Podcast Summary

This podcast features a guest from Unsheth, a DeFi protocol that aggregates liquid staking tokens. The discussion revolves around Unsheth’s operations, its use of Layer Zero, and its plans for expansion. The conversation also delves into the complexities of liquid staking derivatives, the introduction of a ZK ML Oracle by Unsheth, and the risks associated with Liquid Restaking Tokens. The podcast concludes with a discussion on the challenges of scaling protocols and the ongoing development of Paladin V2, an on-chain governance solution.

Key Takeaways

Unsheth’s Role in DeFi and Plans for Expansion

- Unsheth’s Functionality: Unsheth allows users to stake their ETH with multiple major liquid staking protocols simultaneously, earning a weighted average staking yield. It also serves as a stable swap for liquid staking tokens.

- Performance and Expansion: Historically, Unsheth has outperformed the average ETH staking yield by 1-5% by earning swap fees and other associated fees. It is currently live on Ethereum, BNB Chain, and Arbitrum, with plans to expand to other chains.

Introduction of ZK ML Oracle by Unsheth

- Addressing Variations and Risks: The ZK ML Oracle by Unsheth aims to handle the variations and risks associated with new slashing conditions and yield generation abilities.

- Decentralized Reporting: The ZK Oracle technology developed by Unsheth and Sushi Labs allows for decentralized and trustless reporting of the amount of ETH backing each Liquid Staked Derivative (LSD), providing a proof of reserves for LSDs.

Risks Associated with Liquid Restaking Tokens

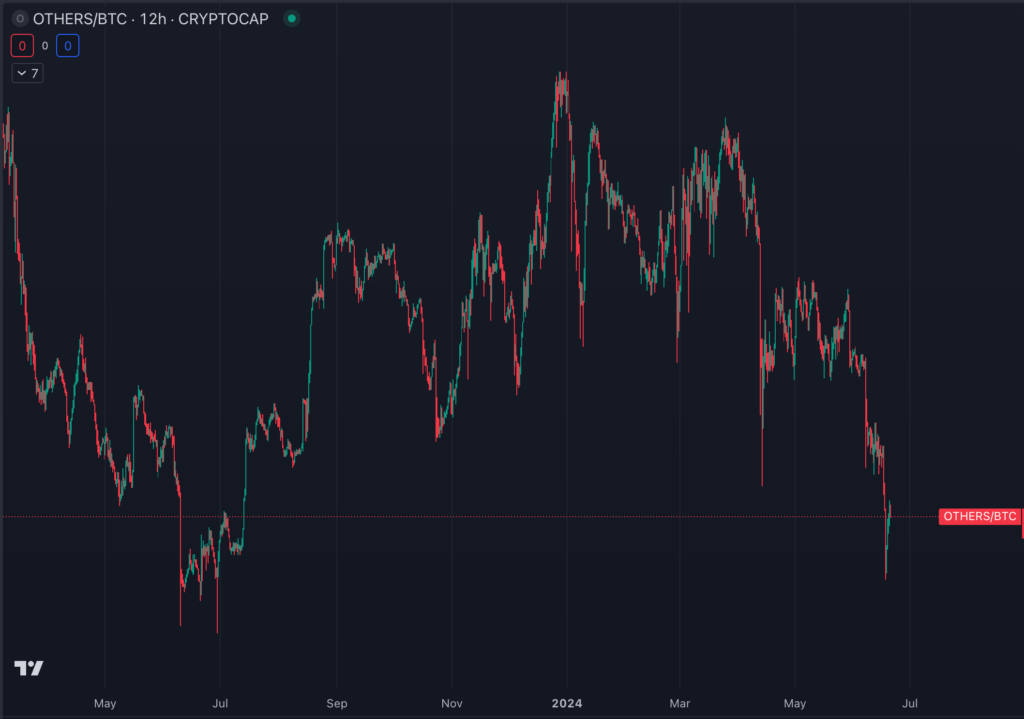

- Availability of ETH: The discussion highlights the risk that the ETH seen today may not be available tomorrow due to slashing or hacking risks. Different restaking applications have different rules on slashing, and the risk assessment needs to be done on an individual basis.

- Assessing Risk: Protocols like Ion Protocol and LCX File Learning Protocol are trying to assess this risk and create risk scores for Liquid Restaking Tokens. It is estimated that it will take three to six months to address these concerns and assess the risk scoring based on historical data.

Challenges of Scaling Protocols

- Scaling Difficulties: The discussion revolves around the challenges of scaling protocols that involve minting synthetic assets and looping them, as it becomes difficult to come by a lot of ETH.

- Looping Protocols: The looping protocols described in the conversation involve throwing incentives, VC money, or pre-sale money into curve pools, where people mint synthetic assets and loop them. This process benefits early participants but doesn’t scale beyond tens of millions.

Development of Paladin V2

- Upgrading On-Chain Governance: Paladin has been working on their V2, which is an upgrade to their on-chain governance solution. The problem targeted in Paladin V1 was overpaying for votes and lack of clarity in voting incentives.

- Introducing New Concepts: V2 introduces the concept of quadratic incentives and dynamic incentives, allowing for liquidity rewards within specific bounds based on outcomes. Most people are excited about the range governance concept and issuing quests with fixed parameters.

Sentiment Analysis

- Bullish: The podcast expresses a bullish sentiment towards Unsheth and its operations. The guest highlights Unsheth’s performance, which has historically outperformed the average ETH staking yield by 1-5%. The introduction of the ZK ML Oracle by Unsheth is also seen as a positive development, as it aims to handle the variations and risks associated with new slashing conditions and yield generation abilities.

- Bearish: A bearish sentiment is expressed towards the risks associated with Liquid Restaking Tokens. The discussion highlights the risk that the ETH seen today may not be available tomorrow due to slashing or hacking risks. The challenges of scaling protocols that involve minting synthetic assets and looping them are also seen as a potential downside, as it becomes difficult to come by a lot of ETH.

- Neutral: The sentiment towards the development of Paladin V2 is neutral. While the upgrade to their on-chain governance solution is seen as a positive development, there is no explicit expression of optimism or pessimism towards its future performance.