Research Summary

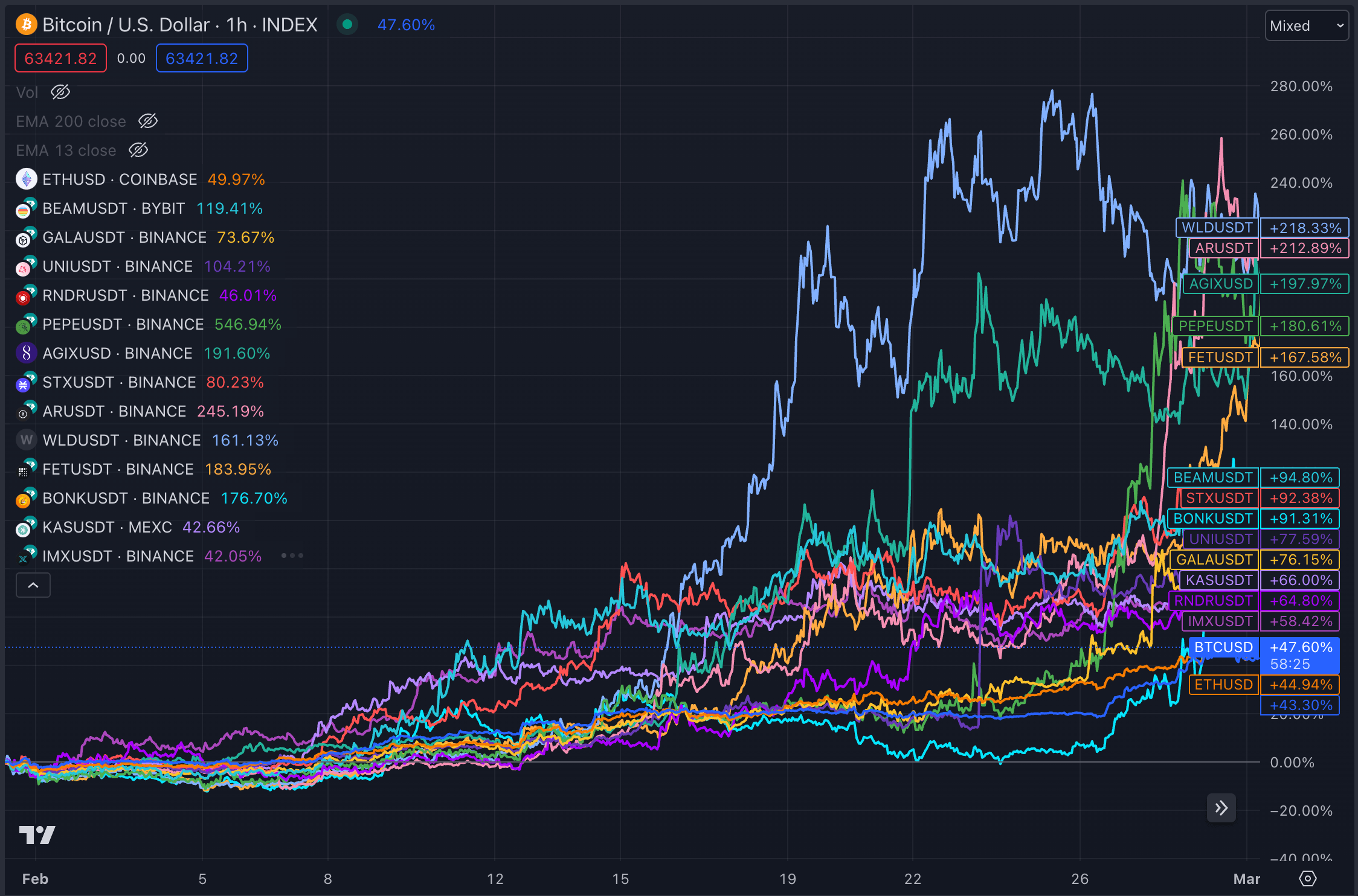

The report provides a comprehensive review of the cryptocurrency market in February, highlighting key events, narratives, and best-performing coins. It also discusses the impact of AI on the sector, the performance of Bitcoin and Ethereum, and the launch of new coins.

Key Takeaways

Launch and Performance of New Coins

- Launch of New Coins: Several mid/large cap coins were launched in February, including $JUP, $DYM, $MAVIA, $ZETA, $STRK, $PIXEL, and $PORTAL. However, the performance of these coins varied, with $DYM, $MAVIA, and $ZETA profiting the most.

- Performance of $WLD: The AI sector gained attention after OpenAI shared examples of outputs from its future text-to-video model, Sora. This led to a significant increase in the value of $WLD, which closed the month with +220% gains.

Impact of Events on Coin Performance

- Uniswap Fee Switch: A governance proposal by the Uniswap Foundation led to a +80% pump on $UNI and a short-lived “DeFi season” on the usual DeFi 1.0 coins.

- Binance Delisting: Binance’s announcement of delisting $XMR and $MULTI resulted in a significant hit to these coins, with more than -30% drawdowns in a day.

Bitcoin’s Dominance

- Bitcoin’s Performance: Bitcoin had one of its largest monthly gains ever with +43%, outperforming most altcoins. This was largely due to huge inflows from the $BTC ETF, with a few days above $500M inflows.

Ethereum’s Performance

- Ethereum’s Performance: Despite Bitcoin’s impressive performance, Ethereum managed to outperform it with +46% gains over the month. However, it was rejected back to 0.055 after reaching the 0.06 resistance.

Actionable Insights

- Monitor the AI Sector: The AI sector is gaining attention in the crypto market, as evidenced by the performance of $WLD. Stakeholders should keep an eye on developments in this sector.

- Consider the Impact of Governance Proposals: The Uniswap fee switch proposal had a significant impact on the value of $UNI. Stakeholders should consider the potential impact of such proposals on coin performance.

- Assess the Impact of Exchange Actions: The delisting of coins by exchanges like Binance can significantly impact coin value. Stakeholders should monitor such actions and their potential impact.

- Track Bitcoin’s Performance: Bitcoin’s performance can have a significant impact on the overall crypto market. Stakeholders should closely monitor its performance and the factors contributing to it.

- Monitor Ethereum’s Performance: Despite Bitcoin’s dominance, Ethereum managed to outperform it. Stakeholders should keep an eye on Ethereum’s performance and the factors contributing to it.