Research Summary

The report provides an in-depth analysis of Chromia ($CHR), a Layer-1 blockchain solution. It highlights Chromia’s unique architecture, strategic market focus, low valuation, and upcoming mainnet launch. The report also compares Chromia with Arweave, another blockchain platform, in terms of data storage mechanisms and developer tools.

Key Takeaways

Chromia’s Unique Architecture and Market Positioning

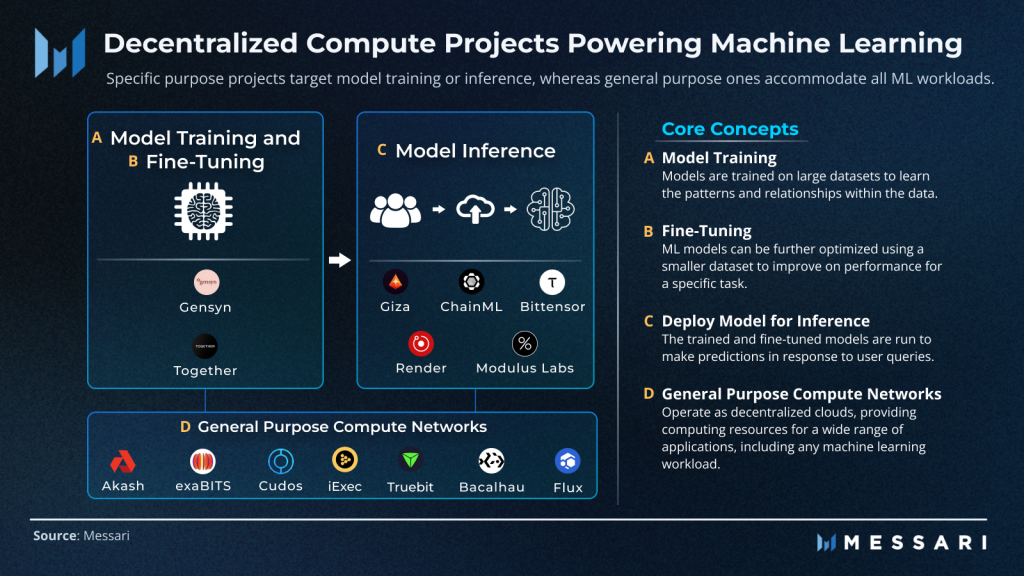

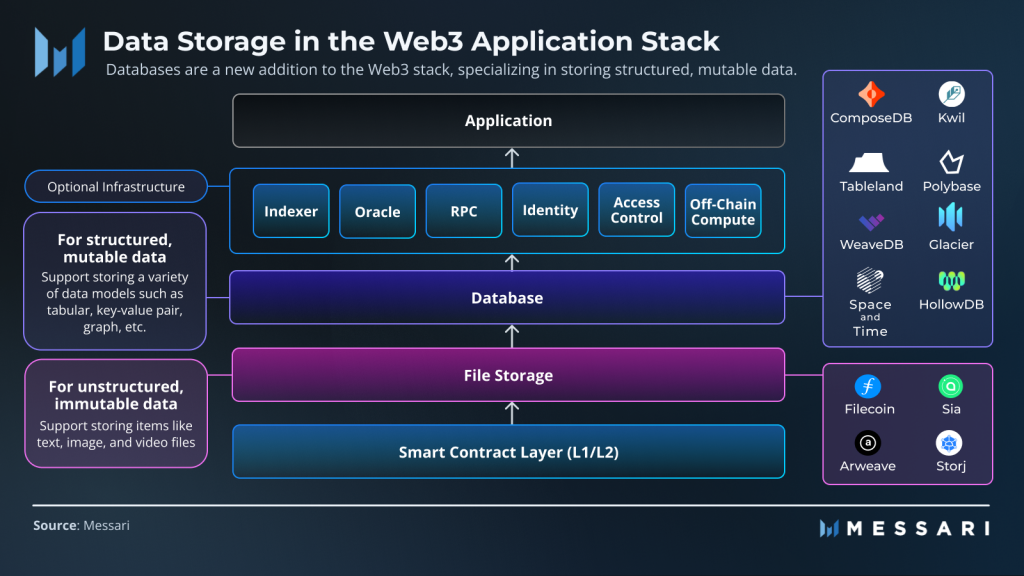

- Relational Blockchain Design: Chromia’s unique architecture, which uses structured relational tables for data storage, sets it apart in the crowded blockchain space. This design is particularly suitable for complex decentralized applications (dApps), especially in the gaming and decentralized AI sectors.

- Strategic Market Focus: Chromia targets high-growth sectors like gaming and decentralized AI, positioning it to capture significant market share in these rapidly expanding niches.

Chromia’s Upcoming Mainnet Launch

- MVP Mainnet Launch: The report highlights the upcoming MVP Mainnet launch on July 16, 2024, as a potential catalyst for increased attention and potential price appreciation. The launch includes essential features like native token integration for fees, EVM bridging, and a new staking and delegation system.

Chromia’s Strategic Partnerships

- Collaborations with Key Players: Chromia’s strategic partnerships with UltiverseDAO, Alliance Games, and Xoob Games are expected to drive user adoption, showcase the platform’s capabilities, and increase demand for $CHR tokens.

Chromia’s Valuation and Tokenomics

- Low Valuation: With a fully diluted valuation (FDV) of $250 million, Chromia appears significantly undervalued compared to its peers in the modular L1, decentralized, and storage sectors.

- Tokenomics and Supply Dynamics: The report notes that 96% of $CHR tokens are already in circulation, reducing the risk of future dilution and sell pressure from early investors. The token’s utility as both gas fee and platform currency creates a natural supply-sink mechanism, which could support long-term value appreciation.

Chromia’s Developer Appeal and Technical Advantages

- Developer-Centric Approach: Chromia’s Rell programming language and incentivized testnet programs could accelerate ecosystem growth and dApp development.

- Technical Advantages: Chromia’s efficiency in handling complex data structures positions it favorably in the gaming and data storage niches.

Actionable Insights

- Monitor Chromia’s Mainnet Launch: The upcoming MVP Mainnet launch could serve as a catalyst for increased attention and potential price appreciation. Investors should monitor the launch and its impact on $CHR’s price.

- Assess Chromia’s Market Positioning: Chromia’s focus on high-growth sectors like gaming and decentralized AI could position it to capture significant market share. Investors should assess the potential growth in these sectors and Chromia’s ability to capitalize on it.

- Consider Chromia’s Valuation: With a low FDV compared to its peers, Chromia appears undervalued. Investors should consider this valuation in their analysis.

- Examine Chromia’s Tokenomics: The high circulation rate of $CHR tokens and their utility as both gas fee and platform currency could support long-term value appreciation. Investors should examine these tokenomics closely.

- Review Chromia’s Developer Appeal: Chromia’s Rell programming language and incentivized testnet programs could attract developers and accelerate dApp development. Investors should review these initiatives and their potential impact on Chromia’s ecosystem growth.