Research Summary

The report provides an analysis of the current market trends, focusing on the fundamentals, technicals, and market tone. It discusses the performance of the Nasdaq 100, market internals, and the impact of cyclical vs defensive sectors. The report also highlights the rising tanker prices due to disruptions in global energy trade and the performance of the Global Shipping ETF.

Key Takeaways

Market Performance and Predictions

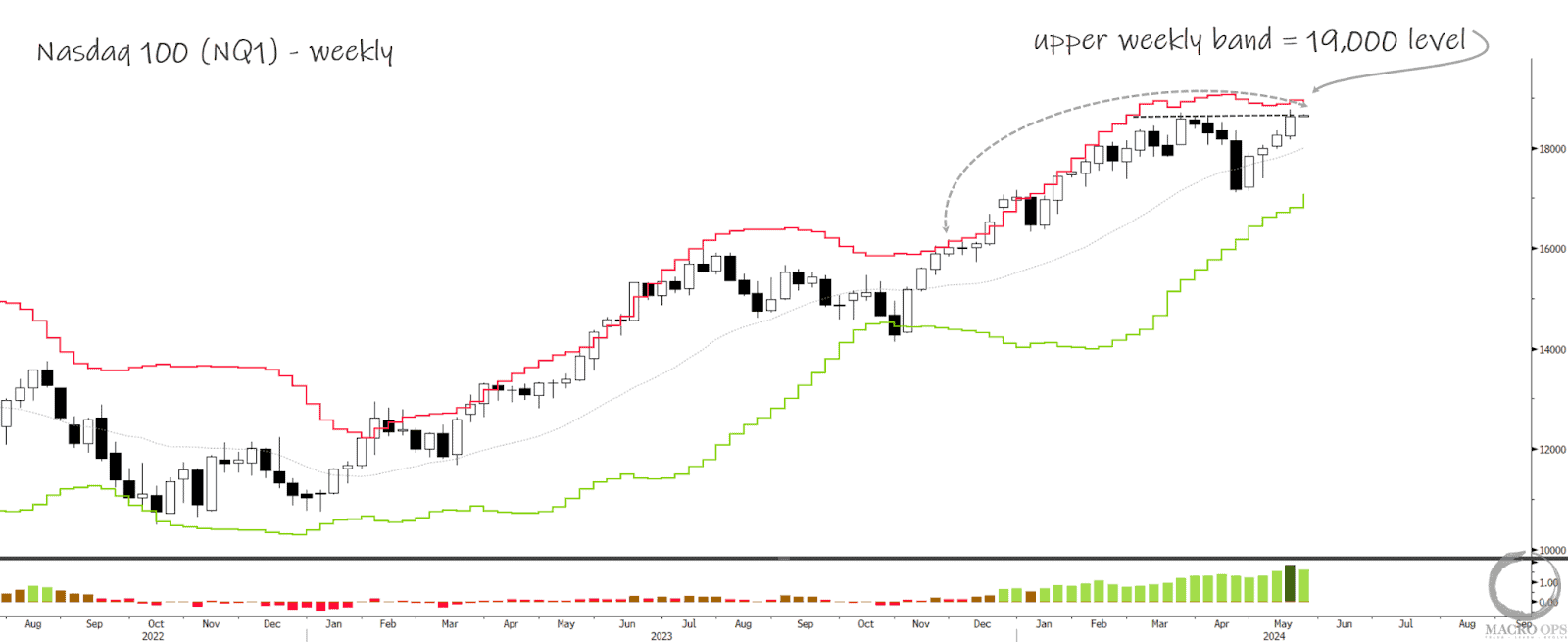

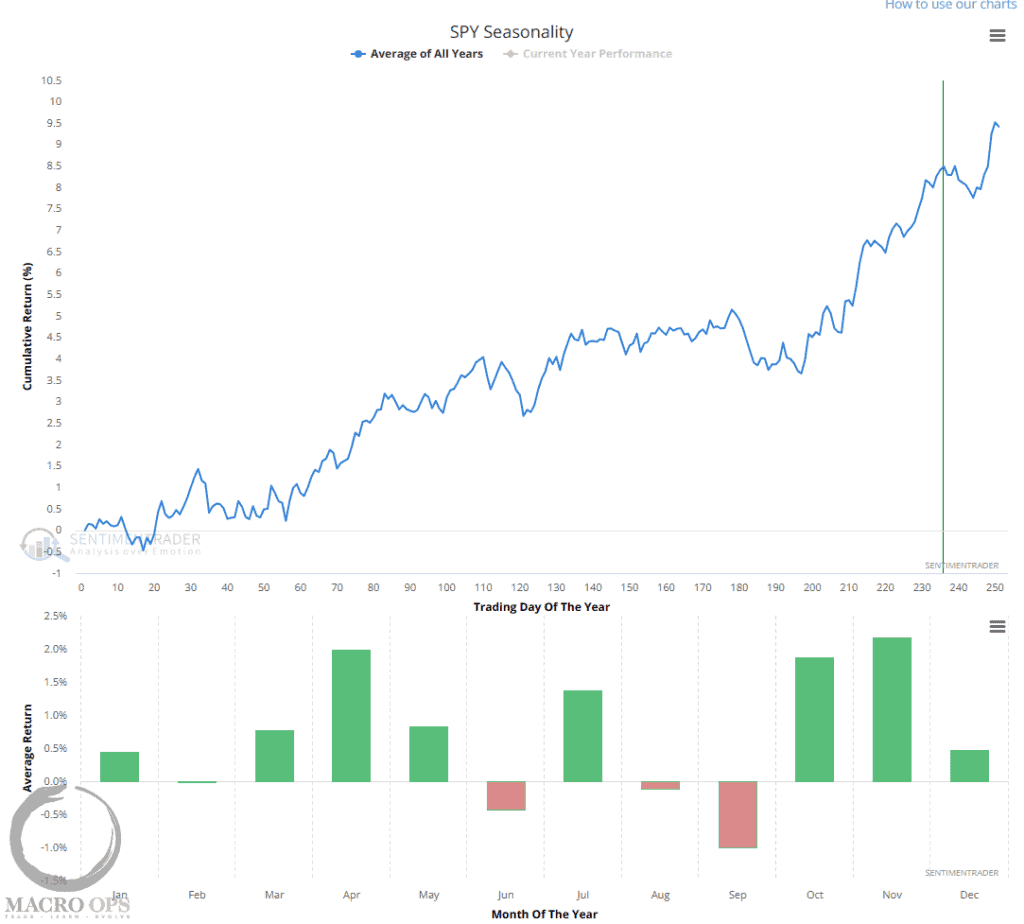

- Continued Market Uptrend: The report suggests that the market is experiencing an uptrend, with the Nasdaq 100 reaching a new weekly all-time closing high. The recommendation is to buy dips and add on rips, anticipating some sideways compression in the coming weeks.

- Negative Market Signals: The only negative development noted is in the Market Internals Aggregator, which dropped further last week. However, this is attributed to the cyclical vs defensive sectors rather than a broader market downturn.

Impact of Sector Performance

- Cyclical vs Defensive Sectors: The drop in the Market Internals Aggregator is primarily due to the performance of cyclical vs defensive sectors. The report suggests that the strong performance of the utility sector is due to latecomers buying into the AI theme, rather than a bearish sign of slower growth.

Global Energy Trade Disruptions

- Rising Tanker Prices: The report highlights that violent attacks have disrupted global energy trade, leading to longer shipping routes and less tonnage available for shipping. This has resulted in rising costs to ship goods and increased demand for ships, causing tanker vessel prices to double over the past two years.

Performance of the Global Shipping ETF

- Top-Performing Holdings: The report provides an overview of the top-performing holdings over the past year from the Global Shipping ETF (BOAT), suggesting that investors might want to look at the charts of STNG, TNK, TK, and similar tankers.

Actionable Insights

- Monitor Market Internals: Given the drop in the Market Internals Aggregator, it would be prudent to keep a close eye on market internals, particularly the performance of cyclical vs defensive sectors.

- Consider the Impact of Sector Performance: The strong performance of the utility sector due to the AI theme suggests that investors should consider the impact of sector performance on overall market trends.

- Understand Global Energy Trade Disruptions: The disruptions in global energy trade and their impact on shipping costs and demand for ships highlight the need to understand the broader geopolitical and economic factors affecting the market.

- Review the Performance of Shipping ETFs: The performance of the Global Shipping ETF (BOAT) and its top-performing holdings suggest that investors might want to review the performance of shipping ETFs and their holdings.