Research Summary

The report discusses the dynamics of new token launches, particularly those with low float and high fully diluted valuations (FDV). It highlights the shift from public fundraising to private VC funding, the increasing divergence between private and public market returns, and the impact of market demand on token valuations. The report also explores the concept of “phantom markets” and the potential manipulation of low float markets.

Key Takeaways

Shift from Public to Private Funding

- Transition in Crypto Funding: The report notes a shift from public fundraising, as seen in the ICO era, to private VC funding in the crypto space. This transition has limited public access to early investment opportunities, with private investors capturing increasingly higher multiples compared to public market participants.

- Example of Solana: Solana’s initial funding round in 2018 had a valuation of around $20m, similar to Ethereum’s ICO. Seed investors buying SOL at $0.04 experienced a return of ~4,000x at current prices, not accounting for additional staking returns.

Increasing Divergence Between Private and Public Market Returns

- Private Market Advantage: The report suggests a growing divergence between financial returns in private markets versus public markets. Early private investors are capturing increasingly higher multiples compared to public market participants.

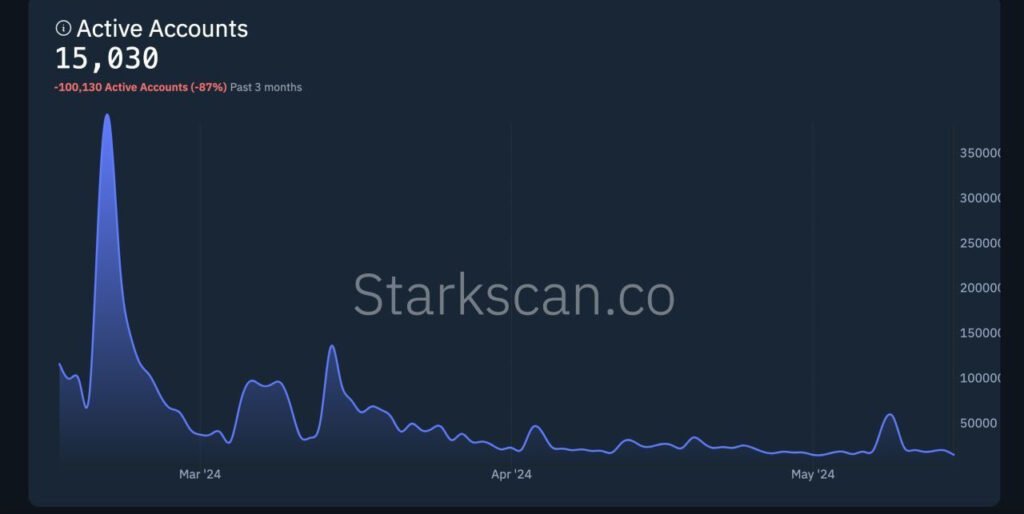

- Example of StarkNet: StarkNet’s seed valuation stood at $80m, with its lowest ever open-market valuation at $11 billion FDV, offering 138x returns from the seed round, while public market buyers have not seen any returns as of the report’s knowledge cutoff.

Impact of Market Demand on Token Valuations

- Market Demand Driving Valuations: The report notes that new tokens are launching at higher valuations due to significantly increased market demand. For instance, if Solana were to launch in the current market, its FDV would likely be around $10 billion, potentially undervalued given the popularity of alternative Layer 1 (alt L1) solutions.

- Example of Avalanche: Avalanche’s launch FDV was around $2.2 billion, which would have placed it in the top 15 coins. Recalculating Avalanche’s launch FDV with modern prices suggests it would launch at $15-20 billion today.

