Research Summary

The report provides an in-depth analysis of the role and impact of derivatives in the cryptocurrency market. It explores the types of derivatives, their applications, and the underlying data. The report also highlights the use cases of derivatives in traditional finance and crypto, and how they have become essential tools for managing risk and enhancing trading strategies.

Key Takeaways

Significance of Derivatives in Crypto Market

- Role of Derivatives: Derivatives have become a cornerstone of the financial ecosystem, allowing participants to manage risk effectively and markets to function more efficiently. In the cryptocurrency market, derivatives provide sophisticated tools for traders and investors, offering various strategies for hedging, speculation, and risk management.

- Types of Derivatives: The primary types of derivatives in crypto are futures, perpetual futures, and options, each serving different needs. Futures contracts allow traders to speculate on the future price of a cryptocurrency or hedge against price fluctuations. Perpetual futures are similar to standard futures but without an expiry date. Options give the holder the right, but not the obligation, to buy or sell an asset at a specific price before or at the contract’s expiration.

Use Cases of Derivatives

- Hedging and Speculation: Derivatives allow investors to hedge against downside risk and enable diversified trading strategies not achievable with only spot trades. They also allow investors to capitalize on market inefficiencies through arbitrage. For instance, miners can use futures to lock-in selling prices, and purchase options to hedge against unfavorable price movements.

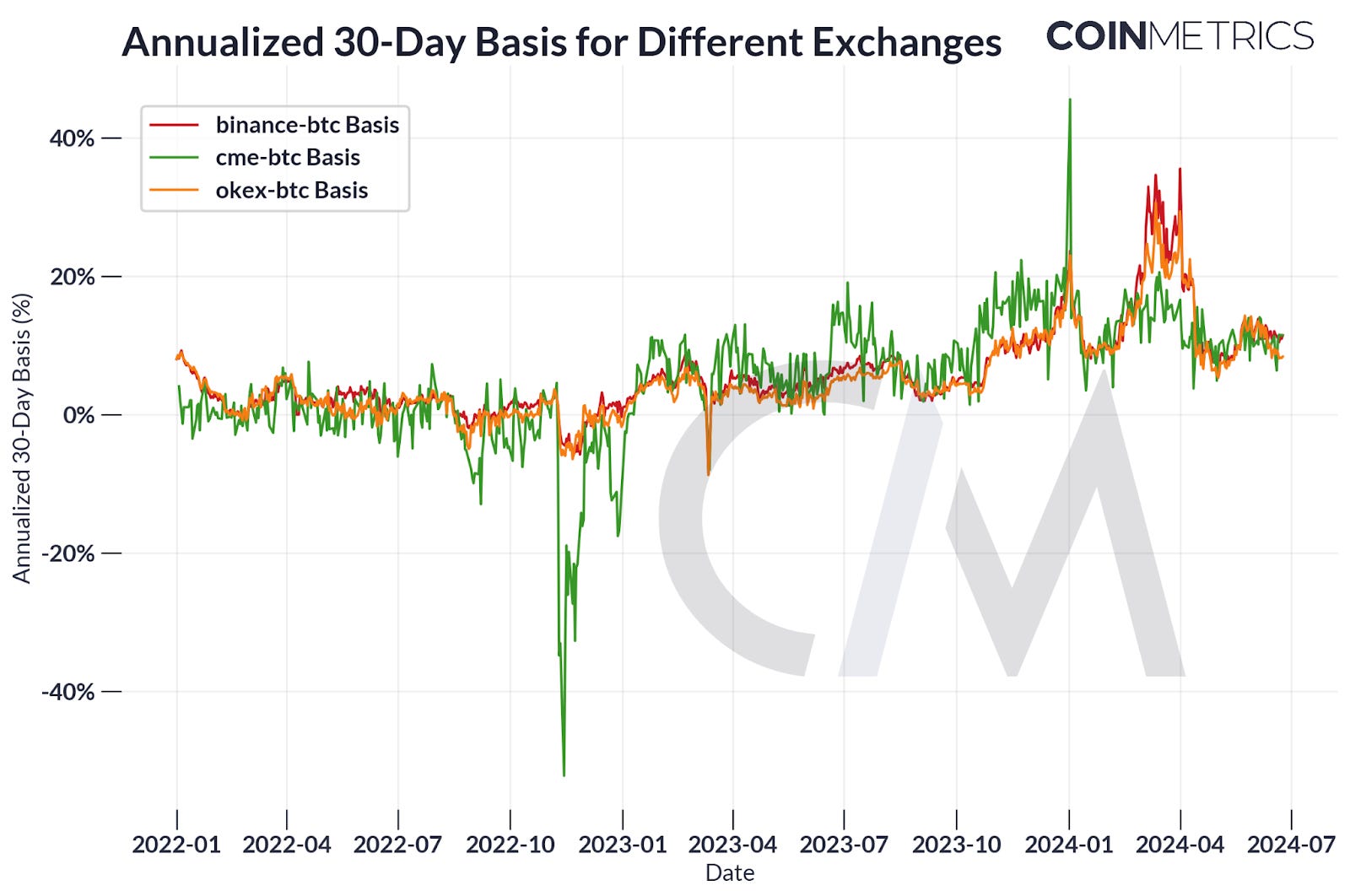

- Market Expectations: The ratio of the futures price over its underlying spot price, known as the Implied Forward Rate, is useful for comparing returns, and expectations, across different assets. Positive implied yields signify that investors expect the value of the underlying asset to increase over the duration of the contract, while negative yields indicate an expected decrease.

Impact of Derivatives on Crypto Market

- Volume in Futures vs. Spot Markets: While spot volumes initially dominated, futures trading now captures the majority of market activity—currently 78%. This is primarily due to factors like the robust infrastructure of centralized exchanges, tools offered by DEXs, greater regulatory clarity for futures products, and the strong appeal of leverage.

- Rising Levels of Open Interest: The rising levels of open interest in BTC futures across exchanges, particularly in the period surrounding the launch of spot Bitcoin ETFs, serve as a gauge for market activity. This highlights an important use case for derivatives, as they allow investors to manage risk and strategically position themselves in the market.

Actionable Insights

- Understanding Derivatives: Investors and traders should familiarize themselves with the different types of derivatives and their applications in the crypto market. This knowledge can help them make informed decisions and develop effective trading strategies.

- Monitoring Market Expectations: By keeping an eye on the Implied Forward Rate, investors can gain insights into market expectations and potential price movements. This can guide their investment decisions and risk management strategies.

- Exploring Futures Trading: With futures trading capturing the majority of market activity, investors might want to explore this area. However, they should be aware of the risks involved, particularly with leveraged trading.