Podcast Summary

The podcast features an interview with an anonymous crypto trader, known as “CL207”. The guest shares their journey into crypto trading, their experiences during the market crash in 2020, and their strategies for trading cryptocurrencies like Dogecoin. They also discuss the current state of the cryptocurrency market, the importance of social media attention in determining value, and the potential of yield farming and real-world assets. The guest also shares their thoughts on the need for a reputation system in the crypto market and the role of gut feelings in trading decisions.

Key Takeaways

Transition from Buy-and-Hold to Active Trading

- Trading Journey: The guest started their crypto trading journey in 2018 with a buy-and-hold strategy before transitioning to active trading. They became fascinated with understanding price movements and shared their trading ideas on Twitter.

- Market Crash Experience: During the market crash in 2020, the guest was involved in a fund interested in manipulating prices. However, they did not lose much as they did not trade their personal account heavily.

- Independent Trading: After leaving the fund, the guest started trading independently in 2020. Their biggest single trade was around 2-300, not a significant amount.

Current State of the Cryptocurrency Market

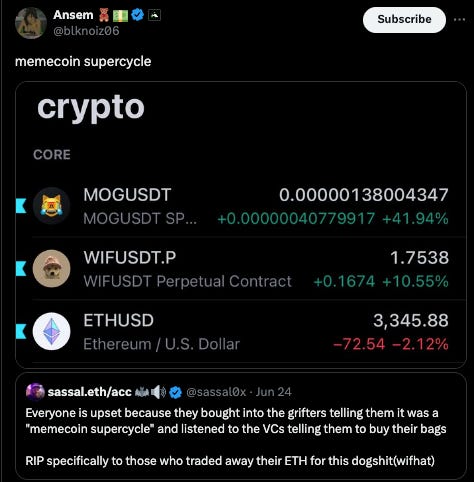

- Speculative Nature: The guest describes the current state of the cryptocurrency market as a collective pursuit of buying lottery tickets and engaging in degenerate trading. They mention that Dogecoin was trading at a high volume of 200-300 billion dollars a day during its peak.

- Value of Cryptocurrencies: Despite the speculative nature, the guest acknowledges the value of cryptocurrencies as globally traded assets and highlights the convenience and lower fees associated with using stablecoins for transactions.

- Yield Farming: The guest mentions the popularity of yield farming and the potential risks and rewards associated with it. They suggest that it can be a lower-risk option compared to trading on leverage.

Valuation Models for Cryptocurrencies and Tokens

- Social Media Influence: The guest emphasizes that attention and social media have become the new fundamentals in the market. Protocols need to be talked about and shilled to gain value and attract buyers.

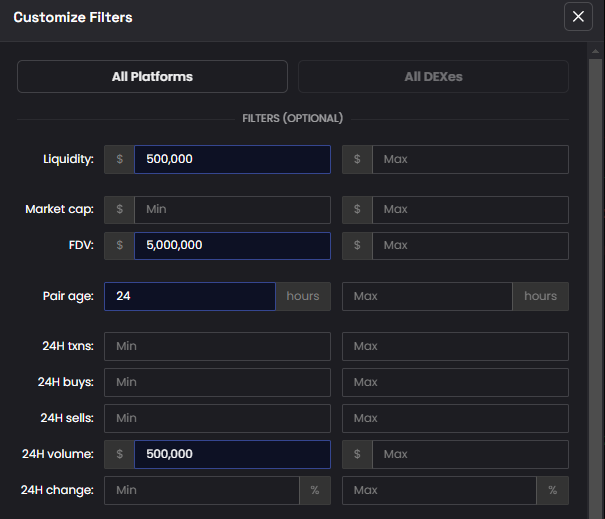

- Trading Strategy: The guest describes themselves as an aggressive trader who doesn’t care about entry points and uses momentum as a stop loss. They primarily trade big caps and focus on flows, such as when Coinbase is buying on spot and institutions are longing on perpetuals.

- Narrative Trading: The guest discusses the importance of narrative trading and mentions that they are not a great altcoin trader except for DeFi, where they saw the potential due to conversations with funds and retail traders.

Real-World Assets and Yield Farming

- Yield-Related Opportunities: The host believes that yield-related opportunities are generally a good thesis. They discuss the dilution of yield in most DeFi farms as TVL increases, but highlight that RWAs like treasuries or other types of debt can handle larger inflows without dilution.

- Underestimation of RWAs: The host discusses the potential underestimation of RWAs as a sector, noting that some protocols are buying and renting out houses to generate passive income.

- Appeal of RWAs: The host speculates that the appeal of RWAs may lie in their familiarity to both the younger and older generations.

Importance of Reputation System and Gut Feelings in Trading

- Reputation System: The guest suggests the need for a reputation system to filter out scams and fake accounts in the crypto market. They acknowledge the difficulty of implementing such a system but highlight its potential benefits.

- Gut Feelings: The guest emphasizes the importance of gut feelings and a sense of price levels in their trading decisions. They mention that gut feeling and a sense of price levels play a significant role in their trading decisions, given their constant monitoring of charts and familiarity with market movements.

- Risk Management: The guest discusses their personal risk management approach, including scaling into positions and cutting losses if down a certain percentage, even if they believe the trade will eventually go in their favor.

Sentiment Analysis

- Bullish: The guest expresses a bullish sentiment towards the cryptocurrency market, acknowledging the value of cryptocurrencies as globally traded assets and the potential of yield farming. They also see potential in DeFi and real-world assets, suggesting a positive outlook for these sectors.

- Bearish: The guest expresses a bearish sentiment towards the speculative nature of the market, describing it as a collective pursuit of buying lottery tickets and engaging in degenerate trading. They also mention the challenges of utilizing Crypto Twitter effectively and the need for a reputation system to filter out scams and fake accounts.

- Neutral: The guest maintains a neutral stance on certain aspects of the market, such as the valuation models for cryptocurrencies and tokens. They acknowledge the importance of social media attention in determining value but also emphasize the need for protocols to have good fundamentals. They also express a neutral sentiment towards their trading decisions, mentioning that some may not be based on perfect expected value (EV) but rather on a more game-like approach.