Research Summary

- The report discusses market positioning, focusing on the developing setup in bonds, some Agg shorts, and a long in small-caps.

- Speculators are observed to be very short USD, long on precious metals, increasingly long on energy, and crowded short in bonds. The most crowded longs are cotton, Dow Jones, and EURUSD, while the shorts are in DXY, 5yr, and 2yr Treasuries.

- The report emphasizes a potential big trade in buying bonds towards the year’s end, highlighting the need for patience and waiting for signals of a likely bottom.

- A divergence in Copper/Gold is noted, and a move similar to the one leading up to the major bottom in bonds in November 2018 is anticipated.

- Speculators are crowded long in cotton, and the report identifies a potential double top, suggesting a short position with a risk point above recent highs.

- Cocoa is identified as another market with crowded spec positioning and extreme technical extension, with a recommendation to short on a bounce back to the Bollinger Band midline.

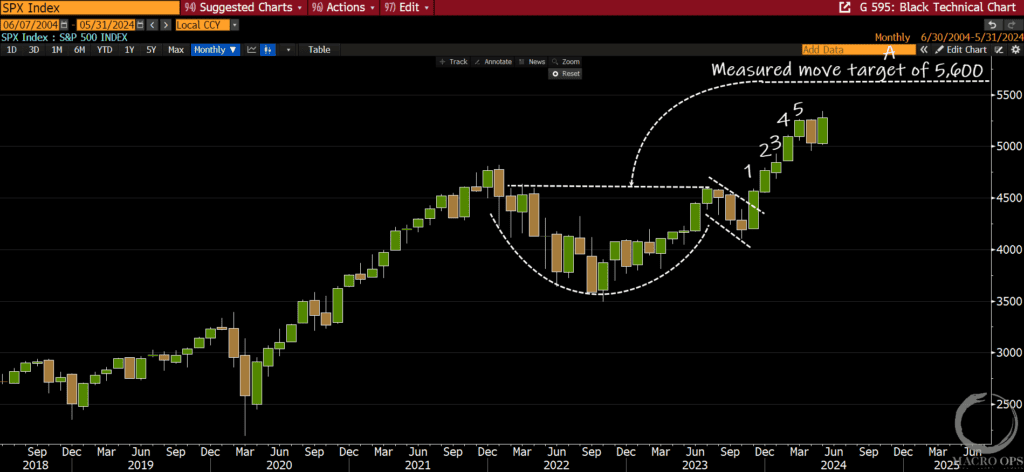

