Research Summary

The report discusses the introduction of options on three altcoins, Solana (SOL), Ripple (XRP), and Polygon (MATIC) by Deribit in March 2024. These new altcoin option markets will use USDC as the settlement currency, offering several potential benefits for traders. The report also explains the use of coins as collateral, linear vs inverse options, contract multipliers, and profit/loss calculation examples.

Key Takeaways

Introduction of New Altcoin Options

- New Altcoin Options: Deribit is launching options on three altcoins, Solana (SOL), Ripple (XRP), and Polygon (MATIC) in March 2024. These new options will use USDC as the settlement currency, differentiating them from the current BTC and ETH inverse options on Deribit.

Benefits of Using USDC as Settlement Currency

- Advantages of USDC: Using USDC as the settlement currency offers several potential benefits for traders. It allows the same currency to be used for different altcoin currency options, reducing the need for rebalancing collateral when positions are held in multiple currencies. It also simplifies PNL calculations and certain strategies such as cash secured puts.

Use of Coins as Collateral

- Coins as Collateral: Traders can hold the coins themselves to offset certain types of risk, specifically, upside risk. For example, if a trader shorts a SOL call option, holding some SOL can offset the risk to the upside. However, the balance will only be used to offset risk in that currency and only upside risks will be offset.

Linear vs Inverse Options

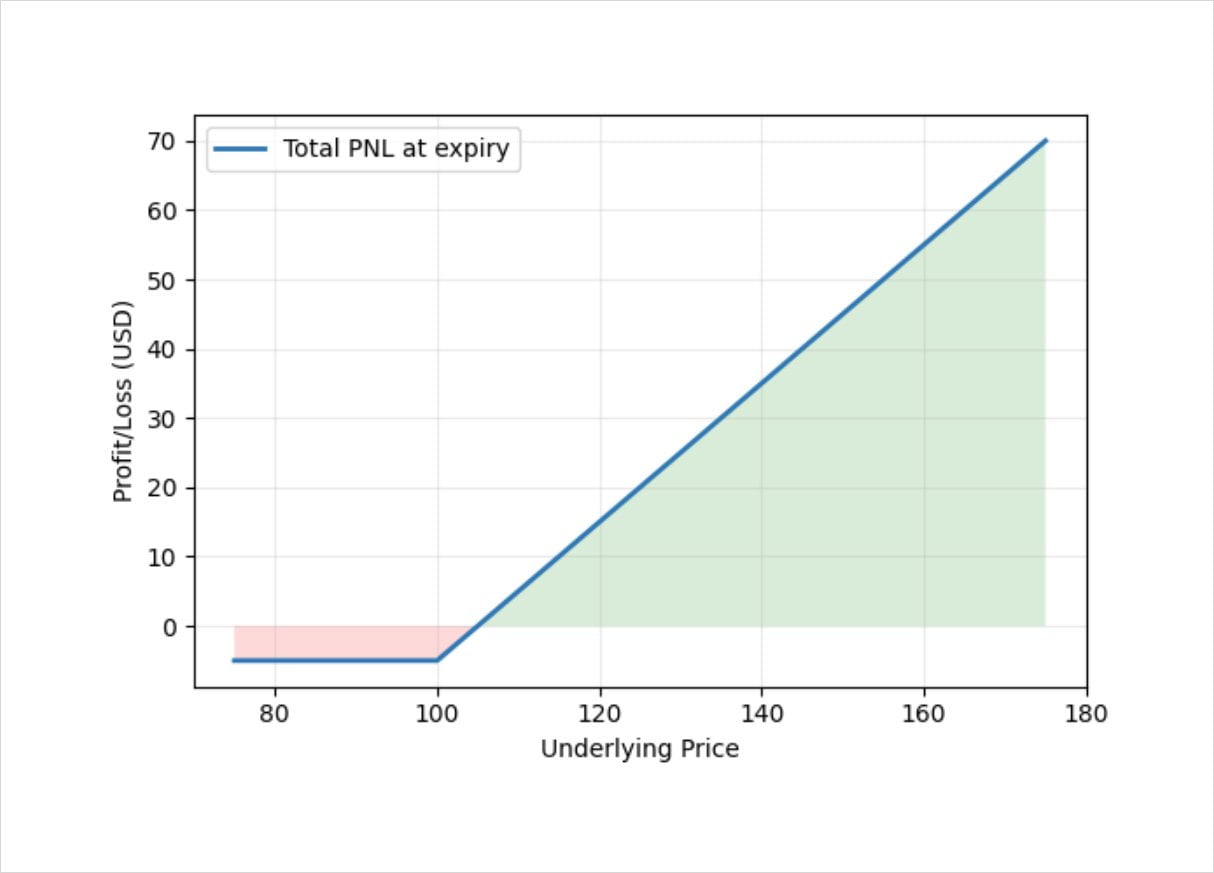

- Linear vs Inverse Options: The new stablecoin settled options are referred to as linear options to highlight the difference from the existing inverse options on Deribit. The term ‘linear’ refers to the payoff at expiry, which for the stablecoin settled options is a straight line, unlike the curve in the payoff of an inverse option.

Contract Multipliers

- Contract Multipliers: The new linear options introduce larger contract multipliers to account for the much lower price per coin for the newly added cryptocurrencies. The contract multipliers for the newly launched coins are SOL 10, XRP 1,000, and MATIC 1,000.

Actionable Insights

- Explore the New Altcoin Options: Traders interested in altcoins should explore the new options on SOL, XRP, and MATIC launched by Deribit. These options offer a new way to trade these altcoins and could provide additional opportunities for profit.

- Consider the Benefits of USDC Settlement: Traders should consider the potential benefits of using USDC as the settlement currency for these new options. This could simplify trading and reduce the need for rebalancing collateral when trading multiple currencies.

- Understand the Use of Coins as Collateral: Traders should understand how they can use the coins themselves as collateral to offset certain types of risk. This could provide additional flexibility in managing risk in their trading strategies.

- Learn about Linear vs Inverse Options: Traders should familiarize themselves with the differences between linear and inverse options. Understanding these differences could help them make more informed trading decisions.

- Understand Contract Multipliers: Traders should understand how contract multipliers work for the new linear options. This could help them calculate potential profits and losses more accurately.