Research Summary

The report provides an in-depth analysis of the restaking landscape in the DeFi sector, highlighting key players, emerging trends, and potential risks. It discusses the growth of restaking, the role of Eigenlayer, the emergence of Liquid Restaked Tokens (LRTs), and the importance of diversification in restaking. The report also explores the potential of new blockchain services and the future of restaking.

Key Takeaways

Restaking’s Rapid Growth

- Projected Dominance: Restaking is expected to be the fastest-growing DeFi category in 2024, with Eigenlayer alone projected to hold $2 billion USD. This highlights the increasing significance of restaking in the DeFi landscape.

- Liquid Restaking: Liquid restaking is also showing substantial growth, currently ranking as the 13th largest DeFi category with $1 billion USD. This underscores the growing interest in this financial innovation.

Role of Eigenlayer

- Active Validation Services (AVS): Eigenlayer’s AVS are gaining traction with the launch of the first AVS token (ALT) and the opening of Eigenlayer deposits on February 5th. This marks a pivotal moment for investors and users in the space.

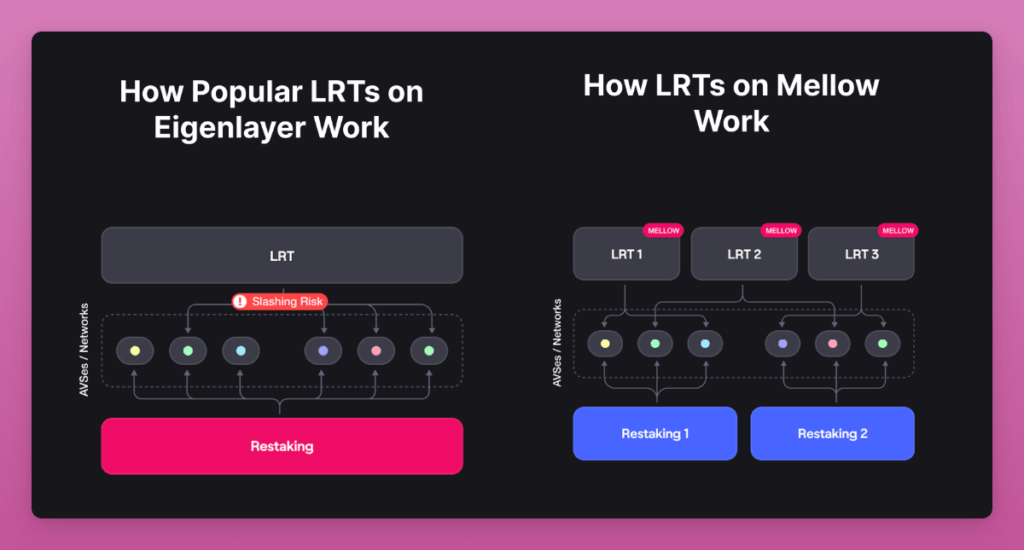

- Encouraging Decentralization: To promote decentralization, Eigenlayer has implemented a point system that caps single deposits and LST/LRT allocations at 33%. This encourages stakers to diversify their investments.

Emergence of Liquid Restaked Tokens (LRTs)

- Competitive Market: A variety of LRT contenders are emerging, with EtherFi leading the market share at 51%, followed by Renzo and Swell. Each offers unique incentives and referral bonuses for participants, indicating a competitive and dynamic LRT market.

- New Entrants: Eigenpie, a new entrant with $100M in TVL, supports 6 LSTs and offers double points for early participants, showcasing the competitive nature of the LRT market.

Future of Restaking

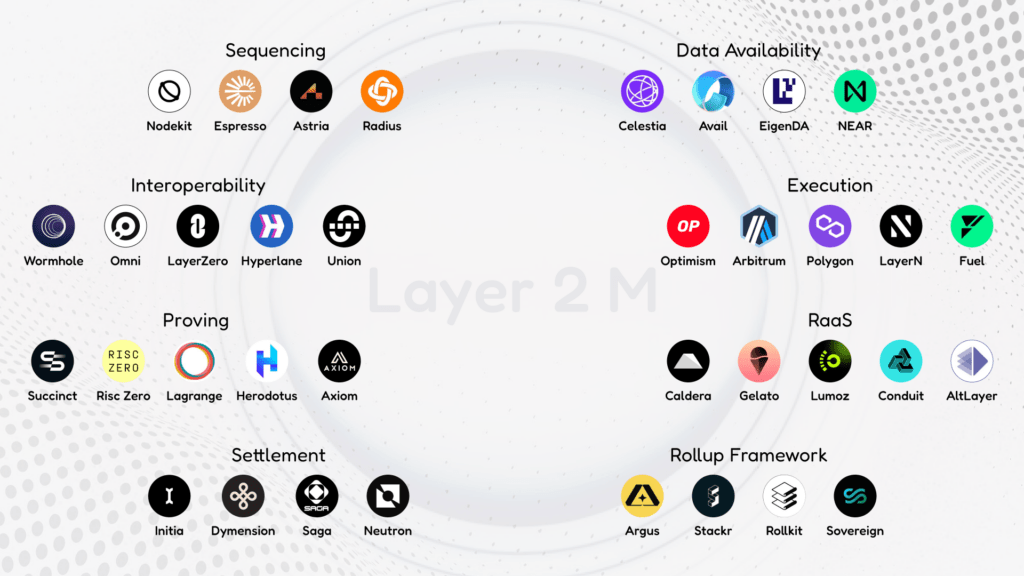

- Stage 2 Testnet: The Stage 2 Testnet allows restakers to delegate to Operators who validate AVS, with EigenDA being the first AVS at this stage. The Stage 2 mainnet is anticipated to launch in the first half of 2024, followed by Stage 3, which will introduce more AVS.

- Caution Amid Optimism: Despite the risks associated with restaking, such as increased slashing risk, potential centralization, and smart contract vulnerabilities, the author believes they are currently limited as Eigenlayer is in Stage 2 Testnet and permissionless AVS deployment is not yet enabled.

Actionable Insights

- Monitor the Growth of Restaking: Given the projected growth of restaking, it would be beneficial to keep a close eye on this sector, particularly the performance of Eigenlayer and the development of Liquid Restaking.

- Consider Diversification: With Eigenlayer’s point system encouraging diversification, investors and users may want to consider diversifying their investments across various LSTs/LRTs for balanced point accrual and risk management.

- Stay Informed About New Blockchain Services: As new blockchain services are expected to emerge, staying informed about these developments could provide insights into potential opportunities and risks in the restaking landscape.

- Understand the Risks: While the author expresses cautious optimism about the future of restaking, it’s important to understand the associated risks, including increased slashing risk, potential centralization, and smart contract vulnerabilities.