Research Summary

The report from Markets & Mayhem discusses key trends in the global economy, with a particular focus on the energy sector, liquidity, risk re-rating, and the financial market. It highlights the inversion of the 10-year to 3-month Treasury yield curve, the impact of oil production cuts, the role of energy in soft economic landings, and the potential re-rating of risk in the financial market.

Key Takeaways

Energy Sector Dynamics

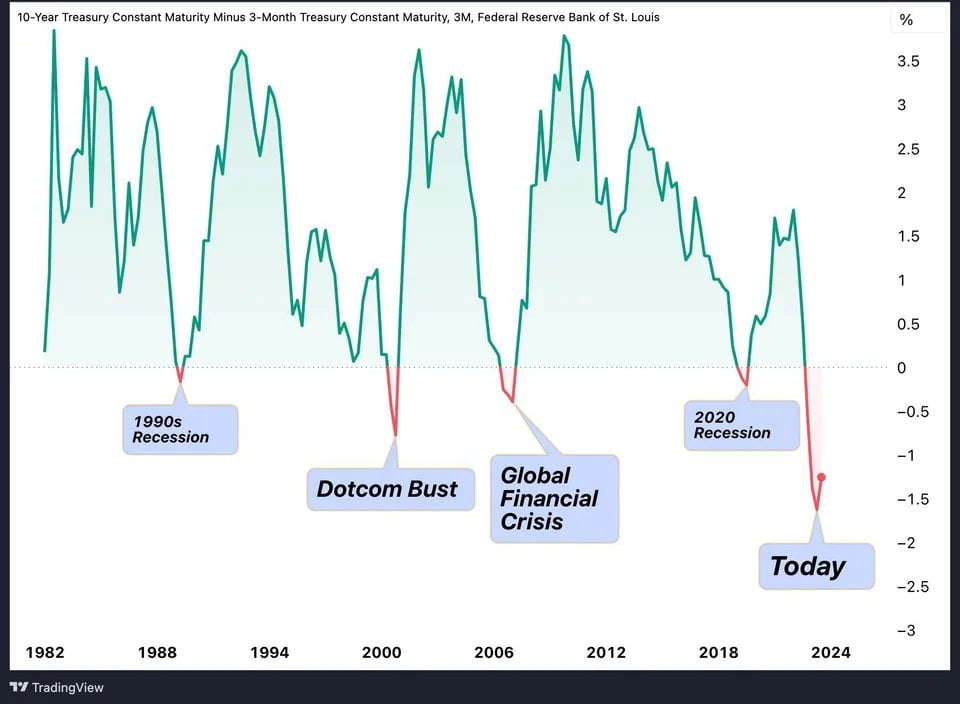

- Inverted Treasury Yield Curve: The 10-year to 3-month Treasury yield curve is deeply inverted, indicating potential economic instability. The report suggests that the steepening of the curve could signal trouble, as seen in the past.

- Oil Production Cuts: Extended oil production cuts by Saudi Arabia and Russia, coupled with rising demand, could keep a floor under oil prices.

- US Strategic Petroleum Reserve: The reserve is at a 40-year low, and any significant supply disruption could push oil prices higher, especially during peak hurricane season.

Financial Market Trends

- Recession Probabilities: Recession probabilities have decreased across multiple asset classes, which could be a contrarian indicator.

- Global Liquidity: Global liquidity has fallen by $1 trillion over the last 10 weeks, potentially impacting global equities.

- Risk Re-Rating: Earnings yields are below cash yields, which often leads to a re-rating of risk lower. This is important to consider if we have not yet seen the trough in earnings.

Market Positioning

- Short and Long Positions: Goldman Sachs data shows a significant amount of weekly short flow, with cumulative short flows reaching 2023 highs. On the other hand, hedge funds are quite long on regional banks.

- Regional Banks Exposure: Regional banks are exposed to further losses on duration exposure as rates rise, especially with a growing wall of CRE debt maturing throughout 2023 and 2024.

Actionable Insights

- Monitor Energy Market: Given the potential for oil price increases due to production cuts and low strategic reserves, it’s crucial to keep a close eye on the energy market.

- Assess Risk Re-Rating: With earnings yields below cash yields, there’s a possibility of risk re-rating. Investors should be mindful of this when assessing their portfolios.

- Consider Market Positioning: The significant short flow and long positions on regional banks suggest a need for careful market positioning and risk management strategies.