Research Summary

The report provides an in-depth analysis of the cryptocurrency market, focusing on the performance of various coins during bull runs, the influence of narratives, and the role of key figures in the industry. It also discusses the potential for high returns in altcoins, the impact of market trends, and the importance of understanding market dynamics for successful investment strategies.

Key Takeaways

Performance of Cryptocurrencies During Bull Runs

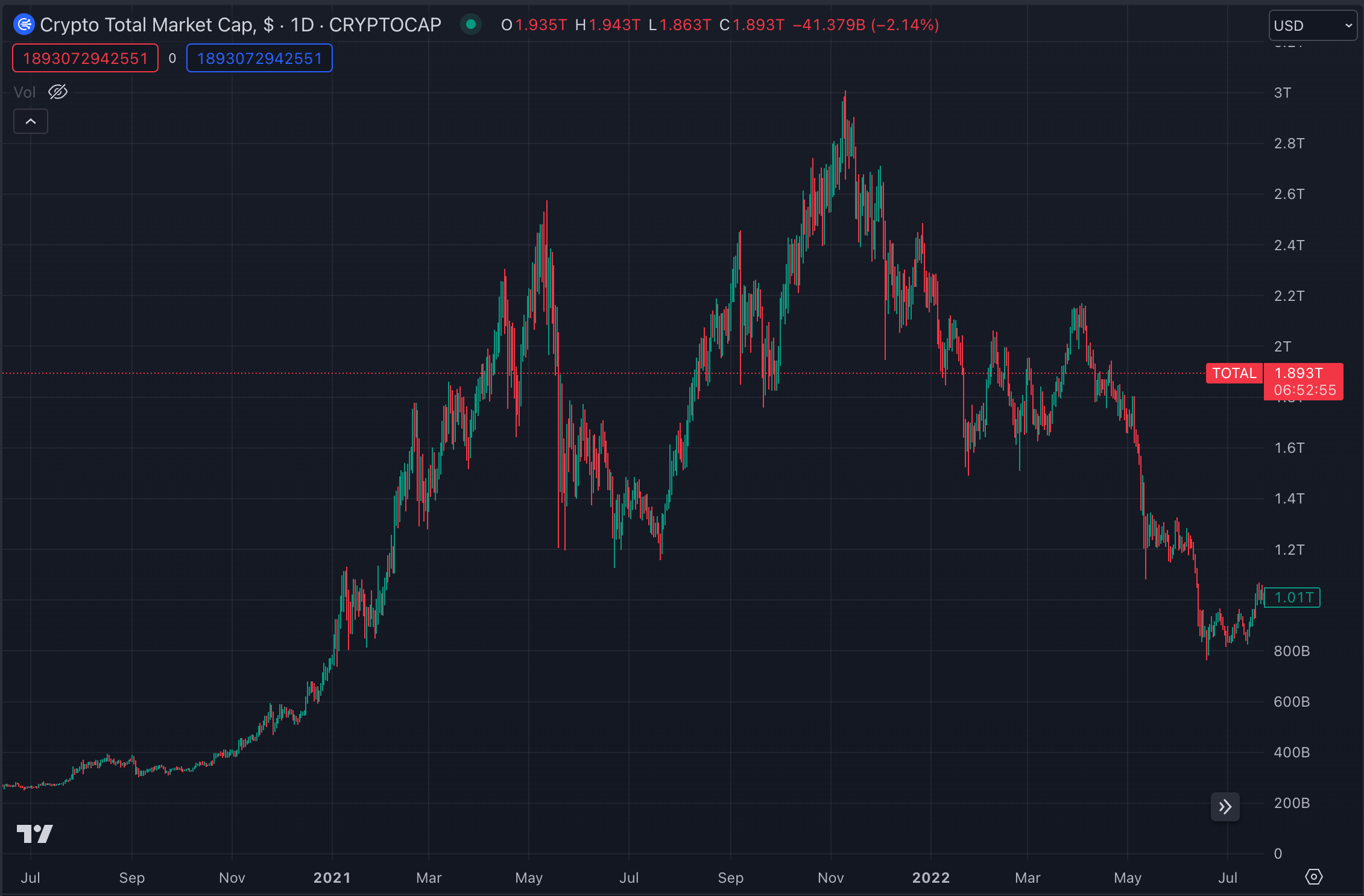

- Altcoin Outperformance: The report highlights that newer cryptocurrencies tend to outperform older ones during bull runs. For instance, in the 2021 cycle, older coins like XRP and XLM failed to reach their previous all-time highs in USD. However, Bitcoin (BTC) and Ethereum (ETH) are exceptions to this trend.

- Rotational Nature of Crypto Market: Historical snapshots of CoinMarketCap rankings reveal the rotational nature of the crypto market, with many coins falling out of favor over time. This suggests that investors need to stay updated with market trends and adjust their strategies accordingly.

Impact of Narratives on Crypto Market

- Metaverse Mania: The report notes that Facebook’s rebranding to Meta and its focus on building the metaverse sparked a significant speculative wave in the crypto market. This led to nearly 10X growth in leading coins in the metaverse narrative, such as $SAND, $MANA, and $GALA, within a month of the Meta announcement.

- AI Narrative: The AI narrative in 2024, influenced by the launch of ChatGPT, has seen AI-related coins perform well during various periods. Despite skepticism about the substance of many AI coins, the strong AI narrative in the tech world suggests potential for significant gains in AI x crypto.

Role of Key Figures in Crypto Market

- Influence of Prominent Figures: The report highlights that psychological biases in crypto lead to extreme market volatility, often influenced by prominent figures or “main characters” in the industry. Key figures like SBF ($SOL, $FTT), CZ ($BNB), Su Zhu ($AVAX), Elon Musk ($DOGE), Do Kwon ($LUNA), Richard Heart ($HEX), Charles Hoskinson ($ADA), Andre Cronje ($FTM), and Daniele Sestagalli ($TIME, $SPELL, $ICE) have been catalysts for their respective tokens’ performance.

- Cult-like Followings and “Ponzi-like” Tokenomics: The combination of cult-like followings and “ponzi-like” tokenomics, often centered around charismatic leaders, can signal impending pump-and-dump scenarios in the market. High-yield, unsustainable tokenomics are a common feature of assets that may be heading towards a sharp correction.

Actionable Insights

- Understand Market Dynamics: The report suggests that understanding the market’s main themes, such as the dominance of alternative Layer 1 (L1) platforms, is crucial for successful investment strategies. Investors should stay updated with market trends and adjust their strategies accordingly.

- Recognize the Influence of Narratives: The report emphasizes the impact of narratives on the crypto market. Investors should pay attention to emerging narratives and their potential impact on various coins. For instance, the metaverse and AI narratives have significantly influenced the performance of related coins.

- Consider the Role of Key Figures: The report highlights the role of key figures in the crypto market. Investors should consider the influence of these figures on the performance of their respective tokens. However, they should also be cautious of cult-like followings and “ponzi-like” tokenomics, which can signal impending pump-and-dump scenarios.