Podcast Summary

This podcast episode features a discussion on the importance of considering multiple trading venues for better execution and lower fees. The hosts also announce the upcoming Digital Assets Summit in London. The episode’s guest, Kane Warwick, founder of Synthetix, discusses the project’s progress and future plans, including the upcoming upgrade, Synthetix V3. The conversation also covers the importance of collateral in the Synthetix ecosystem, the comparison of Synthetix to Luna, and the challenges associated with deploying Synthetix on-chain.

Key Takeaways

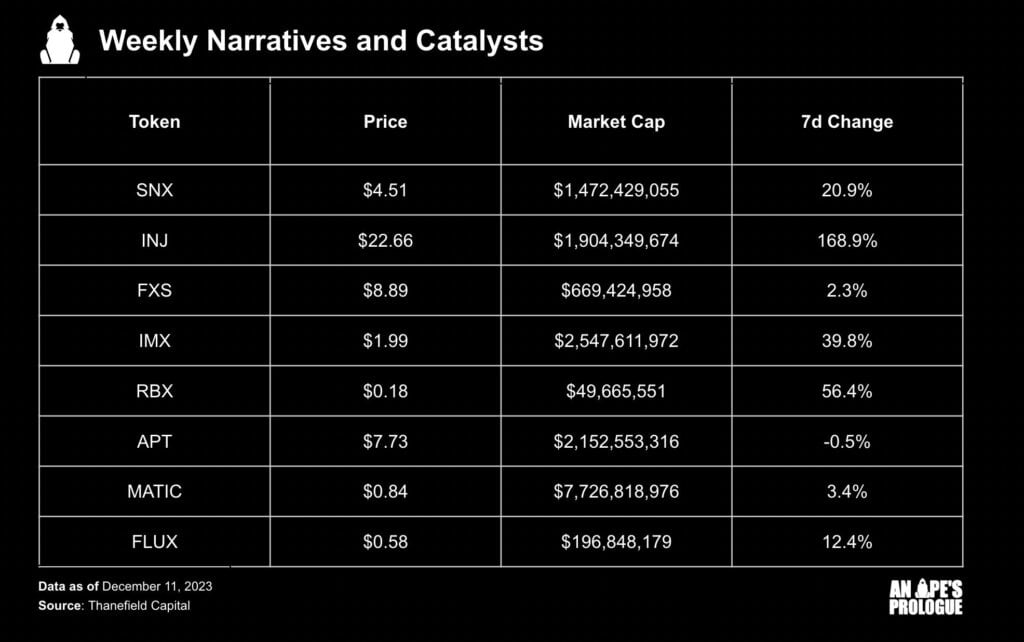

Importance of Multiple Trading Venues

- Trading Efficiency: The hosts emphasize the importance of considering multiple trading venues for better execution and lower fees. They argue that traders who stick to one exchange are missing out on better execution, arbitrage opportunities, and lower fees available on decentralized exchanges (DEXes).

- DEXes vs Centralized Exchanges: The competitiveness of DEXes has improved over the last six to 12 months, offering better fills, liquidity, and lower fees compared to centralized exchanges. Reasons to choose DEXes like Synthetix over centralized exchanges include incentivized rewards, transparency, and avoiding counterparty risk and potential fraud.

Progress and Future Plans of Synthetix

- Product-Market Fit: Synthetix has achieved product-market fit and has been consistently working and improving over time. The upcoming upgrade, Synthetix V3, aims to make minor improvements to the system without requiring a complete overhaul.

- Collateral in Synthetix: The hosts highlight the importance of collateral in the Synthetix ecosystem and the ongoing debate about the suitability of SNX as collateral. Synthetix has managed to survive and thrive by maintaining conservative parameters and generating consistent revenue.

Challenges in Deploying Synthetix On-Chain

- Trader Experience: The hosts discuss the challenges and trader experience associated with deploying Synthetix on-chain. They mention the existence of copycats and the drama surrounding the Tera project.

- Market Dislocation: The market dislocation occurs when there are too many long positions and not enough shorts, and the funding rate mechanism in synthetics helps correct this imbalance. The funding rate in on-chain perps is expected to approach zero as open interest increases.

Open-Source Software Development in Crypto

- Building in Public: Building in public and open-sourcing code benefits society by lowering barriers to entry and allowing for innovation and learning from each other. While building in public may not personally benefit individuals like Kane, it is valuable for society as a whole.

- Token Incentivization: Open-source software development in the crypto space has been accelerated by the introduction of tokens as a coordination and incentivization layer. The presence of tokens aligns developers and users, creating a higher standard for protocols and allowing users to easily switch to better options.

Upcoming Digital Assets Summit

- Event Announcement: The hosts announce the upcoming Digital Assets Summit in London, emphasizing the opportunity to stay ahead of the curve in the institutional adoption of crypto. They offer a 20% discount code, “Empire20,” for the Summit and mention a competition at Blockworks to see who can drive the most ticket sales.

Sentiment Analysis

- Bullish: The podcast hosts express a bullish sentiment towards the future of Synthetix and the potential of decentralized exchanges. They highlight the improvements in DEXes over the past year and the benefits they offer over centralized exchanges. The hosts also express optimism about the upcoming Digital Assets Summit and the potential for institutional adoption of crypto.

- Bearish: There is a bearish sentiment expressed towards the challenges faced in deploying Synthetix on-chain and the difficulties of coordinating decision-making in decentralized systems. The hosts also express skepticism about the claims of widespread adoption of certain projects in Korea.

- Neutral: The hosts maintain a neutral stance on the suitability of SNX as collateral in the Synthetix ecosystem, acknowledging the ongoing debate on this issue. They also discuss the trade-off between efficiency and decentralization in building in a decentralized open-source context, without expressing a clear preference for one over the other.