Research Summary

The report provides an analysis of the recent performance of various cryptocurrencies, including Bitcoin ($BTC), Ethereum ($ETH), and several altcoins. It also discusses the potential impact of recent news and events on these cryptocurrencies, including the expected release of Mt Gox creditors’ coins, the German government’s sale of seized Bitcoin, and the potential launch of an Ethereum ETF.

Key Takeaways

Bitcoin’s Performance and Influencing Factors

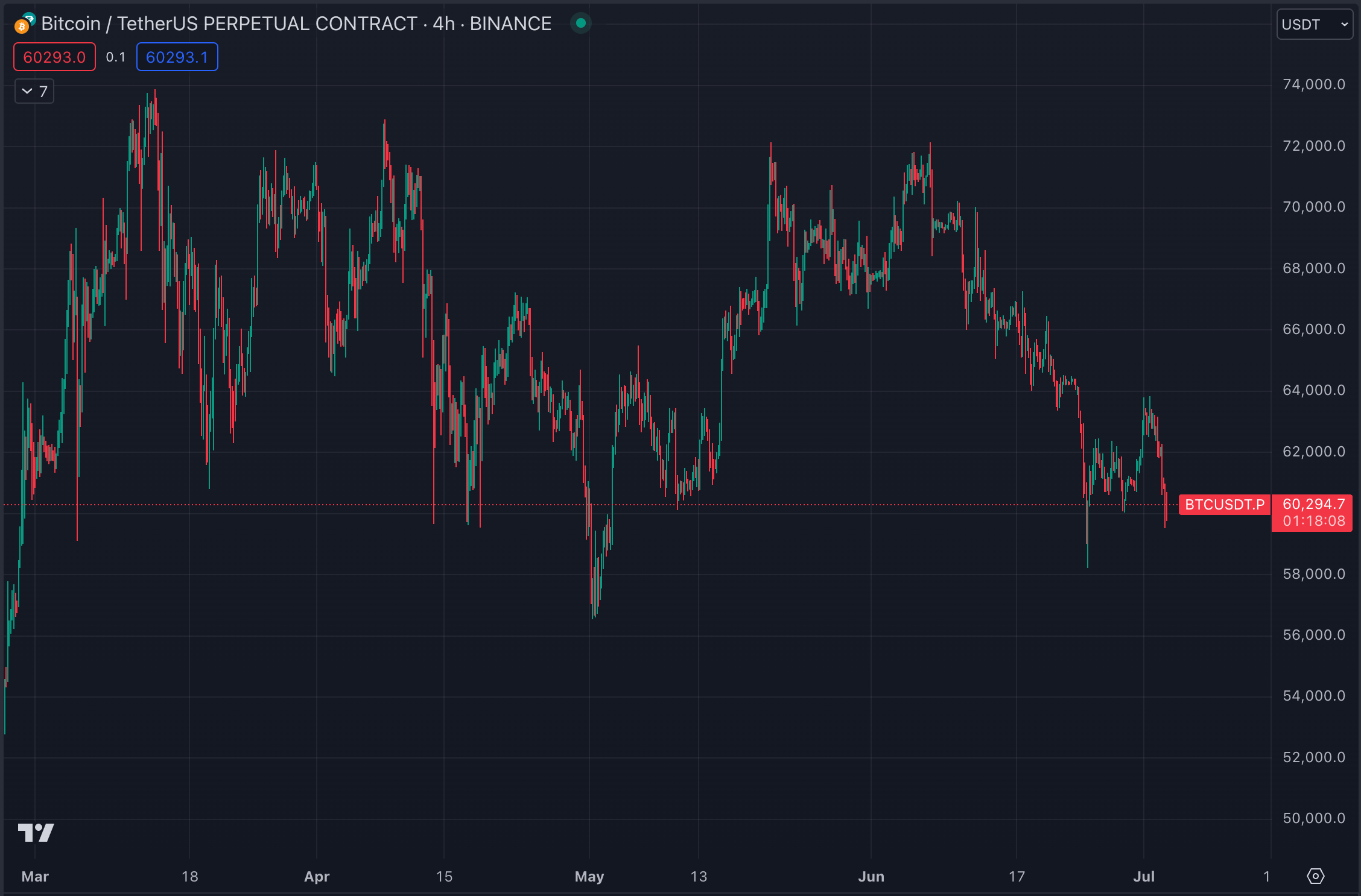

- Bitcoin’s Recent Downturn: The report notes that Bitcoin’s value dropped sharply from around $65k to $58.5k on June 24, but has since rebounded to the $60k region. This drop coincided with several bearish news events, including the expected release of Mt Gox creditors’ coins and the German government’s sale of seized Bitcoin.

- ETF Flows and Stablecoin Supply: The report mentions that there has been non-stop selling until June 24, followed by weak inflows. The stablecoin supply has remained flat for weeks.

Altcoins’ Performance and Influencing Factors

- Altcoins’ Recovery: The report suggests that the June 18 capitulation marked the local bottom for altcoins, and the chart has been going up since then. However, this recovery depends on the majors (BTC and ETH) not bleeding down for another 2 months.

- Impact of Regulatory Actions: The report notes that the SEC’s lawsuit against Consensys over Metamask swaps and staking services negatively impacted the price of $LDO, causing it to drop from $2.4 to around $1.75.

Ethereum’s Performance and Influencing Factors

- Ethereum’s Stability: Despite the headwinds facing Bitcoin, Ethereum has remained relatively stable, trading around 0.055. The report suggests that the upcoming Ethereum ETF is not correctly priced in.

- Performance of Ethereum-Related Coins: The report notes that many “ETH related coins” have been suffering, with several experiencing significant drops in value over the past week or two.

Actionable Insights

- Monitor Bitcoin’s Performance: Given the recent downturn and subsequent rebound, it may be beneficial to closely monitor Bitcoin’s performance and the impact of bearish news events.

- Assess Altcoins’ Recovery: The report suggests that the June 18 capitulation marked the local bottom for altcoins. It may be worth assessing whether this recovery continues or if it is dependent on the performance of Bitcoin and Ethereum.

- Consider Regulatory Impact: The SEC’s lawsuit against Consensys has had a significant impact on the price of $LDO. It may be beneficial to consider the potential impact of regulatory actions on other cryptocurrencies.

- Evaluate Ethereum’s Stability: Despite the headwinds facing Bitcoin, Ethereum has remained relatively stable. It may be worth evaluating whether this stability continues and the potential impact of the upcoming Ethereum ETF.