Podcast Summary

In this podcast, Kain Warwick, the innovator behind Synthetix, discusses the evolution of the crypto ecosystem, the role of stablecoins, and the potential of tokenizing real-world assets. The conversation also delves into the challenges of early-stage crypto investing and the dynamics of deal flow in angel investing.

Key Takeaways

The Evolution of Stablecoins and Crypto Ecosystem

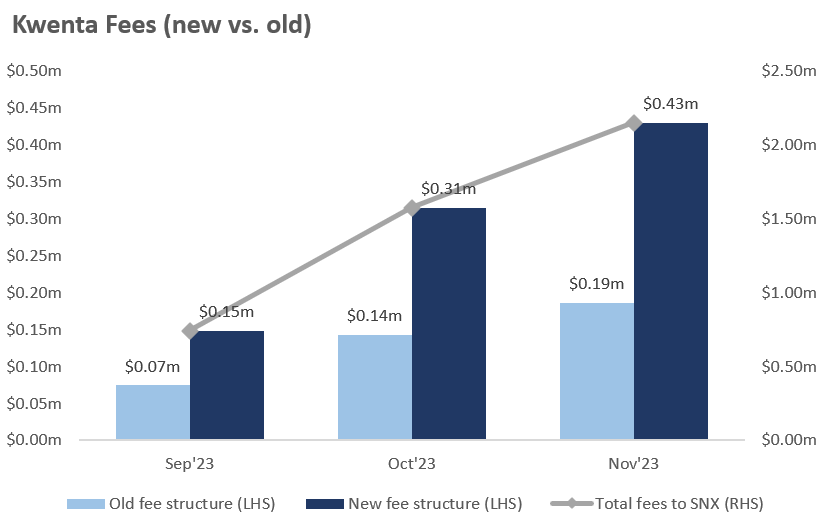

- Stablecoin Development: Warwick discusses the initial idea behind Synthetix as a stablecoin platform and its pivot in 2018 to allow exposure to a range of different assets. He highlights the importance of stablecoins like USDC and Tether in unlocking capital markets and enabling the growth of DeFi.

- Tokenizing Real-World Assets: The conversation explores the emergence of new ways to tokenize real-world assets and extract yield from them, with Maker cited as an example. The potential implications and opportunities of tokenizing real-world assets are discussed.

Challenges in Early-Stage Crypto Investing

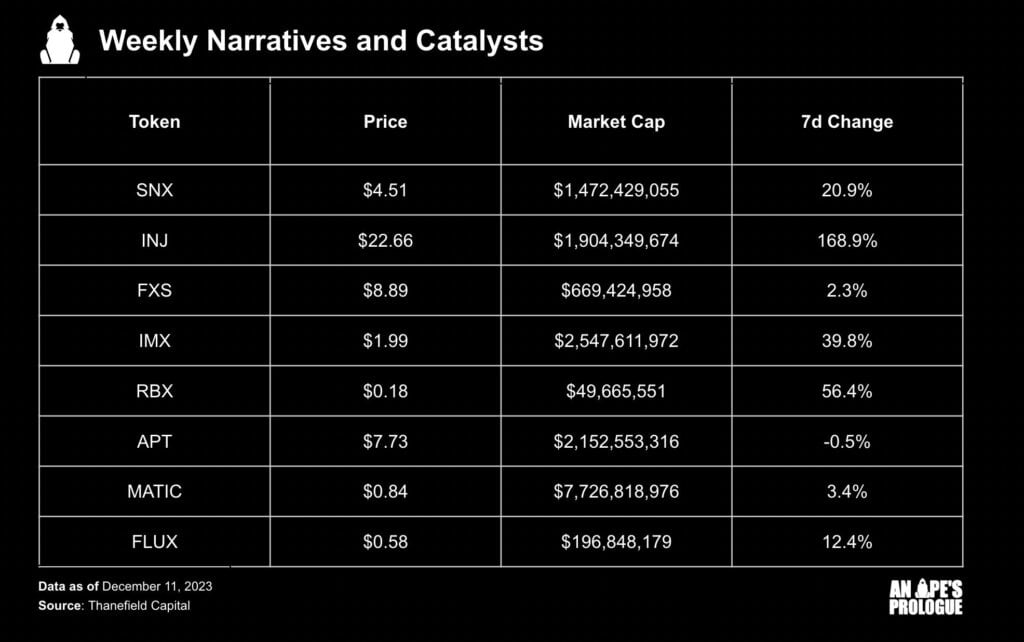

- Investment Limitations: The podcast discusses the challenges and limitations of early-stage crypto investing, including the difficulty of getting large allocations as an angel investor. The high valuations of seed rounds and the lack of credible projects with token generation event (TGE) prices below $50 million are highlighted.

- Meme Coins and Incentives: The host suggests that meme coins are a result of broken incentives in early-stage investing and serve as a market response to capital formation inefficiencies.

Deal Flow in Angel Investing

- Importance of Deal Flow: The speaker discusses the importance of having good deal flow in order to access high-quality investment opportunities. A strong reputation and network in the industry can lead to better deal flow and investment opportunities.

- Toxic Deal Flow: One red flag for toxic deal flow is when the incentives and motivations of the founders are unclear or questionable. If someone is trying to raise money from someone without good deal flow, it could be a red flag indicating a potentially toxic investment opportunity.

Sentiment Analysis

- Bullish: The podcast expresses a bullish sentiment towards the potential of tokenizing real-world assets and the role it plays in the overall development of the crypto ecosystem. The guest also shows optimism about the growth of DeFi enabled by stablecoins.

- Bearish: A bearish sentiment is expressed towards the current state of early-stage crypto investing. The high valuations of seed rounds, the lack of credible projects with low TGE prices, and the broken incentives leading to the emergence of meme coins are seen as challenges.

- Neutral: The podcast maintains a neutral stance on the future of tokenizing real-world assets like oil or gold on-chain. While acknowledging the potential, it is noted that there hasn’t been significant demand for trading these assets on-chain.