Research Summary

The report provides a comprehensive review of the cryptocurrency market in January, highlighting key events, best-performing coins, and potential coins to watch. It also discusses the impact of significant events such as the ETF approval and the liquidation event on the market.

Key Takeaways

Impact of ETF Approval and Liquidation Event

- ETF Approval and Liquidation Event: The report highlights the significant impact of the ETF approval and the liquidation event on the cryptocurrency market. The ETF approval led to a surge in ETHBTC, while the liquidation event resulted in a $4bn loss of open interest. The report suggests that the funding rate could be a good indicator to predict a liquidation cascade.

Performance of New Launches

- New Launches: January saw a significant number of new token launches, including $AI, $XAI, $ONDO, $MANTA, $ALT, and $JUP. Most of these tokens experienced a pump in the first few days of trading, indicating that bidding new coins can be a good strategy.

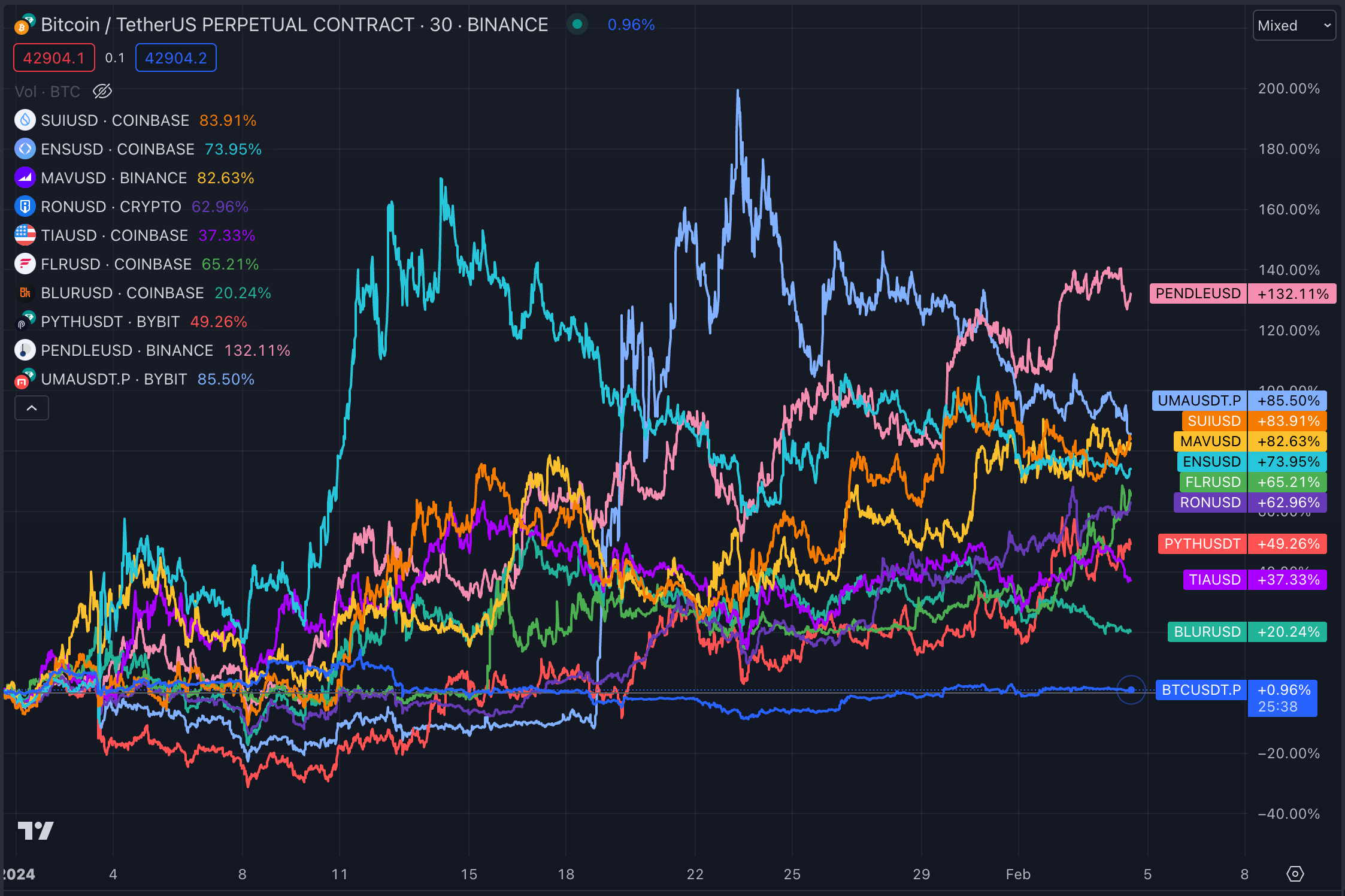

Best-Performing Coins

- Best-Performing Coins: The report identifies the best-performing coins in January, including $SUI, $ENS, $TAO, $MAV, $RON, $TIA, $FLR, $BLUR, $PYTH, $CHZ, $MKR, and $FXS. It also highlights smaller coins that performed well, such as $PENDLE, $UMA, $GEL, $SYN, $API3, $RBN, $RLC, $DUSK, $SC, $STRD, $AKT.

Market Narratives

- Market Narratives: The report discusses the main narratives in January, including the performance of ETH beta coins, the rise of $SUI, the competition in the gaming space between Ronin and Immutable X, and the decentralized AI narrative led by $TAO.

Coins to Watch

- Coins to Watch: The report suggests that now is a good time to accumulate projects that were pumping over the last quarter of 2023, including Gaming, AI, BRC20 and BTCfi, Solana ecosystem, and Memecoins on new chains. It also recommends looking into narratives such as DePIN, RWA, and Restaking.

Actionable Insights

- Monitor Funding Rates: The report suggests that the funding rate could be a good indicator to predict a liquidation cascade. Investors should monitor funding rates to anticipate potential market movements.

- Consider New Launches: With the significant performance of new token launches in January, investors might want to consider bidding on new coins as a potential strategy.

- Focus on Best-Performing Coins: The report identifies several coins that performed well in January. Investors might want to research these coins for potential opportunities.

- Understand Market Narratives: Understanding the main market narratives can provide insights into potential trends and opportunities. Investors should keep an eye on the narratives highlighted in the report.

- Watch for Potential Opportunities: The report suggests that now is a good time to accumulate projects that were pumping over the last quarter of 2023. Investors should watch these sectors for potential opportunities.