Research Summary

The report provides a comprehensive analysis of the crypto market in December 2023, highlighting the significant surge in market capitalization, the performance of various cryptocurrencies, the growth of the DeFi sector, and the rise of NFTs. It also discusses the impact of potential regulatory decisions, the emergence of new Layer-2 solutions, and the trend of inscriptions on EVM-compatible chains.

Key Takeaways

Market Performance and Regulatory Anticipation

- Market Surge: The crypto market saw a 15% increase in total market capitalization in December 2023, driven by the anticipation of the potential approval of the first spot Bitcoin ETF in the United States.

- Performance of Key Cryptocurrencies: Alternative Layer-1 coins such as AVAX, SOL, and ADA led the market gains with impressive month-on-month increases. Bitcoin and Ethereum saw modest gains, while XRP and TRX underperformed.

- Regulatory Anticipation: Market participants remain cautiously optimistic about the SEC’s decision on the Bitcoin ETF, with the outcome highly anticipated in the first two weeks of January.

DeFi Sector and NFT Market Growth

- DeFi Sector Growth: The DeFi sector experienced a 15.2% month-over-month increase in total value locked (TVL), with Solana leading the growth. Lending protocols AAVE, JustLend, and Compound recorded month-over-month gains, indicating increased adoption.

- NFT Market Surge: The NFT market continued its growth trajectory with a 77.17% month-over-month increase in total sales volume, surpassing US$1.7 billion. Bitcoin and Solana NFT sales volumes grew significantly, with collections such as $SATS, $RATS, and $MICE BRC-20 NFTs dominating the trading volume rankings.

Emergence of New Layer-2 Solutions

- New Layer-2 Solutions: New Layer-2 solutions offering native yields, such as Blast and Manta Pacific, have gained traction, with rising numbers of depositors and assets being bridged into these networks.

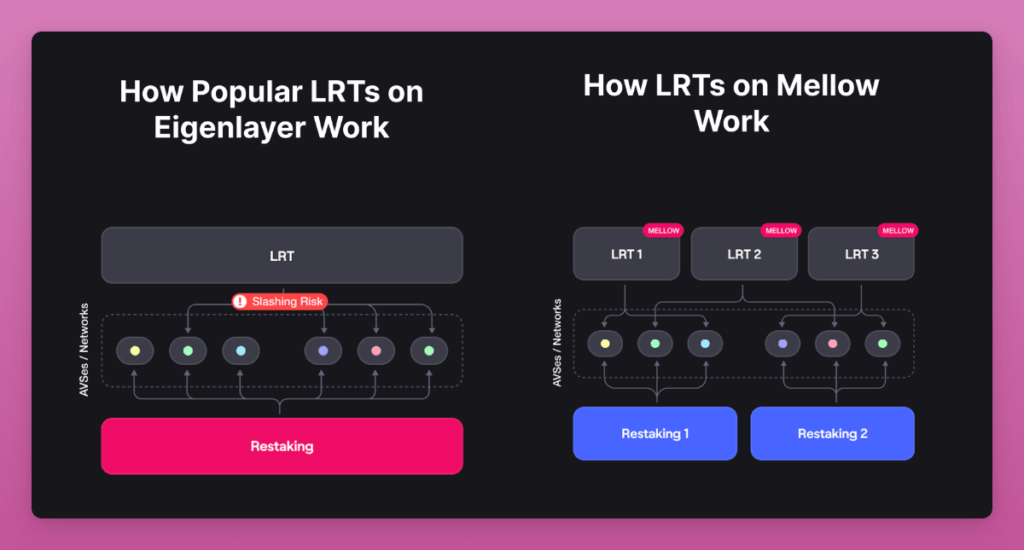

- Restaking Protocol EigenLayer: The restaking protocol EigenLayer’s increase in deposit caps for liquid staking tokens (LSTs) led to a surge in total value locked (TVL) from around US$250 million to US$1.1 billion, indicating a strong demand for yield-generating opportunities among ETH and LST holders.

Trend of Inscriptions on EVM-Compatible Chains

- Inscriptions Trend: The trend of inscriptions, initially popular on Bitcoin, has spread to various EVM-compatible chains, amassing over 491.9 million inscriptions, with Polygon, Avalanche, and BNB Chain leading the activity. This trend has resulted in increased transaction activity, higher fees, and longer processing times.

Actionable Insights

- Monitor Regulatory Developments: Keep a close eye on the SEC’s decision on the Bitcoin ETF, as it could significantly impact the crypto market.

- Research the Potential of Alternative Layer-1 Coins: Given the impressive performance of AVAX, SOL, and ADA, it may be worthwhile to explore these “Ethereum Killer” coins further.

- Assess the Growth of the DeFi Sector and NFT Market: The significant growth in these areas suggests potential opportunities for involvement in DeFi protocols and NFT trading.

- Explore New Layer-2 Solutions: The emergence of new Layer-2 solutions like Blast and Manta Pacific offering native yields presents potential areas for further exploration.

- Understand the Implications of the Inscriptions Trend: The trend of inscriptions on EVM-compatible chains could have significant implications for transaction costs and processing times, warranting further investigation.