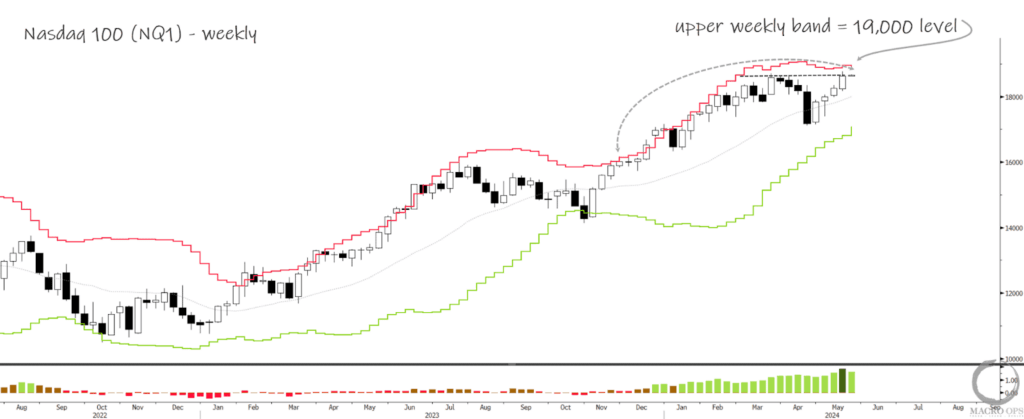

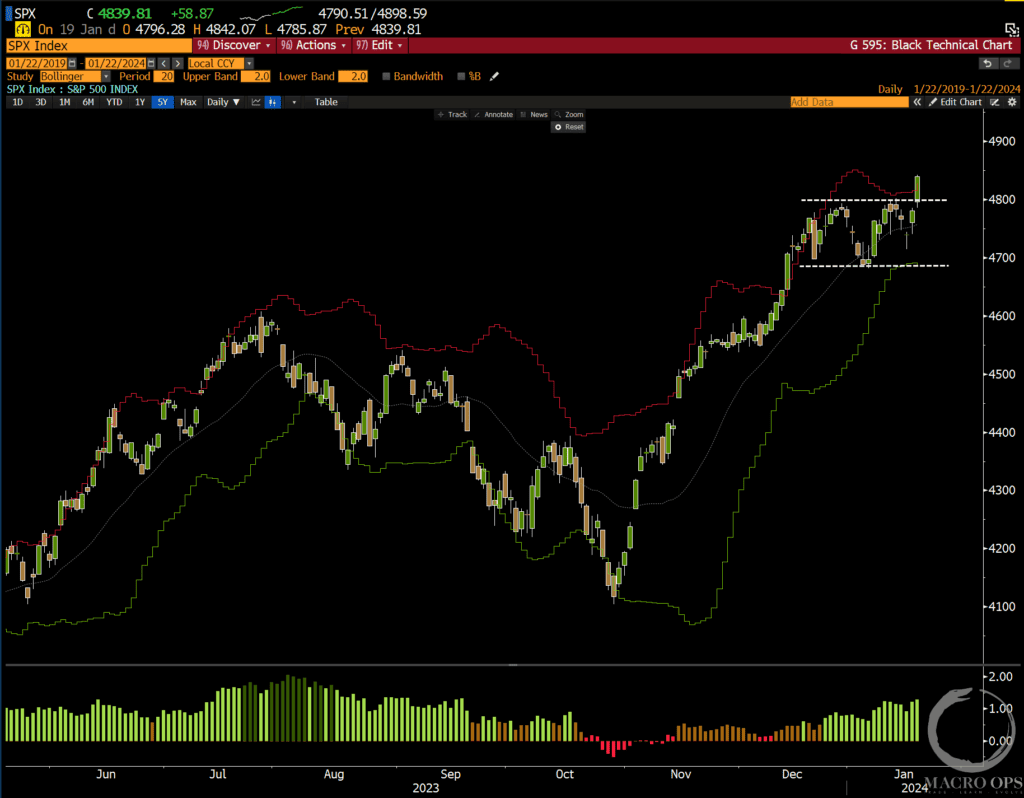

- The report expresses a weak opinion on equities, acknowledging the bearish positioning and recession narrative, but expecting a bumpier ride for the second half.

- Multi-asset fund equity exposure is surging, with a suggestion to look for a developing top in names like MSFT, AAPL, NVDA, and GOOGL.

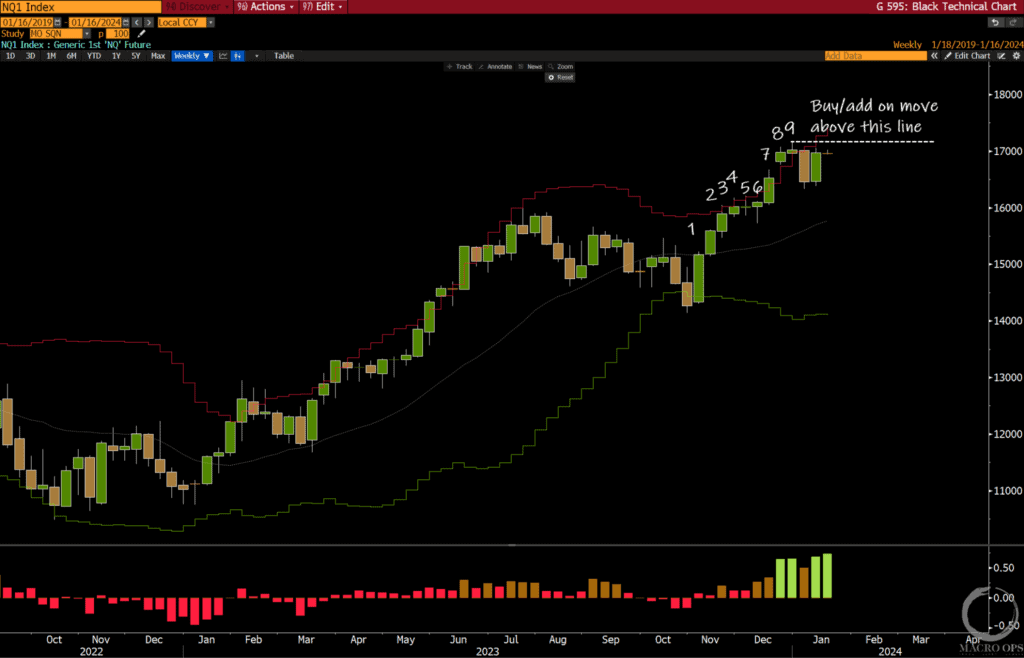

- A quick swing trade setup in the Russell is mentioned, with specifications on the conditions for the trade.

Actionable Insights

- Investment Opportunity: Consider buying bonds towards the year’s end, but with patience and careful observation of market signals.

- Shorting Strategy: Potential short positions in cotton and cocoa, based on crowded spec positioning and technical indicators.

- Equity Watch: Monitor multi-asset fund equity exposure, especially in tech giants like MSFT, AAPL, NVDA, and GOOGL, for developing tops.

- Swing Trade: Consider the setup in the Russell for a quick swing trade, following the specified conditions in the report.