Research Summary

The report provides an in-depth analysis of Ethena, a protocol offering a high yield “Internet Bond” based on Ethereum (ETH). It discusses the problem Ethena aims to solve, how it works, its potential risks, and critiques.

Key Takeaways

Ethena’s Solution to Yield Problems

- Yield Solution: Ethena is a decentralized stablecoin that promises attractive returns to yield-seekers. It aims to solve the problems of low yields, lack of transparency, and centralization that have plagued previous attempts at providing yields on stablecoins.

How Ethena Works

- Operational Mechanism: Ethena uses investors’ capital to buy ETH, mints their USDe stablecoin equivalent to the value of the ETH purchased, stakes a portion of the ETH, transfers the remainder to custodians, and opens futures contracts to sell ETH across centralized exchanges. This strategy mitigates the risk associated with the volatile ETH price.

Yield Sources

- Yield Generation: The yield from Ethena comes from two sources: Ethereum staking rewards (4-6% per year) and the premium from selling futures contracts (20-40% in bull markets).

Critiques and Risks of Ethena

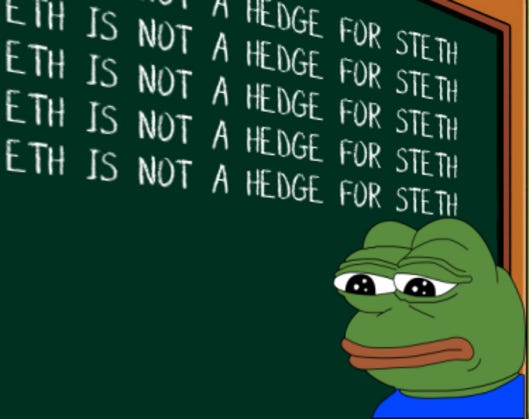

- Challenges and Risks: Critiques of Ethena include its centralization and the potential for its trading activity to compress yields and incur higher trading costs. The report also highlights the risk associated with Ethena’s use of staked ETH derivatives rather than ETH as the collateral asset, as there’s no liquid futures market for staked ETH.

Market Perception of Risk

- Risk Perception: The report notes that crypto market participants are often poor at pricing and caring about risk, suggesting that Ethena may continue to attract investors as long as yields are good.

Actionable Insights

- Understanding Ethena’s Mechanism: Investors should thoroughly understand how Ethena works, including its use of staked ETH derivatives and futures contracts, before investing.

- Evaluating Risks: It’s crucial to evaluate the risks associated with Ethena, including the potential for compressed yields and the risks associated with staked ETH.

- Assessing Market Perception: Investors should consider the market’s often poor perception and handling of risk when considering an investment in Ethena.