Research Summary

The report discusses various financial trends and indicators, including the S&P 500’s seasonal tendency, bullish sentiment and positioning, a bullish pattern in the Qs, a surge in financial sector breadth, and a bullish setup in corn. It also highlights weakening US labor data and negative foreign direct investment in China.

Key Takeaways

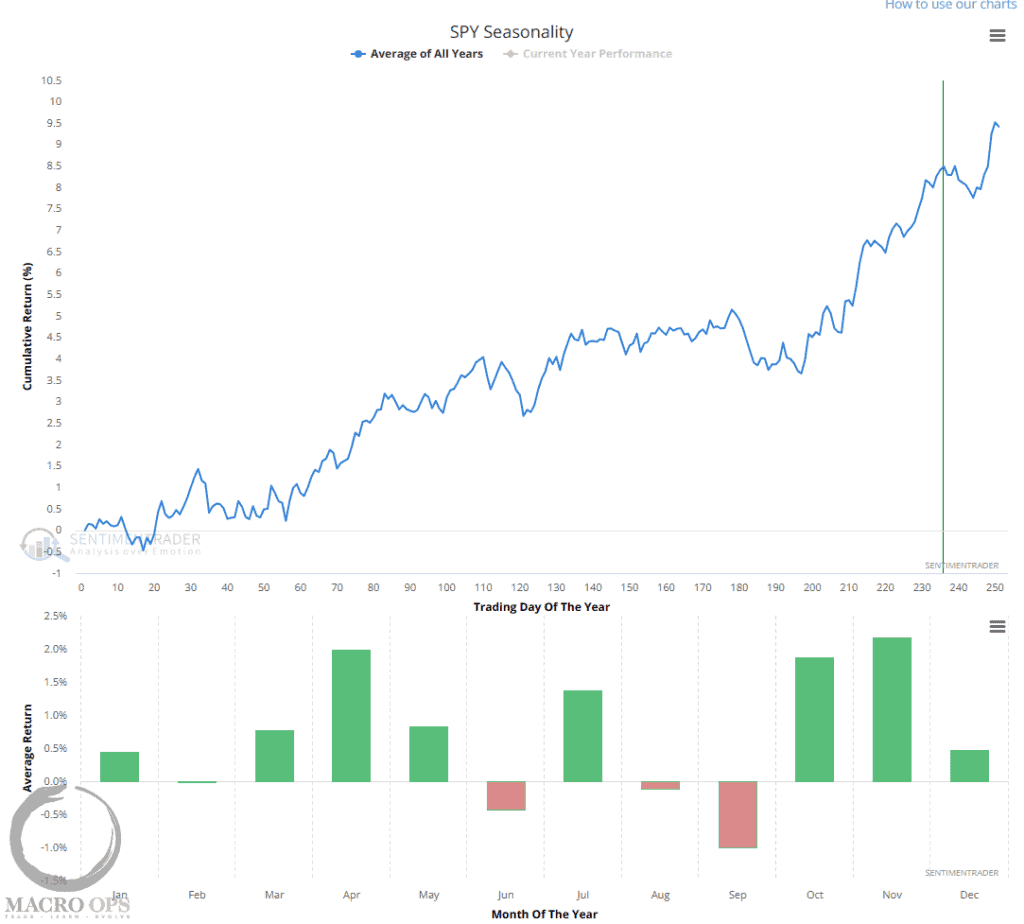

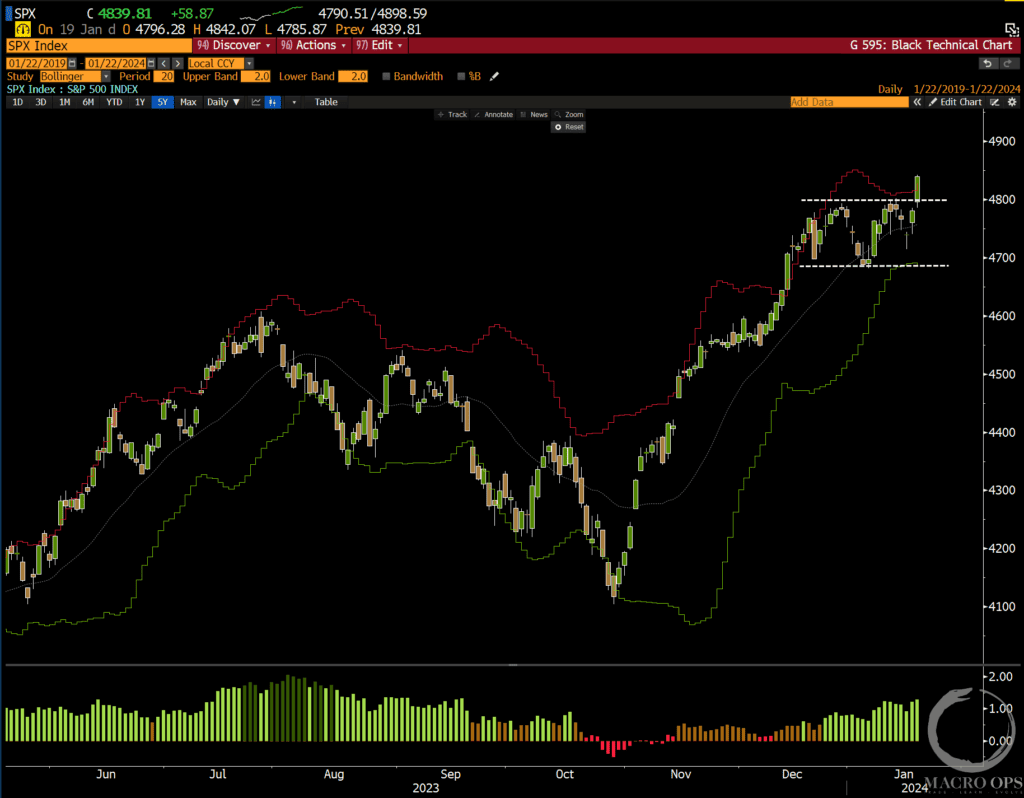

Seasonal Tendency of the SPX

- Year-End Runup: The report notes that the S&P 500 (SPX) typically dips over the next eight trading days before bottoming out and running up towards the end of the year.

Bullish Sentiment and Positioning

- Strong Market Breadth: Market sentiment and positioning are turning more bullish, but not at levels that usually indicate larger pullbacks. Market breadth is strong, nearing overextension, and market internals continue to support the broader upward trend.

