Research Summary

The report discusses the recent surge in Ordinals trading volume, which peaked at $35.2M, leading to unprecedented NFT activity and generating $97.9M in fees on the Bitcoin network. However, this success has resulted in network congestion, higher transaction fees, and increased confirmation time. The report also highlights the potential for Bitcoin’s growth with upcoming spot ETF approvals and halving, despite network congestion issues.

Key Takeaways

Record-Breaking Ordinals Trading Volume

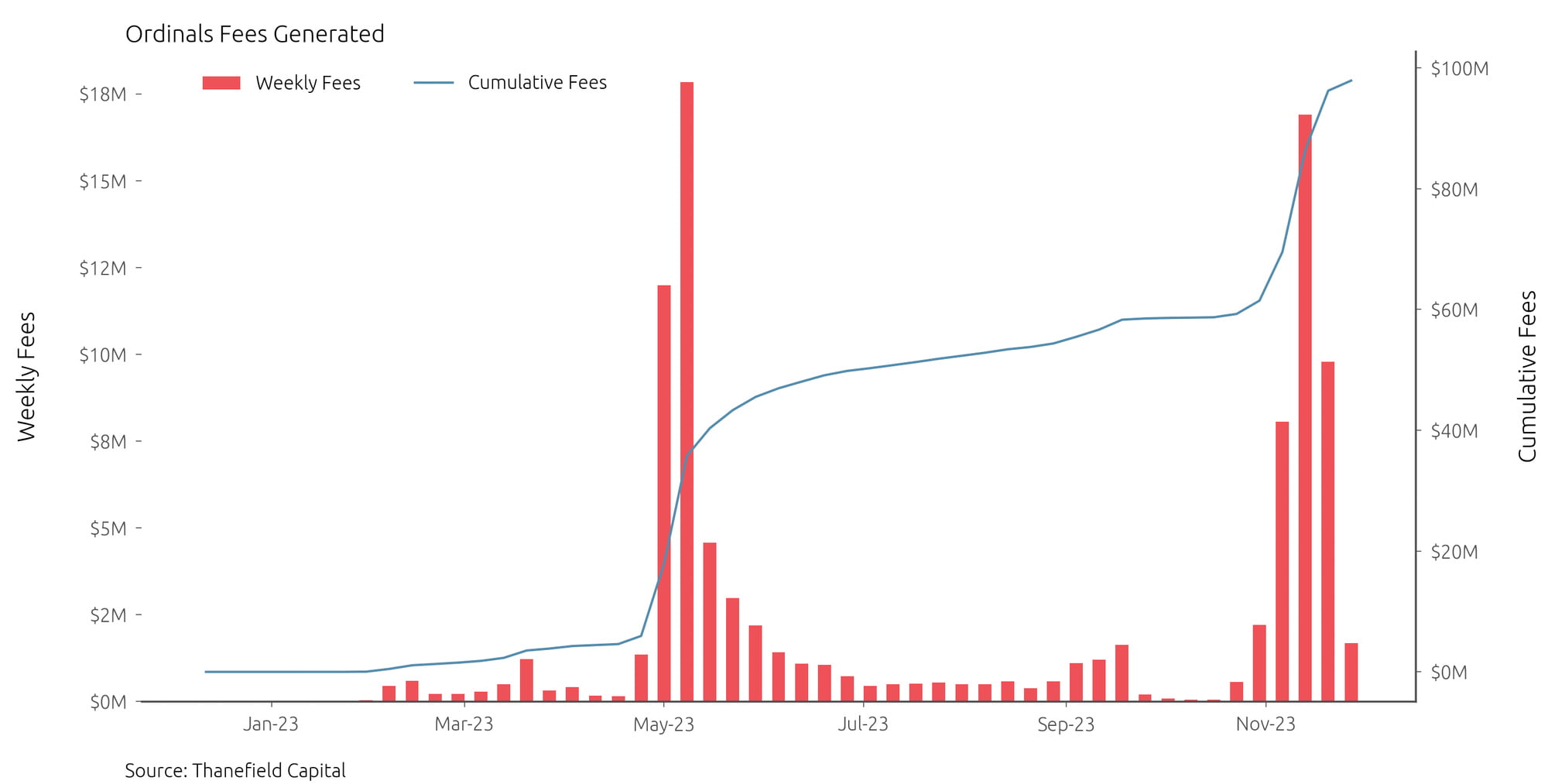

- Unprecedented NFT Activity: The report notes that Ordinals trading volume reached a record high of $35.2M last week. This surge in trading volume led to an unprecedented level of NFT activity, with 2.4M Inscriptions on the Bitcoin network. The increased activity generated a total of $97.9M in fees, indicating strong demand for participation in the Ordinals ecosystem.

Network Congestion Issues

- Increased Transaction Fees and Confirmation Time: The success of Ordinals has resulted in network congestion on the Bitcoin network. This has led to higher transaction fees and increased confirmation time. The report notes a 46% rise in average block confirmation time to 158 minutes and a 174% increase in network transaction fees, totaling $11.75M—over twice that of Ethereum’s $5.58M fees.

Benefit to Bitcoin Miners

- Revenue Milestone: Despite the network congestion issues, the situation has benefited Bitcoin miners. The report notes that miners earned $40M in revenue, a milestone not attained since April 2022.

Potential for Bitcoin’s Growth

- Spot ETF Approvals and Halving: The report highlights the potential for Bitcoin’s growth with upcoming spot ETF approvals and halving. These events are likely to lead to a rise in institutional and retail Bitcoin demand.

Need for Scalable Solutions

- Infrastructure Upgrades: The record-breaking achievements of Ordinals have highlighted the need for scalable solutions and infrastructure upgrades on the Bitcoin network. As Ordinals gain popularity and compete for blockspace, continuous innovation is essential to meet evolving network demands and ensure seamless operations.

Actionable Insights

- Consider the Impact of Network Congestion: The report highlights the impact of network congestion on transaction fees and confirmation times. Stakeholders should consider these factors when planning their activities on the Bitcoin network.

- Explore Layer 2 Solutions: The report suggests that implementing Layer 2 solutions, similar to Ethereum, could address network congestion challenges. This could allow for higher transaction throughput while supporting the execution of smart contracts.

- Monitor Upcoming Bitcoin Events: With potential spot ETF approvals and Bitcoin halving on the horizon, stakeholders should monitor these events as they could lead to a rise in Bitcoin demand.