Research Summary

The report covers a range of updates in the DeFi sector, including new partnerships, protocol launches, and governance proposals. It also highlights regulatory developments in the crypto space and significant transactions by major players such as Microstrategy and Ark Invest.

Key Takeaways

Protocol Developments and Partnerships

- Manifold Finance’s V3 Launch: Manifold Finance, a multichain MEV service liquid staking protocol, has announced the launch of V3. This includes an enhanced blockspace auction, a utility token that captures surplus auction fees, and the launch of an OP-based L2.

- Stake DAO and Reserve Partnership: Stake DAO has partnered with Reserve to launch $USDC+, an overcollateralized yield-bearing USDC basket backed by $fUSDC, Morpho $USDC, and Compound $USDC.

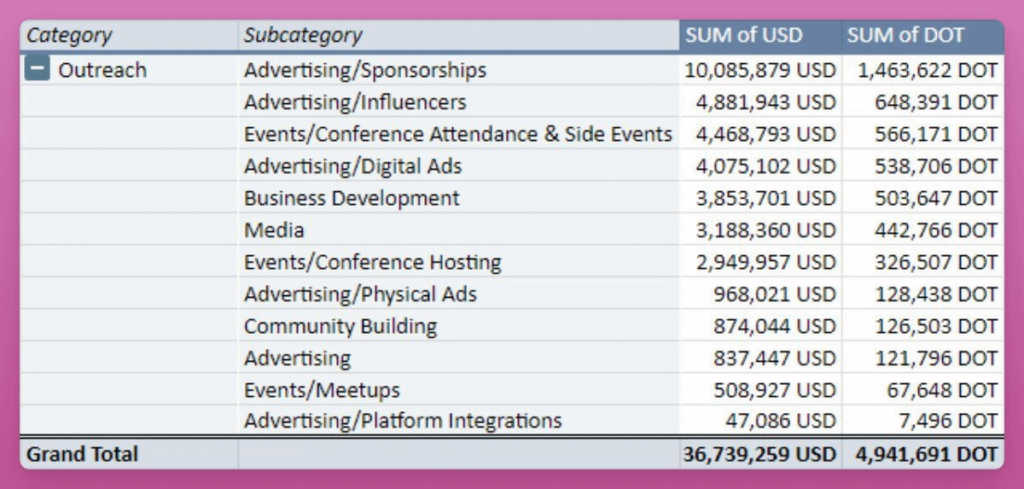

- Polkadot and Unity Games Collaboration: Polkadot has partnered with Unity Games, which has added Polkadot to their verified solutions program for increased visibility to developers.

Regulatory Developments

- SEC Delays Ethereum ETF Decisions: The SEC has postponed decisions on Ethereum ETFs until May, while Bitcoin ETF approvals are tentatively set for January 2024.

- Hong Kong’s Crypto Regulations: Hong Kong regulators are considering spot crypto ETF applications and have proposed mandatory licenses for fiat-backed stablecoin issuers.

Significant Transactions

- Microstrategy’s Bitcoin Purchase: Microstrategy has bought an additional $615M worth of Bitcoin, bringing their total holdings to 189,150 BTC worth $5.9B.

- Ark Invest’s Asset Allocation: Ark Invest has sold another $28M worth of Coinbase shares and allocated $92M to ProShares Bitcoin Strategy ETF.

Actionable Insights

- Monitor the Impact of Protocol Developments: The launch of new protocols and partnerships in the DeFi sector could influence the performance of associated tokens. Stakeholders should monitor these developments to understand their potential impact.

- Stay Abreast of Regulatory Changes: Regulatory decisions, such as the SEC’s delay on Ethereum ETF decisions and Hong Kong’s proposed crypto regulations, can significantly impact the crypto market. Stakeholders should stay updated on these changes to make informed decisions.

- Track Significant Transactions: Large transactions by major players like Microstrategy and Ark Invest can influence market trends. Stakeholders should track these transactions to understand their potential impact on the market.