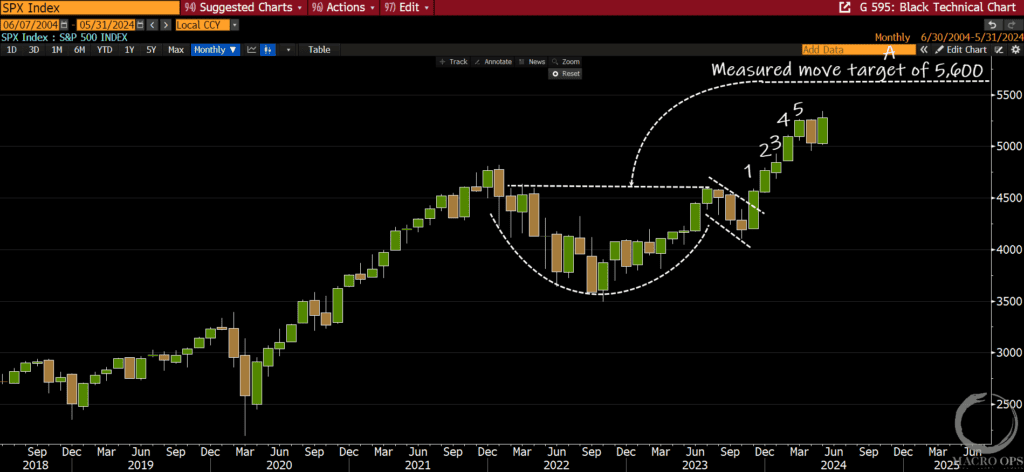

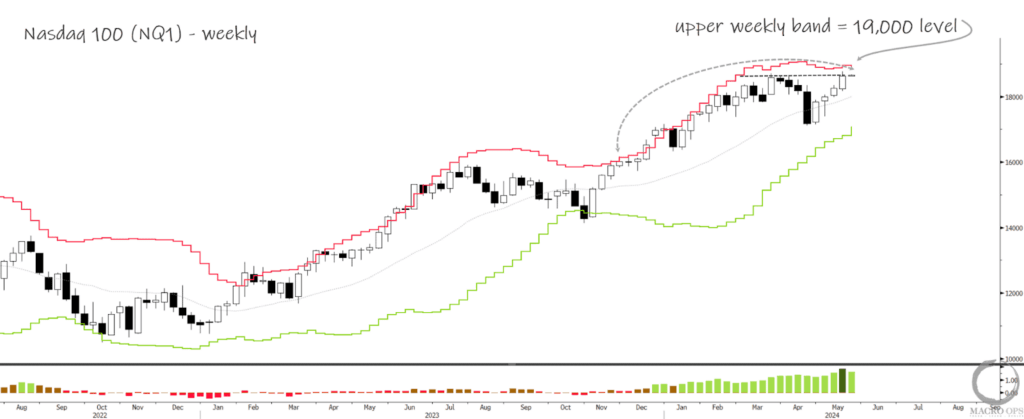

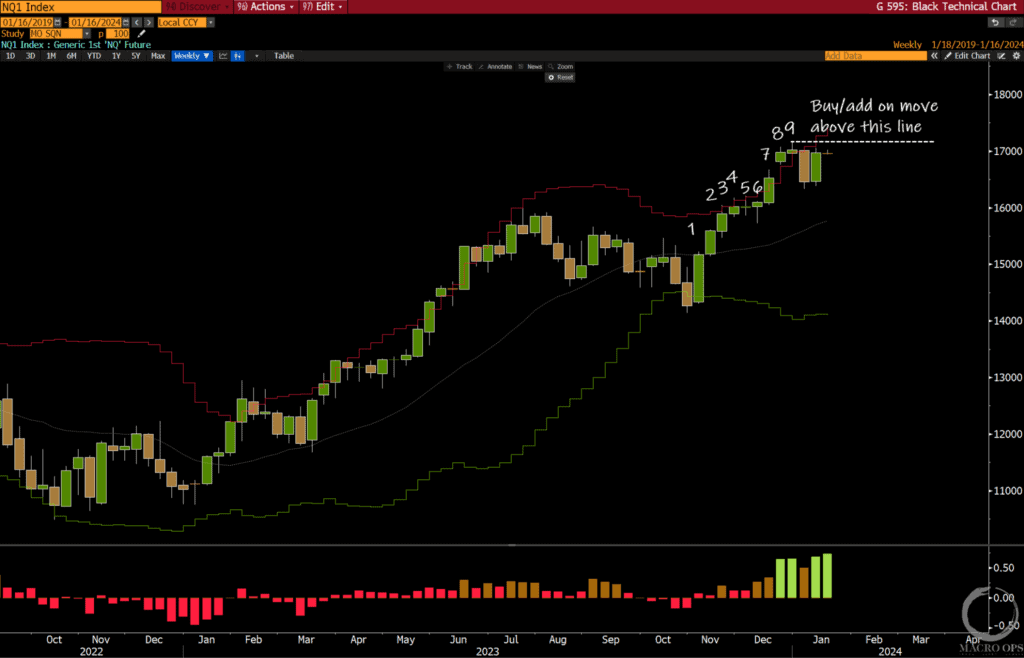

Bullish Pattern in the Qs

- Large Cup-n-Handle Pattern: The Qs, a common term for the NASDAQ-100 Index, have completed a large 24-month cup-n-handle pattern, which is a bullish pattern. The report suggests adding to positions on a daily close above its current sideways range.

Surge in Financial Sector Breadth

- Buy Signal for Financials: The financial sector experienced a surge in breadth last week, triggering a buy signal. A breadth composite containing six indicators exploded to the highest level in over two years. The previous signal in November 2020 led to a nearly 16% gain over the following three months.

Bullish Setup in Corn

- Over 2std Oversold: Corn recently hit over 2 standard deviations oversold from its 20 and 50-day moving averages, and nearly 1.5 standard deviations below its 200-day moving average. The report suggests a potential long position on a confirmed breakout.

Actionable Insights

- Monitor SPX Seasonal Trends: Investors should keep an eye on the S&P 500’s seasonal trends, as it typically dips before a year-end runup.

- Consider Bullish Market Positioning: With market sentiment and positioning turning more bullish, investors might want to consider aligning their strategies accordingly.

- Watch for Breakouts in the Qs: The completion of a large cup-n-handle pattern in the Qs suggests potential for a breakout, which could present a buying opportunity.

- Track Financial Sector Breadth: The recent surge in financial sector breadth indicates a buy signal, which investors should take into account when making investment decisions.

- Assess Corn Market Conditions: The oversold condition of corn, combined with its strongest period of seasonality, suggests potential for a bullish setup.