Podcast Summary

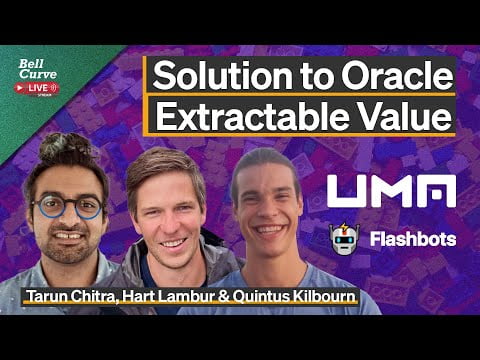

This podcast delves into the concept of Miner Extractable Value (MEV) within the Ethereum supply chain, focusing on liquidations. Key stakeholders discussed include UMA, Chainlink, and Flashbots. The conversation explores the role of liquidations in DeFi protocols, the use of auctions to recapture MEV, and the potential of protocols like Oval and Swab in optimizing liquidation processes and capturing MEV.

Key Takeaways

Understanding Liquidation MEV

- Concept of Liquidation MEV: Liquidation MEV refers to the value extracted from influencing the ordering or inclusion/exclusion of transactions following an oracle update, particularly in the context of liquidations in DeFi protocols. Liquidations occur when the price of an asset falls below a certain threshold, triggering the liquidation process.

- Role of Flashbots and Oval: Flashbots and the Oval protocol aim to recapture MEV by auctioning off the first right to use a Chainlink price update through the Flashbots MEV share infrastructure. This allows for the recapture of MEV that protocols are currently losing.

Role of Auctions in Liquidations

- Importance of Auctions: The addition of the MEV share auction in the Swab protocol provides a market mechanism to determine the discount for liquidated collateral. This auction mechanism helps capture MEV and redirect it back to the protocol, reducing average costs for liquidations.

- Impact on Liquidation Parameters: Lossy Oracle prices can affect the aggressiveness of liquidation parameters, as higher volatility requires higher discounts to account for uncertainty. Oracles that provide price information can also offer insights into liquidity, allowing protocols to optimize costs in the long run.

Future of Lending Protocols

- Combination of Dynamic Pricing and Risk Holding: The future of lending protocols is seen as a combination of improving true price dynamically and having protocols hold some risk on their own. This could involve protocols tolerating bad debt and implementing soft liquidation mechanisms, with the protocol holding risk and trading with users.

- Need for Market-Based Information: The need for market-based information to make decisions in these sophisticated mechanisms is emphasized. This could involve using auctions as a solution to problems in the crypto space, with the belief that adding an auction can solve many issues.

Role of MEV in Protocol Improvement

- Redistribution of MEV: The concept of MEV (extractable value) and the need for its redistribution is discussed, with the proposer often benefiting the most. MEV share and Swab are seen as mechanisms to redirect value away from proposers and towards protocols or users.

- Potential of MEV: The potential of using MEV to improve protocols, make fees cheaper, pay for services, or create revenue streams is explored. The concept of MEV exhaust is introduced, where the more a protocol is used, the more MEV is created, and capturing this MEV can benefit the protocol.

Sentiment Analysis

- Bullish: The podcast presents a bullish sentiment towards the use of auctions and the potential of MEV in improving protocols and creating revenue streams. The future of lending protocols is seen positively, with the belief that a combination of dynamic pricing and risk holding can optimize liquidation processes.

- Neutral: The podcast maintains a neutral stance on the current state of liquidations in DeFi protocols, acknowledging the high-risk nature of these events and the need for more efficient mechanisms to recapture MEV.