Research Summary

The report provides an analysis of recent enforcement actions and court rulings involving web3 regulation in the U.S. It evaluates these actions based on the “Regulate Web3 Apps, Not Protocols” (RANP) framework, focusing on cases involving Coinbase (Wallet), Uniswap, ZeroEx, OPYN, and Deridex. The report concludes that the current U.S. regulatory landscape is more optimistic than the prevailing industry outlook.

Key Takeaways

Regulatory Approach to Web3

- Regulatory Focus: The report finds that U.S. government actors are focusing on the activities of businesses, not the activities of developers, in line with the central premise of RANP. This approach is seen as more conducive to the growth of the web3 industry in the U.S.

- Regulatory Consistency: The actions taken by the SEC and CFTC are generally consistent with RANP’s focus on businesses rather than software. However, they differ in their application of existing laws, leading to some ambiguity and confusion.

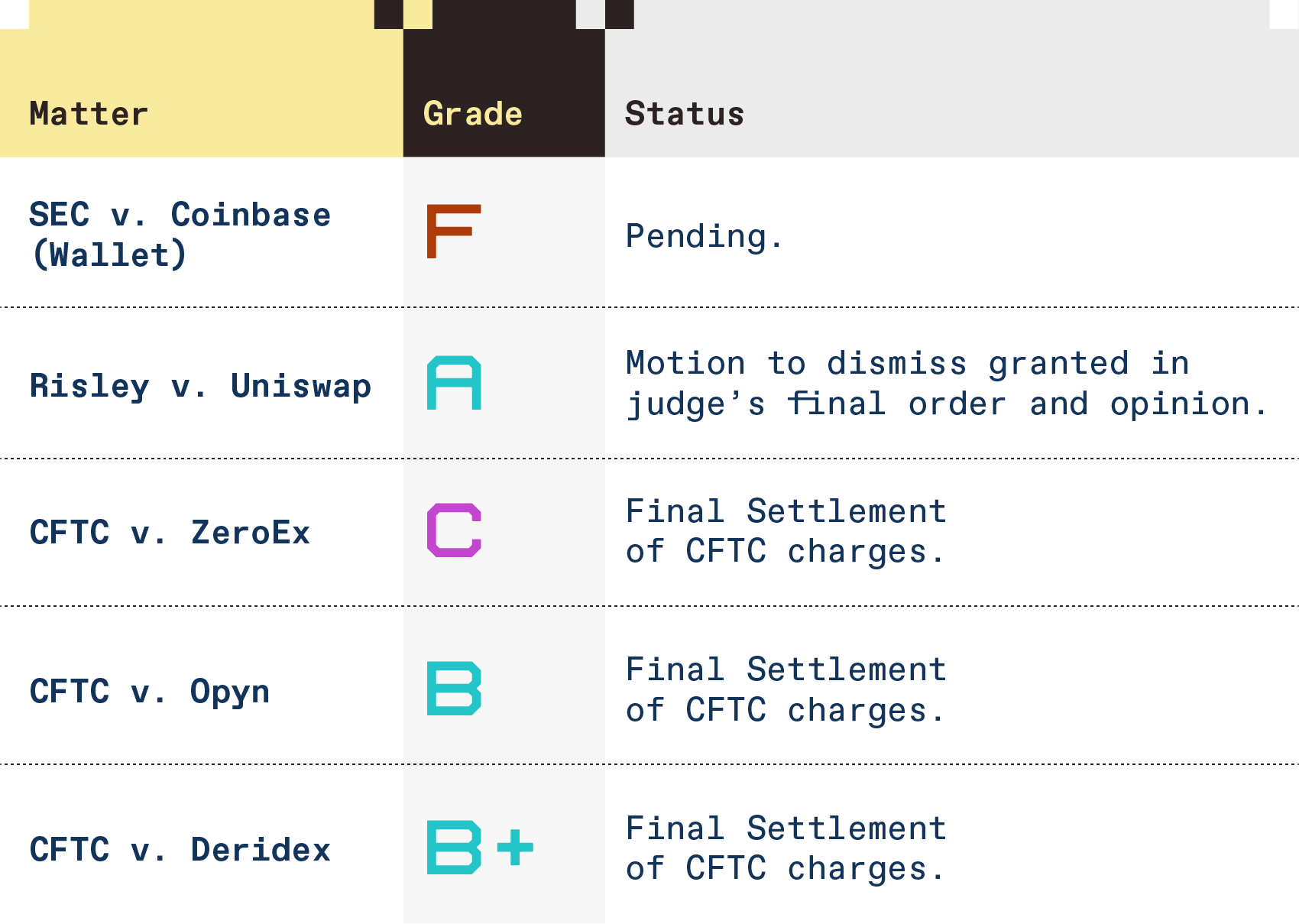

- Regulatory Grades: The report assigns grades to the actions taken against Coinbase (Wallet), Uniswap, ZeroEx, OPYN, and Deridex. The SEC’s action against Coinbase received an ‘F’ grade due to its unpredictable extension of rules, while the CFTC’s actions against ZeroEx, Opyn, and Deridex received ‘C’, ‘B’, and ‘B+’ grades respectively.

Regulatory Challenges and Opportunities

- Regulation-by-Enforcement: Both the SEC and CFTC received lower ratings due to their regulation-by-enforcement approach, which the report argues is counterproductive and fails to foster innovation.

- Need for Clear Regulations: The report criticizes the SEC’s action against Coinbase’s wallet, arguing that clear regulations that govern the challenged conduct or provide a path to compliance are needed instead of stretching the scope of existing regulations.

- Opportunities for Innovation: The report suggests that the CFTC is well-positioned to capitalize on the opportunities in the web3 space, despite its failure to create policy frameworks around decentralized derivatives products. It calls for the use of the CFTC’s authority to review novel approaches and make exemptions to existing rules that allow for safe adoption of innovation.

Actionable Insights

- Regulatory Clarity: There is a need for clear and predictable regulations that govern web3 activities. This would provide a path to compliance and foster financial innovation.

- Regulatory Balance: Regulators should balance the tradeoffs of additional regulation. They should focus on business-related activities undertaken in their jurisdiction, rather than infringing individuals’ freedom to publish open source software.

- Regulatory Innovation: Regulators should embrace novel approaches to derivatives markets and make exemptions to existing rules that allow for innovation to be safely adopted. This would offer consumers a choice to engage with novel technology that presents distinct benefits while protecting against different risks.