Research Summary

The report provides an in-depth analysis of tokenomics, the system of how token supply is distributed in the crypto market. It discusses the varying launch Fully Diluted Valuations (FDVs) over the years, the importance of float (publicly available supply), the role of airdrops in protocol adoption, and the impact of these factors on token valuation and on-chain activity.

Key Takeaways

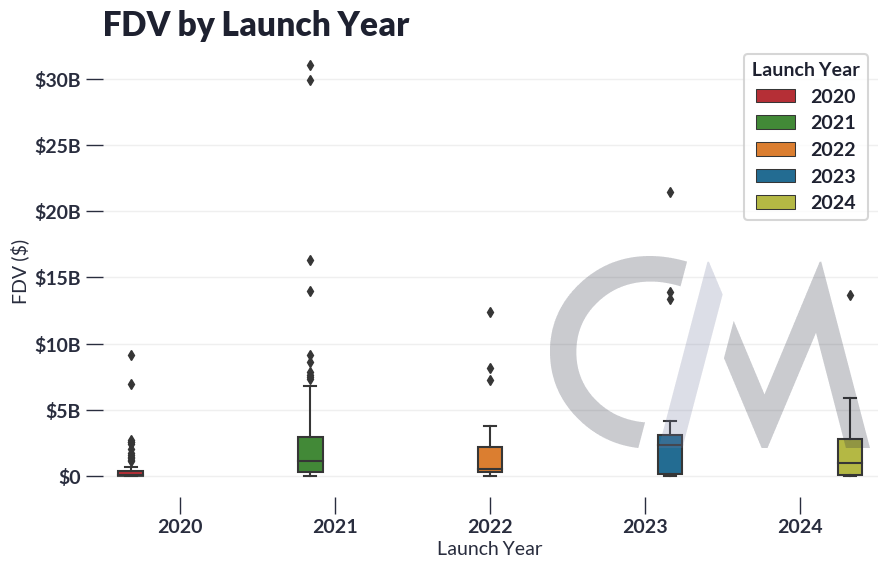

Varying Launch FDVs Over the Years

- Fluctuating FDVs: The report highlights the varying launch FDVs over the years. In 2020, the median was $140M, mainly for DeFi protocols. In 2021, it spiked to $1.4B, driven by NFTs and gaming projects. However, in 2022, it dipped to $800M for Layer 2s (L2s). The years 2023 and 2024 saw a rebound to $2.4B and $1B, respectively, featuring alt Layer 1s (L1s) and Solana projects.

Importance of Float in Token Valuation

- Role of Float: The report emphasizes that FDV overlooks short-term market shocks, making float an important factor in token valuation. Tokens with a high FDV and low float, like World Coin, may misrepresent true valuations. The industry standard is around 5-15% of a token’s supply to be unlocked to the community.

Impact of Airdrops on Protocol Adoption

- Airdrops and Adoption: Airdrops, which distribute tokens for protocol adoption, are often quickly liquidated by recipients. While initially lucrative, most airdropped tokens depreciate long-term, with exceptions like BONK, which saw an ~8x return.

Tokenomics and Network Activity

- Tokenomics and Usage: The report explores whether token rewards lead to real usage. Using Optimism, a Layer 2 project, as an example, it was found that airdrops may provide a short-term bump in the protocol’s usage, but their ability to create sustainable long-term growth remains uncertain.

Challenges with Airdrop Farming

- Airdrop Farming Issues: The report discusses the challenges with airdrop farming, where users generate superfluous activity on-chain in hopes of receiving tokens. This has led to the rise of sybil farms, where several on-chain identities are faked by few actors to generate activity en masse. Protocol teams are developing methods to identify and withhold rewards from sybils.

Actionable Insights

- Understanding Tokenomics: Stakeholders in the crypto market should gain a deep understanding of tokenomics, including factors like FDV and float, to make informed decisions.

- Evaluating Airdrop Strategies: Crypto projects should carefully evaluate their airdrop strategies, considering the potential for quick liquidation and depreciation of airdropped tokens.

- Monitoring On-chain Activity: Investors and project teams should monitor on-chain activity to assess the impact of token rewards on real usage and long-term growth of protocols.

- Addressing Airdrop Farming: Crypto projects should proactively address the challenges posed by airdrop farming and develop strategies to identify and withhold rewards from sybils.