Research Summary

The report discusses the U.S. Securities & Exchange Commission’s (SEC) approval of spot exchange-traded funds (ETFs) for Ethereum (ETH), the second-largest digital asset. This development has led to a significant increase in ETH’s price and has implications for the Ethereum ecosystem, including its supply dynamics and staking ecosystem.

Key Takeaways

Ethereum ETF Approval Boosts ETH Price

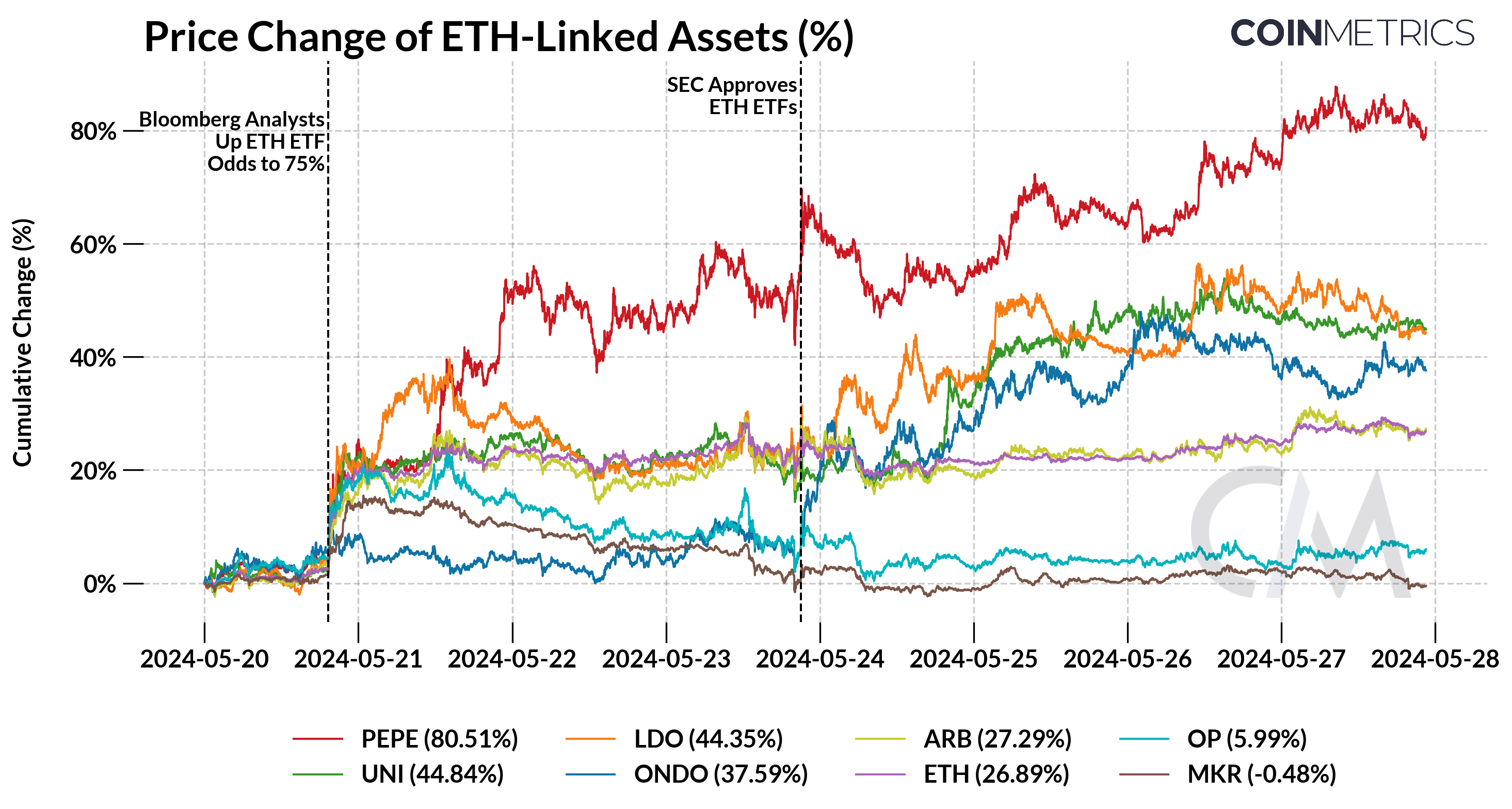

- ETF Approval Impact: The SEC’s approval of spot Ethereum ETFs led to a 25% rise in ETH’s price. The market reacted swiftly to this development, with other Ethereum ecosystem tokens also experiencing significant gains.

Grayscale’s Ethereum Trust Closes Discount to NAV

- ETHE’s NAV Convergence: The discount to net asset value (NAV) for Grayscale’s Ethereum Trust (ETHE) closed from 50% a year ago to 1.28% upon ETF approval. This suggests that the market sentiment around the approval of spot Ether ETFs is positive.

Implications for ETH’s Supply Dynamics

- Staking Exclusion: The exclusion of staking from ETH ETFs could have potential implications for the supply dynamics of ETH, the health of Ethereum’s consensus layer, and the staking ecosystem as a whole. This could potentially reduce the market’s available supply, increasing the likelihood of price appreciation for ETH.

Impact on Ethereum’s Staking Ecosystem

- Staking Dynamics: The exclusion of ETFs from staking could be beneficial for existing stakers, as it prevents the dilution of staking returns that would occur if institutional capital were to enter the staking ecosystem. This could indirectly help maintain a balanced staking ratio and promote a healthier staking distribution.

Record-High Open Interest in ETH Futures Contracts

- Elevated Speculation: The record-high $13.8B open interest in ETH futures contracts signals the presence of elevated speculation around Ether ETFs. This indicates higher levels of activity from retail and institutional participants alike.

Actionable Insights

- Monitor ETH Price Movements: Given the significant impact of the ETF approval on ETH’s price, it would be prudent to closely monitor ETH price movements and market sentiment.

- Assess Impact on Staking Ecosystem: The exclusion of staking from ETH ETFs could have implications for the staking ecosystem. Stakeholders should assess the potential impact on staking yields and the health of Ethereum’s consensus layer.

- Consider Potential Supply Dynamics: The ETF approval could potentially reduce the market’s available supply of ETH. Stakeholders should consider the potential implications for ETH’s supply dynamics.