Research Summary

Prisma Finance, a new LSTFi protocol, enables DeFi users to mint a fully collateralized, non-custodial, and decentralized dollar-denominated stablecoin mkUSD using Ethereum liquid staking tokens (LSTs) as collateral. The protocol reached its debt cap in just 8 hours, locking in a total value of $36.8M. The report also discusses the architecture of Prisma Finance, the minting process of mkUSD, the role of the Prisma Stability pool, and the PRISMA tokenomics.

Key Takeaways

Prisma Finance’s Rapid Growth

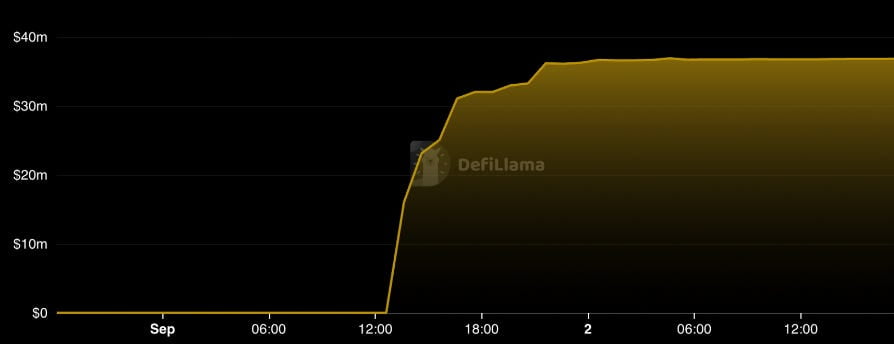

- Impressive Launch: Prisma Finance’s launch on the Ethereum mainnet was successful, hitting its debt cap in just 8 hours and reaching a total value locked (TVL) of $36.8M. This rapid growth indicates a strong market interest in the protocol and its offerings.

Prisma Finance Architecture and mkUSD Minting

- Unique Protocol Design: Prisma Finance is a Liquity-inspired protocol that allows DeFi users to mint a decentralized stablecoin using Ethereum LSTs as collateral. The protocol’s architecture and execution flow are designed to facilitate the minting of mkUSD, an overcollateralized stablecoin with a minimum collateral ratio (MCR) of 120%.

- Stability Pool & Liquidations: The Prisma Stability pool acts as a safeguard to cover the debt from liquidated vaults, ensuring mkUSD is always adequately collateralized. In the event of a vault liquidation, a penalty of 16.67% is applied to the collateral’s USD value.

PRISMA Tokenomics

- Decentralization and Governance: The PRISMA token is primarily a governance token designed to decentralize the Prisma protocol over time. Token holders can vote on governance proposals to upgrade the Prisma protocol. PRISMA tokens can also be used for emission voting and DAO voting.

Risks in LSTFi Stablecoins

- Overcollateralization and Competition: Overcollateralized stablecoins like those offered by Prisma Finance face scalability issues and require large collateral ratios to avoid liquidation. Additionally, the presence of several LST-backed stablecoins in the market, such as DAI, Lybra Finance, and crvUSD, creates liquidity fragmentation and makes the defensibility of the USD peg more difficult.

Actionable Insights

- Monitor Prisma Finance’s Growth: Given the rapid growth of Prisma Finance at launch, it would be beneficial to keep an eye on its continued development and adoption in the DeFi space.

- Understand the Role of LSTs: As Ethereum LSTs are used as collateral in Prisma Finance, understanding their role and dynamics in the DeFi ecosystem can provide valuable insights into the potential of LSTFi protocols.

- Assess the Impact of Overcollateralization: The requirement for large collateral ratios in overcollateralized stablecoins could impact their scalability and adoption. It’s crucial to assess how this factor might influence the growth of Prisma Finance and similar protocols.

- Consider the Competitive Landscape: With several LST-backed stablecoins already in the market, understanding the competitive landscape can help gauge Prisma Finance’s potential for success and its ability to maintain the mkUSD peg over time.