Podcast Summary

This podcast episode delves into the rise of Liquid Restaking Tokens (LRTs) and their impact on the blockchain ecosystem. The discussion explores the dynamics of LRTs, their role in staking, and their implications for asset-backed securities (ABS). The episode also highlights the growth of the Restaking ecosystem, with a significant amount staked on Restaking on the Eigen Layer.

Key Takeaways

The Rise and Role of Liquid Restaking Tokens (LRTs)

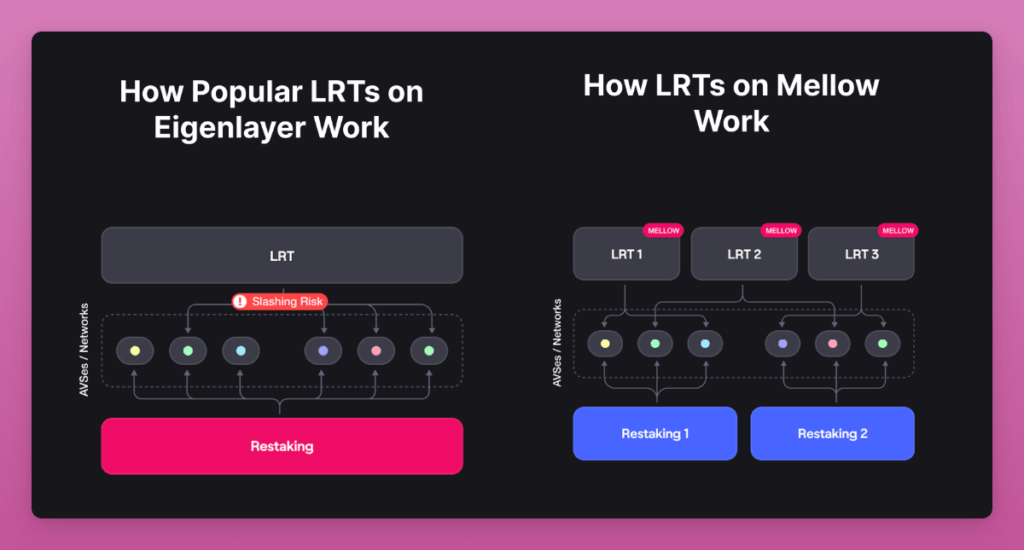

- Emergence of LRTs: LRTs have emerged as a generalization of staking, allowing users to provide additional services to the network in exchange for more yield, albeit with increased risk. They have become crucial for node operators, helping them manage Restaking strategies and comply with regulations.

- Impact on the Ecosystem: LRTs have introduced complexity and altered the risk-reward profile of stake positions. This has made the role of strategy managers vital in the ecosystem. LRTs have also played a significant role in securing more networks and boosting yield.

Comparison of LRTs and Liquid Staking Tokens (LSTs)

- Variability in Reward and Risk: LRTs offer more variability in terms of reward rate and risk compared to LSTs, which are more focused on moneyness and integration with DeFi. This has led to a more fragmented market structure for LRTs due to the heterogeneity of assets and different value propositions.

- Integration with DeFi: LRT protocols are being used in DeFi, with some focusing on utility channels like collateral or gas on Layer 2. This has added to the complexity of the demand side of the market for LRTs.

Implications for Asset-Backed Securities (ABS)

- ABS as a Shelling Point: ABS serves as a shelling point for raising capital and plugging into a user base. The transition from LSTs to LRTs has shifted focus to ABS due to market demand.

- Infrastructure Needs: The limited number of ABS currently available prompts the need for additional infrastructure and ecosystem building to support the market structure.

Future of LRTs

- Potential Evolution: In the future, LRTs may evolve to resemble VC deals, providing security to protocols and having lock-up agreements for a specific period. There is also potential for LRTs to become more independent and agnostic.

- Challenges: Adding complexity to LRTs could be detrimental to their success, as users may find it more difficult to understand and use the protocol. There is also a fundamental tension between what is easy for users and what the market wants, particularly in terms of duration and liquidity guarantees.

Sentiment Analysis

- Bullish: The podcast presents a bullish sentiment towards LRTs, highlighting their growth and potential in the blockchain ecosystem. The hosts discuss the rise of LRTs and their role in staking, emphasizing their importance for node operators and their impact on the risk-reward profile of stake positions.

- Neutral: While the hosts express optimism about the future of LRTs, they also acknowledge the challenges and complexities associated with them. They discuss the potential difficulties users may face in understanding and using LRTs, especially as they evolve and become more complex.