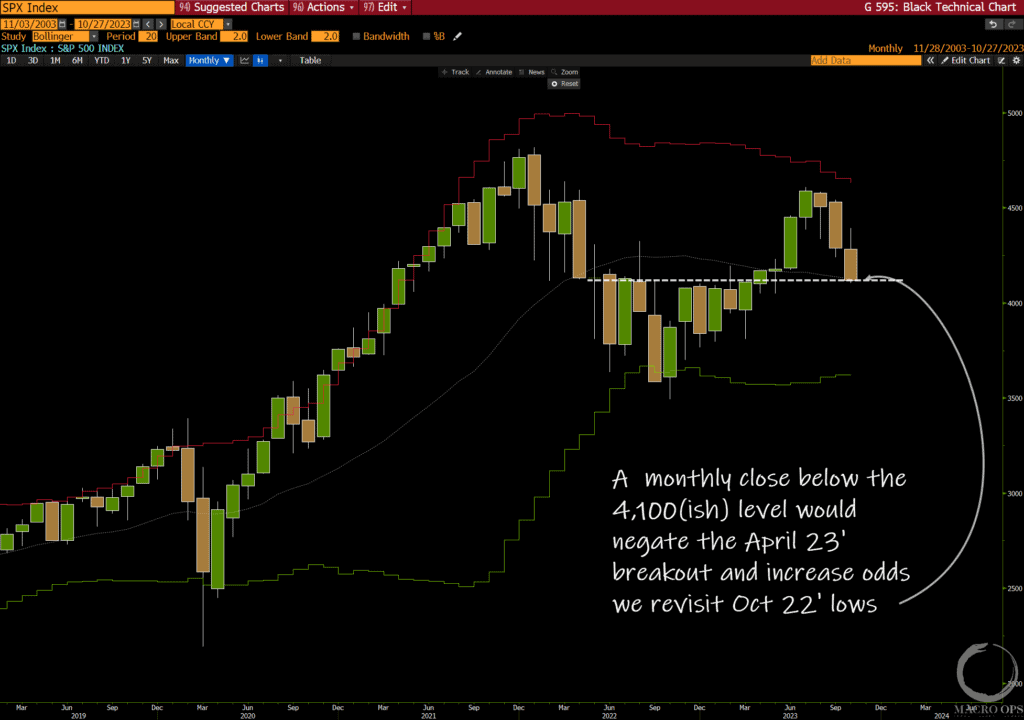

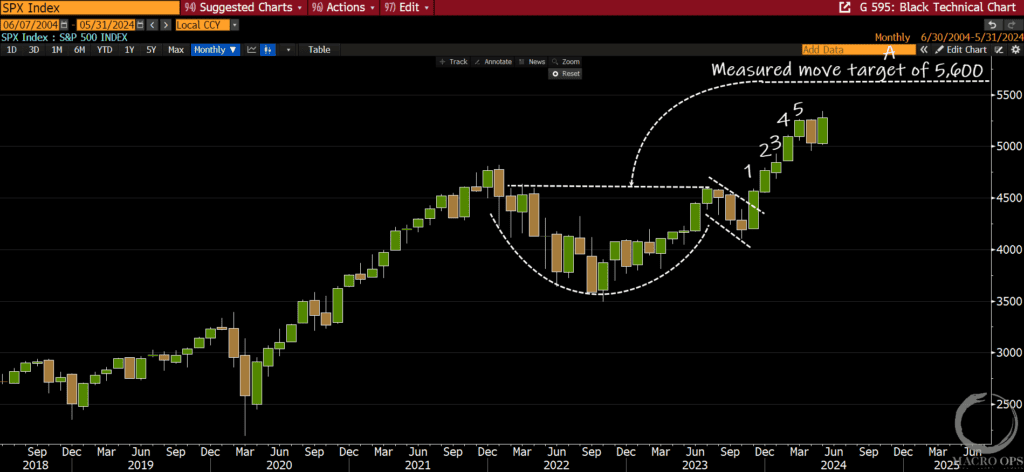

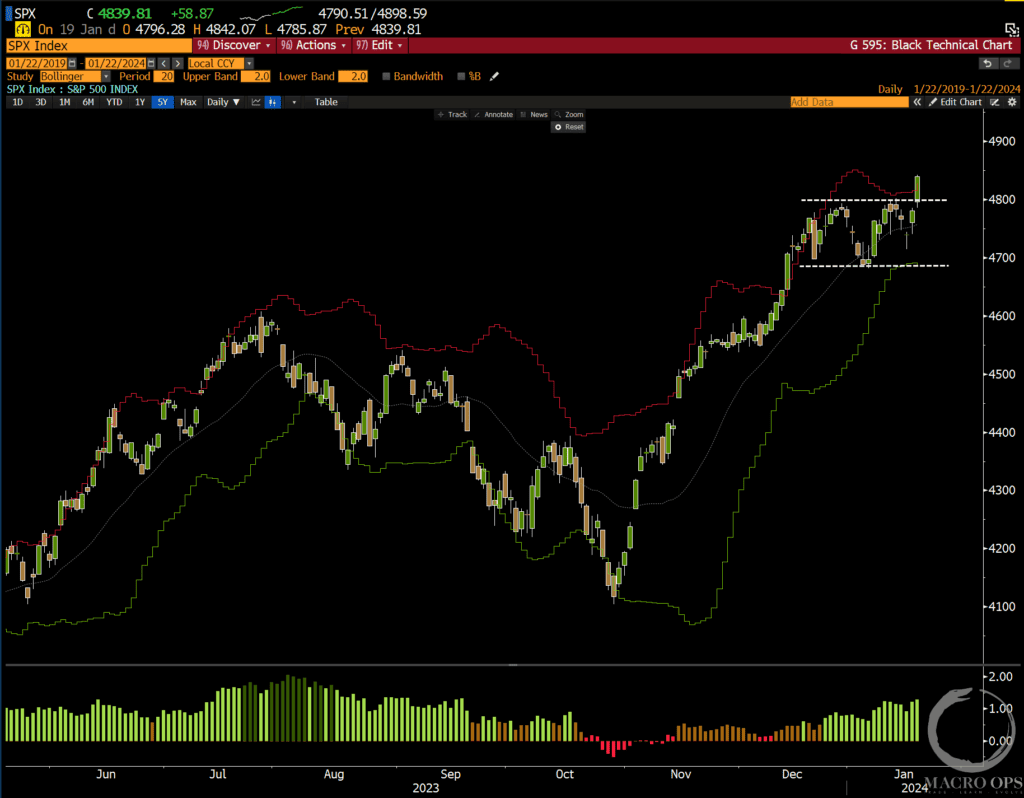

- SPX’s Potential Reversal: The report suggests that the SPX may end October at its April 23 breakout level (around the 4,100 range). A significant move below this could negate the previous breakout and increase the likelihood of a move back towards the October 2022 lows.

- RTY’s Downtrend: RTY is also expected to end the month on its lows. If it fails to reverse soon, the odds of the broader market entering a larger downtrend could increase.

Market Breadth and Positioning

- Breadth Oversold: While breadth is getting oversold, RTY aggregate breadth (across multiple timeframes) remains above the depressed levels that typically mark major bottoms.

- Spec Positioning: Aggregate large spec positioning on a 3-year percentile basis remains quite long, especially considering the price action over the past few weeks. Large and small spec positioning in the SPX is at its 100th 6-month percentile, which is not indicative of market bottoms.

Monetary Policy and Inflation

- Monetary Policy Lag: High nominal growth from fiscal excesses has delayed the lagging impact of monetary policy. However, the leads tracked suggest that we’re getting closer to realizing more of these lagged impacts.

Strength in DXY and Gold

- DXY Strength: The DXY continues to show strength, with the report suggesting that bulls remain in strong control.

- Gold’s Potential Bull Leg: If gold can hold its current levels and close the move above the key 2,000 level, it could indicate the start of a new major bull leg.

Actionable Insights

- Monitor SPX and RTY Trends: Given the potential for SPX and RTY to move towards their lows, it would be prudent to closely monitor these trends for any significant changes.

- Assess Market Breadth: With breadth getting oversold, it’s important to assess market breadth across multiple timeframes to identify potential major bottoms.

- Consider Impact of Monetary Policy: The lagging impact of monetary policy due to high nominal growth should be considered when making financial decisions.

- Watch DXY and Gold: The strength in DXY and gold suggests that these could be key areas to watch for potential opportunities.