Research Summary

The report analyzes the growing influence of meme coins in the crypto market, highlighting their market capitalization, trading volumes, and risks associated with their high concentration of assets among a few holders. It also discusses the evolution of memes and their impact on human culture and digital value creation.

Key Takeaways

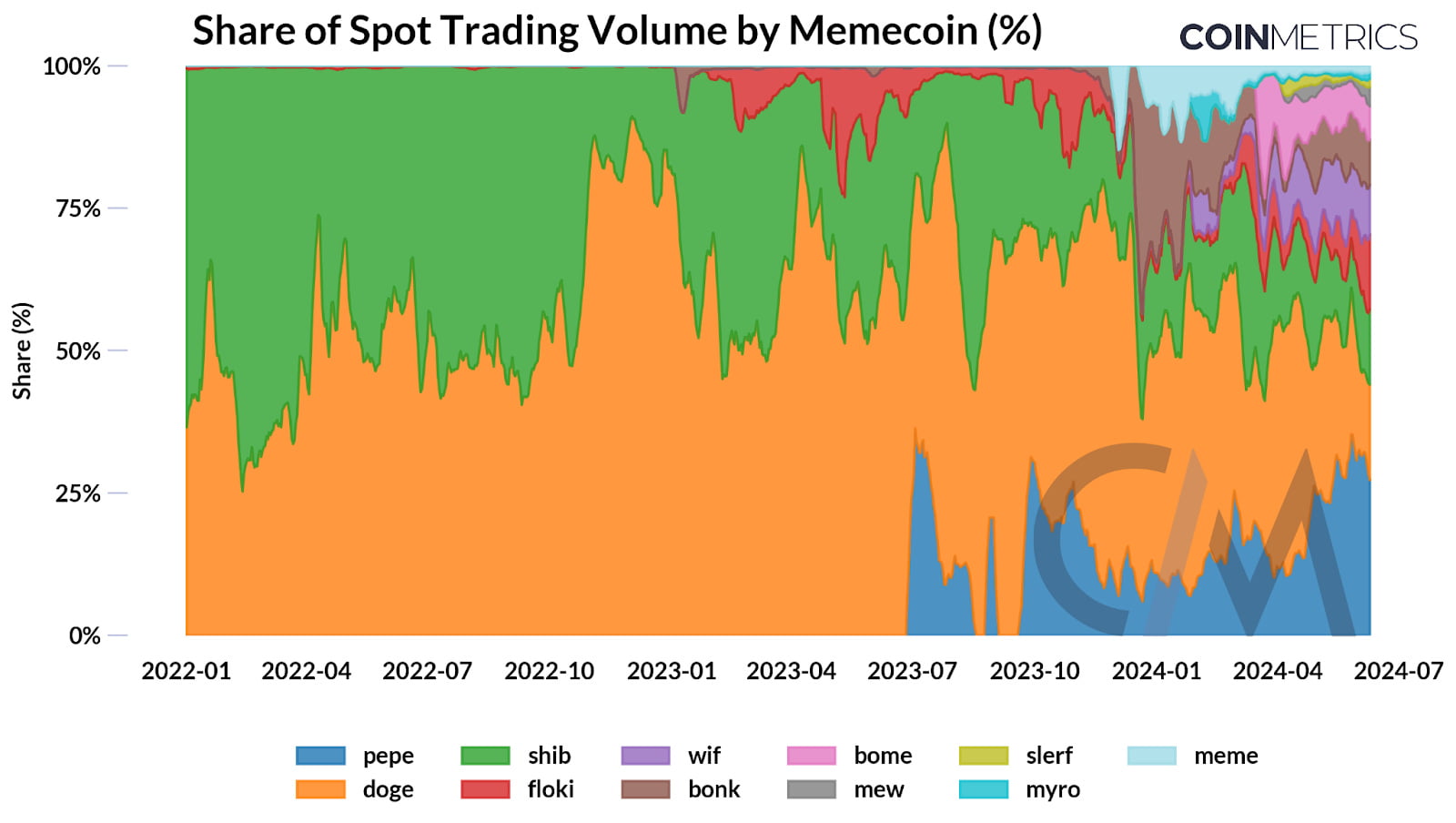

Market Capitalization and Trading Volumes of Meme Coins

- Significant Market Presence: Meme coins have a total market capitalization of $60B, with $13B recorded in spot trading volumes on exchanges in March, surpassing major crypto assets like Ethereum and Solana.

- High Trading Activity: Meme coins recorded $13B in spot trading volumes (7-day average) across centralized exchanges in March, even surpassing major assets like Ethereum (ETH) and Solana (SOL).

Concentration of Assets and Associated Risks

- Asset Concentration: The high concentration of assets among holders for meme coins poses risks such as potential market manipulation and liquidity issues.

- High Gini Coefficient: The Gini coefficient of ~0.8 for these meme coins indicates a substantial centralization of token holdings, posing various risks, including potential market manipulation, liquidity issues, and investor caution.

Evolution and Impact of Memes

- Cultural Impact: Memes have evolved significantly throughout history, influenced by social, cultural, and technological changes. They have found new carriers in the form of viral videos and image macros like “Doge,” diffusing rapidly through the internet and social media platforms.

- Digital Value Creation: Memes have expanded into phenomena such as meme stocks and meme coins like Dogecoin and Pepe, leveraging blockchains and on-chain communities to create forms of digital value.

Performance of Meme Coins

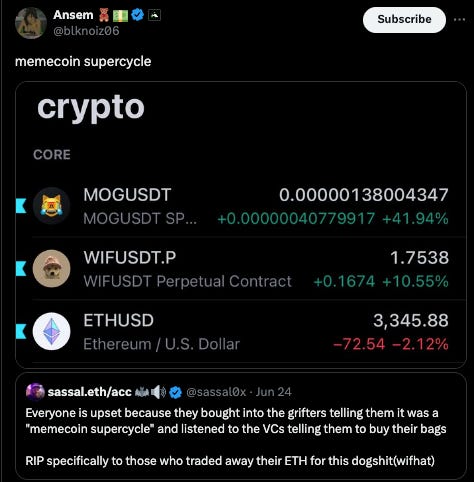

- Outperformance: The meme coin sector has seen notable outperformance compared to other sectors of the crypto-asset ecosystem, averaging 740% returns as of June 2024.

- Investor Preference: The influence of older meme coins like DOGE and SHIB seems to be waning, while PEPE and a suite of new Solana meme coins have gained popularity, representing over 50% of trading volume collectively.

Actionable Insights

- Understanding Market Dynamics: Investors should understand the dynamics of the meme coin sector, including the high concentration of assets among a few holders and the associated risks, before considering any investments.

- Monitoring Market Trends: Keeping track of open interest remains one of the fundamental tools to understand the flows of speculative capital, especially in volatile instruments which can be indicative of shifting market interest or harbinger of liquidations.

- Assessing Liquidity and Market Manipulation Risks: The high Gini coefficient of ~0.8 for these meme coins indicates a substantial centralization of token holdings, posing risks such as market manipulation and liquidity issues. These factors should be carefully considered when evaluating these tokens.