Research Summary

The report discusses the recent settlement between Binance, the world’s largest cryptocurrency exchange, and the U.S. Justice Department, the Commodity Futures Trading Commission, and the Treasury Department. The settlement follows a multi-year investigation into Binance’s alleged violations of U.S. anti-money laundering laws. The report also explores the implications of this settlement for the broader cryptocurrency industry.

Key Takeaways

Binance’s Settlement and Leadership Change

- Binance’s Legal Settlement: Following a multi-year investigation, Binance reached a settlement with the U.S. Justice Department, the Commodity Futures Trading Commission, and the Treasury Department on November 21, 2023. The settlement includes a $4.3 billion fine for Binance and a personal $50 million fine for Changpeng Zhao, who has resigned as Binance CEO.

- Leadership Change at Binance: In response to the settlement, Binance has appointed Richard Teng, the former Head of Regional Markets, as their new CEO. An independent compliance monitor will also oversee Binance operations as part of the settlement.

Market Reaction and Binance’s Financial Stability

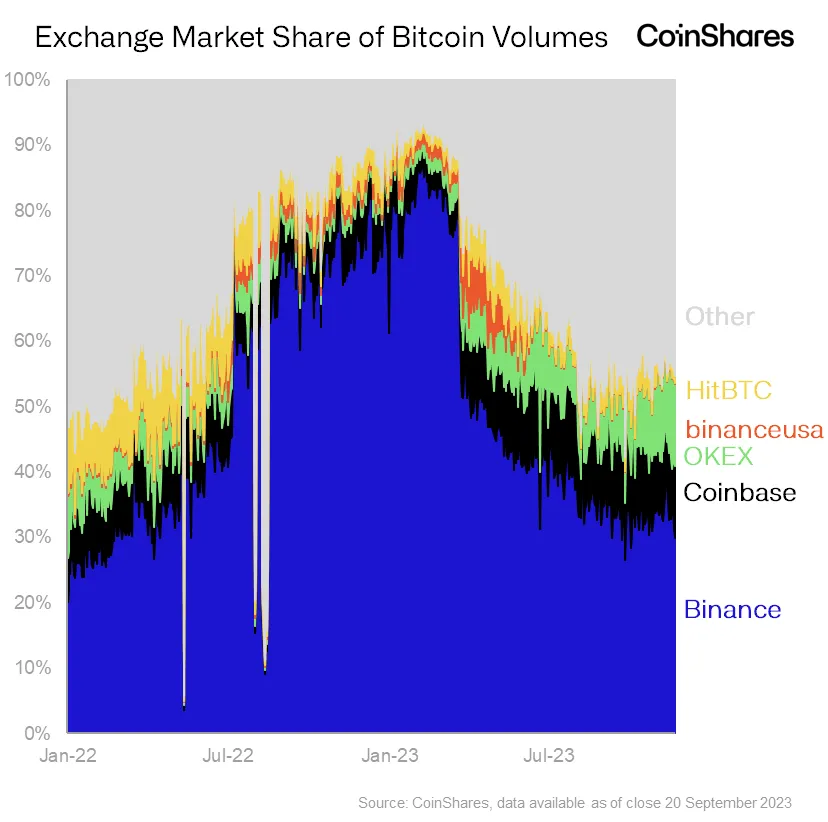

- Market Reaction to the Settlement: Despite initial anxiety within the crypto industry about a potential collapse of Binance, the market reaction to the settlement details was largely muted. This suggests a collective relief that Binance is not in financial trouble and that user assets are safe.

- Binance’s Financial Stability: The report suggests that Binance will likely be able to handle the $4.3 billion fine without major issues. Binance holds approximately $6.3 billion in assets that are not customer funds, including about $3 billion in stablecoins.

Implications for the Crypto Industry

- New Era of Regulatory Oversight: The settlement signifies the onset of a new era defined by enhanced compliance and responsibility within the cryptocurrency exchange industry. This aligns cryptocurrency with other recognized financial asset classes and is expected to bolster investor confidence and ensure long-term stability in the cryptocurrency market.

- Increased Transparency: Following the collapse of FTX, Binance increased transparency of their balances in terms of user funds and crypto assets. This move towards greater transparency is expected to continue in the industry, promoting customer safety.

Actionable Insights

- Understanding Regulatory Developments: Stakeholders in the crypto industry should stay informed about regulatory developments and their implications. This can help them anticipate changes and adapt their strategies accordingly.

- Emphasizing Compliance and Transparency: Crypto exchanges and other businesses in the industry should prioritize compliance with regulatory standards and transparency in their operations. This can help build trust with customers and regulators, and potentially mitigate risks.

- Assessing the Stability of Crypto Exchanges: Investors and users of crypto exchanges should consider the financial stability of these platforms, including their ability to handle potential fines or other financial challenges. This can help them make informed decisions about where to hold and trade their assets.