Podcast Summary

This podcast delves into the complexities of the Chinese economy, its investment-driven growth model, and the challenges it faces in rebalancing its economy. It also discusses the impact of China’s economic policies on the global economy, particularly the US. The guest, Michael Pettis, an author and expert on trade wars and industrial policy, shares his insights on these topics.

Key Takeaways

China’s Economic Challenges

- Investment-Driven Growth: China’s economy is struggling due to its investment-driven growth model, which has led to nonproductive investment and increasing debt. Real estate sales are down 25%, and second-quarter GDP growth is at 4.7%.

- Rebalancing the Economy: China faces difficulties in rebalancing its economy due to the high manufacturing share of GDP and the potential adverse consequences of undermining it. Boosting consumption through debt is unsustainable, and the real way to increase consumption is to increase the household income share.

Impact on the Global Economy

- Trade Surplus: China’s shift in investment from the property sector to manufacturing has led to a growing trade surplus, which the rest of the world must absorb but is increasingly unlikely to do so.

- US Role: The US absorbs roughly half of all trade surpluses in the world, which puts a burden on the country as other countries, including China, export their domestic demand deficiencies. If the US reduces its absorption of excess production, surplus countries will be forced to redirect their surpluses into other large economies.

Trade Wars and Industrial Policy

- Trade Interventions: Tariffs, currency depreciation, artificially repressed interest rates, and wages all work in a similar way by transferring income from households to manufacturers. The impact of tariffs depends on the underlying conditions.

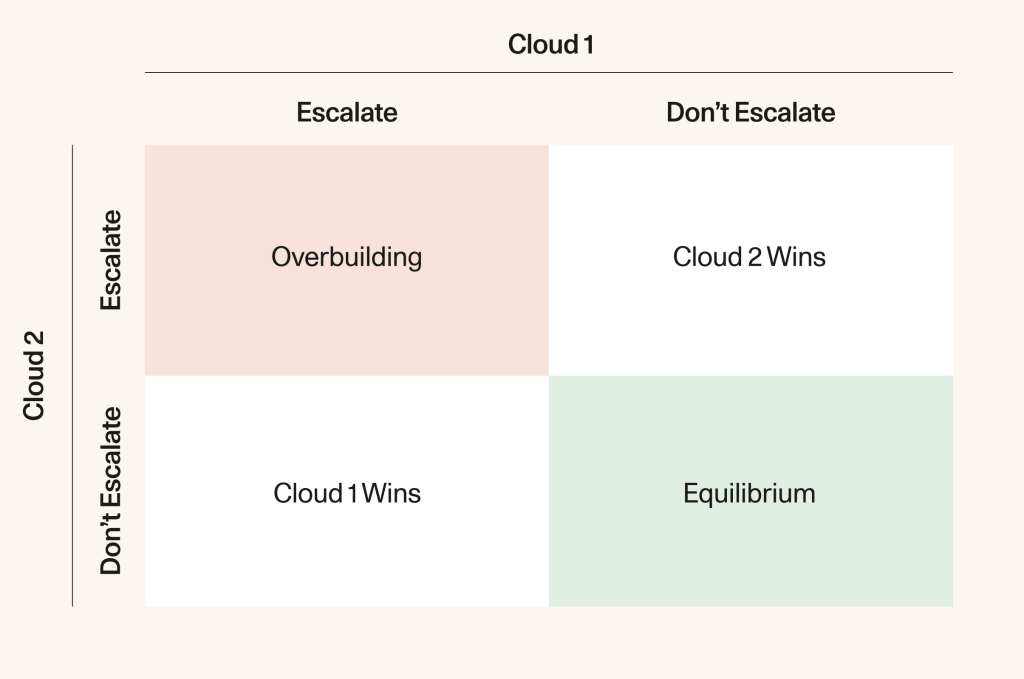

- Industrial Policy: The US economy is subject to industrial policies of other countries, which affects its own industrial policy. There are three options for industrial policy: do nothing (free trade), support strategically important industries, or refuse to play the accommodating role in global imbalances.

Sentiment Analysis

- Bearish: The podcast presents a bearish sentiment towards the Chinese economy due to its investment-driven growth model, which has led to nonproductive investment and increasing debt. The challenges in rebalancing the economy and boosting consumption also contribute to this sentiment.

- Neutral: The sentiment towards the US economy is neutral. While the podcast acknowledges the burden the US faces in absorbing half of all trade surpluses in the world, it also discusses the options the US has in terms of industrial policy to address these challenges.