Research Summary

The report covers a range of developments in the digital asset space, including significant sales by Ark Invest, partnerships and launches by various blockchain projects, and investments by Cyber.Fund and Sui. It also highlights regulatory actions against Coinlist, performance of various tokens, and changes in trading volumes and total value locked (TVL) in different protocols.

Key Takeaways

Significant Asset Sales and Investments

- Ark Invest’s COIN Sales: Ark Invest has sold $42.6 million of COIN, bringing their total sales to $150 million since December 5th.

- Cyber.Fund’s Investment: Cyber.Fund, a crypto-native investment firm, plans to invest $100 million in blockchain projects that intersect with AI and the internet of things.

- Sui’s Investment in Liquid Staking Protocols: Sui will contribute 25 million to three SUI Liquid staking protocols – Aftermath Finance, Haedal Protocol, and Volo.

Partnerships and Launches

- Cronos’ zkEVM Layer 2 Testnet: Cronos, in partnership with Matter Labs, has launched the testnet for their zkEVM Layer 2, allowing developers to build atop Ethereum.

- LayerZero’s V2 Launch: LayerZero has launched V2 on Testnet, introducing several new features and improvements.

- Hitachi and Concordium’s Biometric Wallet: Hitachi’s research arm and Concordium Foundation have partnered to build a biometric crypto wallet using user fingerprints or face id.

Regulatory Actions

- Coinlist’s Settlement with OFAC: Coinlist has agreed to pay a $1.2 million fine to OFAC for processing 989 transactions for Crimean users from April 2020 to May 2022.

Token Performance

- Top Performers: MUBI and LBR were the top performers for tokens below $100M MC, while WOO and OLAS led the pack for tokens above $100M MC. RNDR, AAVE, and INJ outperformed for tokens above $1B MC.

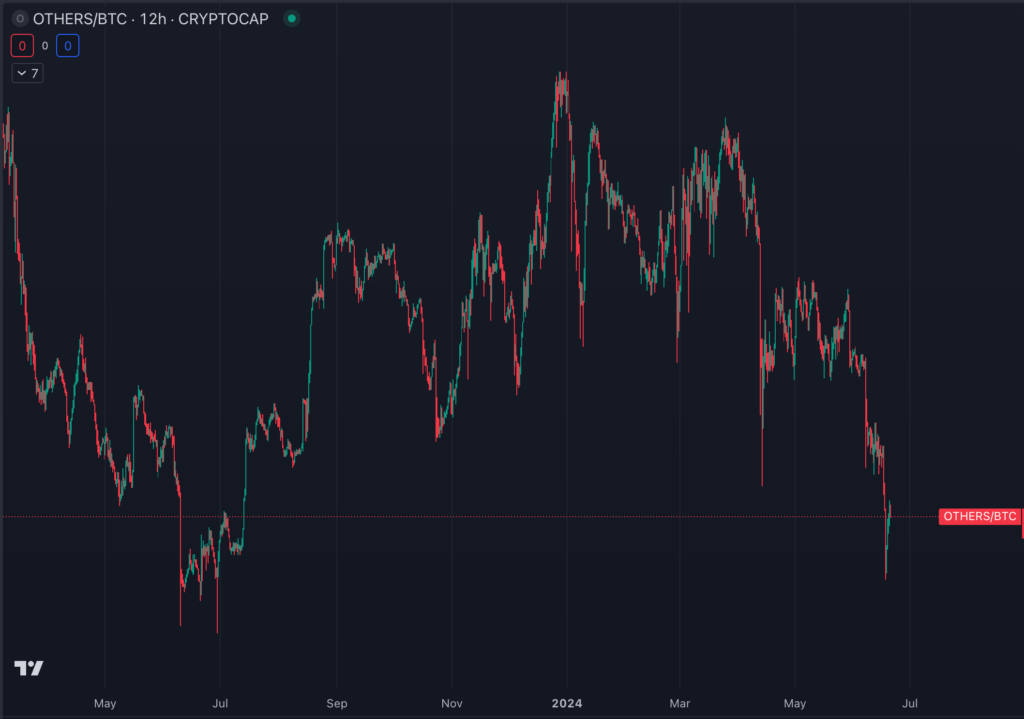

Trading Volumes and TVL

- Trading Volumes: AAVE, LINK, and PRIME dominated onchain volumes.

- TVL Growth: Deri V4, DefiSaver, and Mantle Staked ETH saw significant growth in TVL over the past day.

Actionable Insights

- Monitor Ark Invest’s COIN Sales: The significant sales of COIN by Ark Invest could indicate a shift in their investment strategy or outlook on the asset. It may be worth monitoring their future actions and statements for further insights.

- Research Cyber.Fund’s Investment Focus: Cyber.Fund’s planned investment in blockchain projects intersecting with AI and IoT could highlight promising areas of innovation in the blockchain space.

- Assess Impact of Regulatory Actions: The fine imposed on Coinlist by OFAC underscores the importance of regulatory compliance in the crypto space. It may be beneficial to assess the potential impact of such actions on other crypto platforms and the broader market.

- Track Token Performance: The performance of various tokens, particularly those with significant gains, could provide insights into market trends and investor sentiment. It may be useful to track these tokens and their associated projects for potential opportunities.

- Examine TVL Growth: The growth in TVL in various protocols could indicate increasing user adoption and confidence. It may be worth examining these protocols for potential trends and developments in the DeFi space.