Research Summary

The report discusses the rise of memecoins and introduces the “Memecoin TVL Pump Theory”. This theory suggests that the performance of premier memecoins is linked to the Total Value Locked (TVL) of a blockchain network. The report provides examples of this theory in action and suggests strategies for predicting increases in TVL.

Key Takeaways

The Memecoin Phenomenon

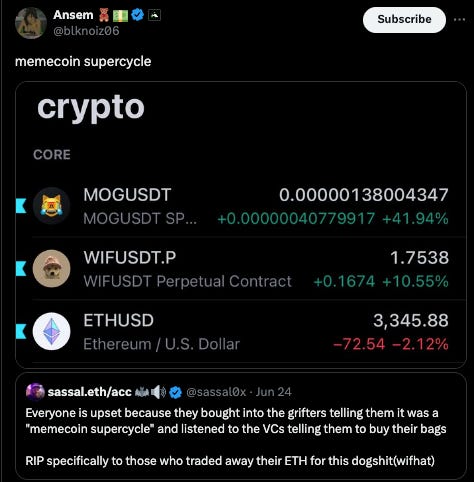

- Memecoin Supercycle: The report highlights the rapid rise of memecoins, with some reaching billions in market capitalisation within months. Memecoins have outperformed other sectors significantly, leading to the term “memecoin supercycle”.

Memecoin TVL Pump Theory

- TVL as a Predictor: The report introduces the “Memecoin TVL Pump Theory”, which suggests that the performance of premier memecoins is linked to the Total Value Locked (TVL) of a blockchain network. If TVL increases, a portion of it will flow into the premier memecoin, boosting its performance.

Historical Examples

- Historical Evidence: The report provides examples of the Memecoin TVL Pump Theory in action, including TOSHI, BRETT, and REDO. In each case, the memecoin’s performance improved as the TVL of the respective blockchain network increased.

TVL Prediction Strategies

- Long-Term and Short-Term Predictions: The report suggests two strategies for predicting increases in TVL: long-term and short-term. Long-term predictions focus on the deeper distribution fundamentals of a chain, while short-term predictions look at near-term catalysts like points programs or airdrops.

De-risked Betting on Memecoins

- Systematic Approach: The report suggests that the Memecoin TVL Pump Theory provides a more systematic and de-risked way of betting on the memecoin sector. By predicting increases in TVL and investing in the premier memecoin of that chain, investors can potentially achieve significant returns.

Actionable Insights

- Research the Potential of Premier Memecoins: Given the link between TVL and memecoin performance, investors could consider researching the potential of premier memecoins on blockchain networks predicted to experience TVL growth.

- Consider Both Long-Term and Short-Term TVL Predictions: The report suggests that both long-term and short-term predictions can be effective in forecasting TVL growth. Investors could consider using both strategies to identify potential investment opportunities.

- Monitor Incentive Programs: Short-term TVL predictions often focus on near-term catalysts like points programs or airdrops. Investors could monitor these programs to predict TVL growth and identify potential investment opportunities.