Research Summary

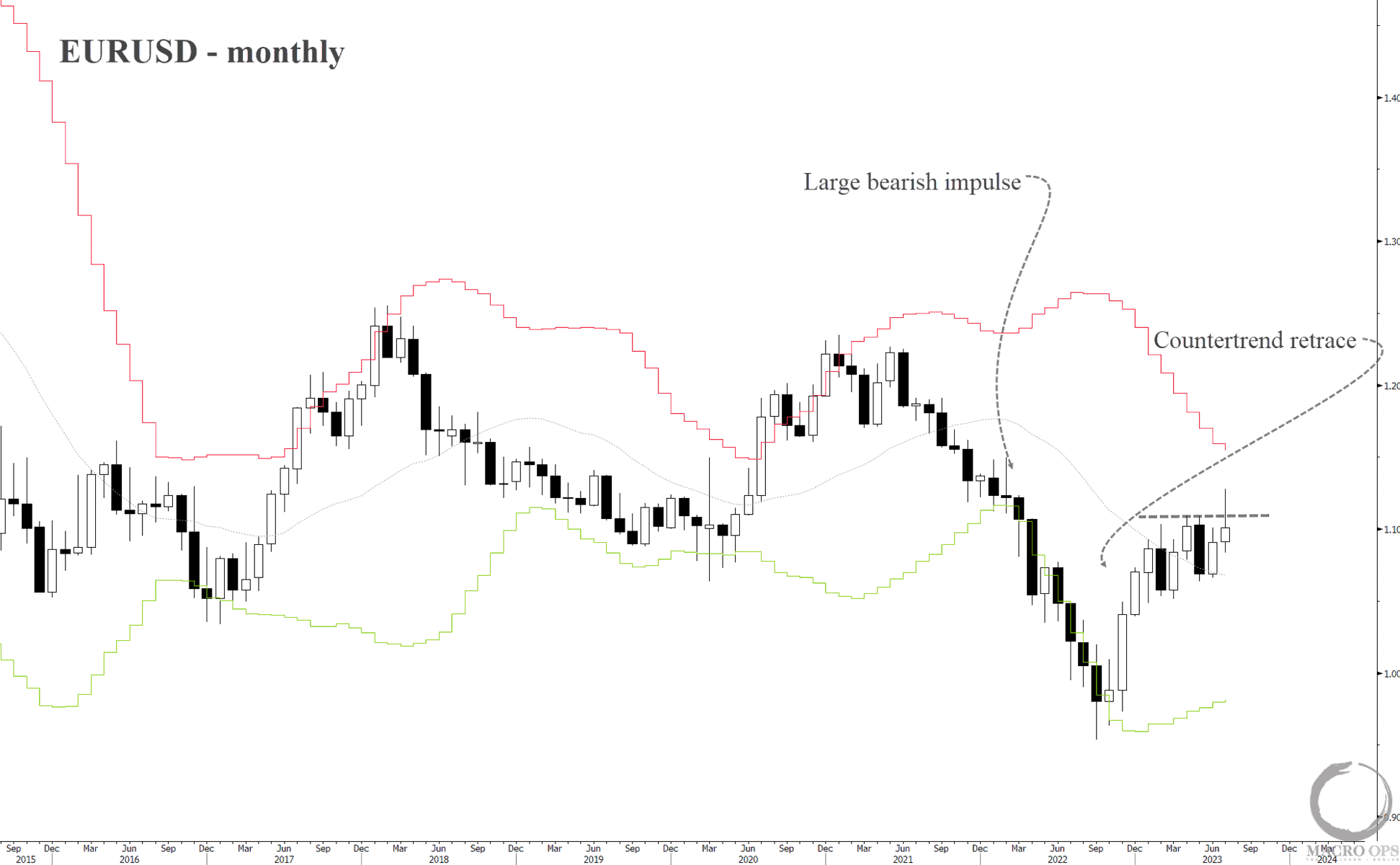

The report provides a comprehensive review of various financial markets and assets, including stocks, crude oil, gold, bonds, currencies, Bitcoin, and specific country indices. The author uses monthly charts to identify and analyze major trends and flows in these markets. The report suggests that the S&P 500 and crude oil are likely to continue their bullish trends, while gold may experience some sideways movement. The author also discusses the potential for a downward trend in EUR/USD and a bearish outlook for Bitcoin.

Actionable Insights

- SPX is likely to continue its bullish trend: The S&P 500 is expected to close near its highs for the month, suggesting a likely upward move in August.

- Crude oil shows a bullish setup: Despite bearish positioning, crude oil is expected to continue its upward trend in August.

- Gold may experience sideways movement: Despite the larger bull trend, gold may experience more sideways to slightly lower chop in the near term due to positioning.

- EUR/USD may see a downward trend: The report suggests a potential resumption of the downward trend in EUR/USD due to recent price action and consensus positioning short USD.

- Bitcoin may experience a bearish trend: The author suggests taking profits on Bitcoin and potentially looking for a short position due to its failure to show bullish participation and recent flip in positioning.

- Industrials sector shows a promising long-term chart: The Industrials sector (XLI) has completed a multi-year inverted H&S continuation pattern, suggesting a potential upward trend.