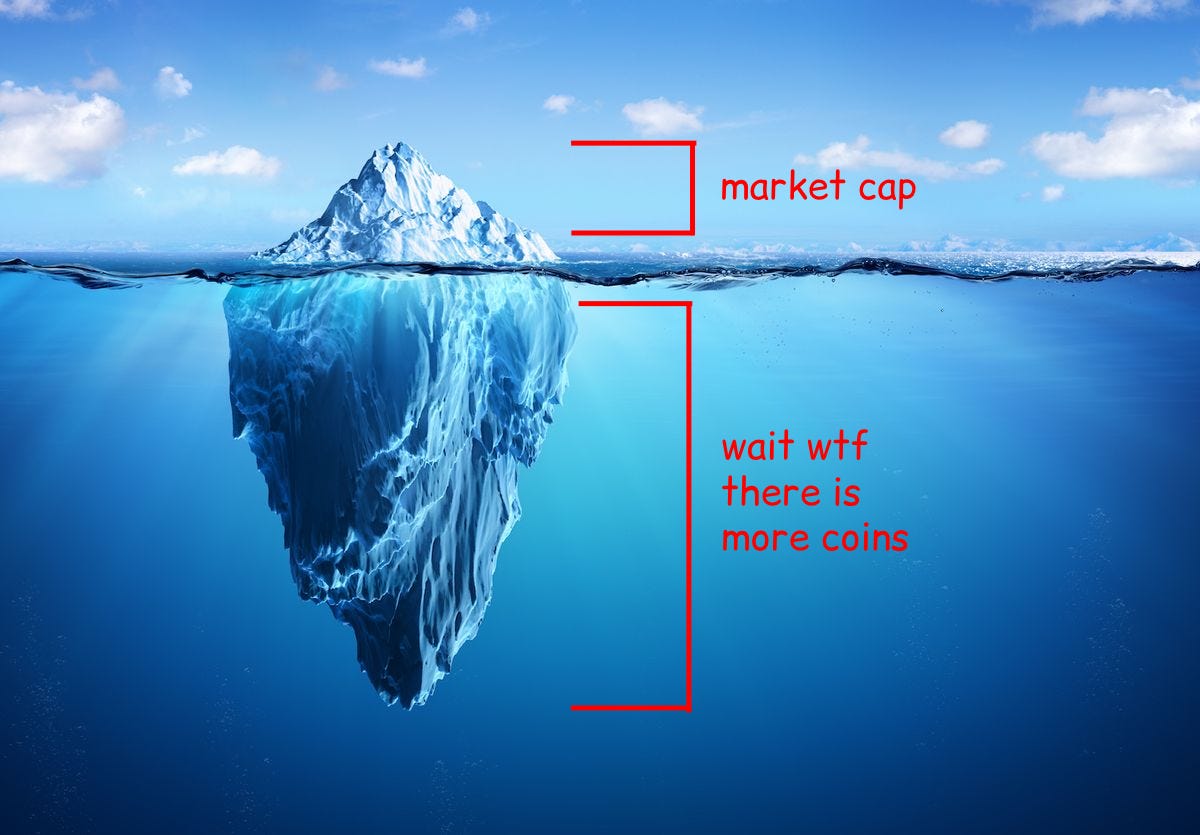

Concept of “Phantom Markets”

- Phantom Market Dynamics: The report introduces the concept of a “phantom market,” where price discovery is skewed because only one person controls the supply and can sell, leading to inflated valuations. This does not reflect natural price discovery based on supply and demand but rather the maximum price a venture capitalist is willing to pay, often resulting in unsustainable valuations.

- Impact on Public Exchanges: When tokens from such a phantom market hit public exchanges like Binance or Coinbase, the discrepancy between the phantom market valuation and the actual market price can be stark, leading to a painful unlock process for investors.

Potential Manipulation of Low Float Markets

- Low Float and Market Manipulation: The report suggests that bad actors can manipulate low float markets. A low float alone is not a red flag; however, it becomes problematic when combined with inflated valuations, dubious agreements, or manipulation by bad actors, as it can be easier to manipulate a low float market.

- Importance of Thorough Research: Investors are advised to conduct thorough research into who holds the unlocked supply of tokens, how it is utilized, and whether it can be distributed, to avoid being misled by apparent float sizes.

Actionable Insights

- Thoroughly Investigate Before Investing: The report emphasizes the importance of thorough research before investing in new token launches. Investors should evaluate the equilibrium between float, FDV, and demand for unlocking coins, considering factors such as the cost basis of locked supply, OTC demand for locked coins, and the selling intentions of current holders.

- Consider Opting Out of Questionable Launches: Investors are advised to opt out of token purchases when faced with questionable launches, as a form of protest against unhealthy market practices. This can influence market dynamics and project perceptions.

- Research Valuations Before Buying Tokens: It is recommended to research valuations before buying tokens and to refuse participation if the valuation is not agreeable. Evaluating the valuation and unlock schedule of a project is crucial, even if the project seems promising, to avoid poor token dynamics or inflated valuations.

- Seek Out Undervalued or Out-of-Favor Opportunities: Investors are encouraged to seek out undervalued or out-of-favor opportunities in the market rather than chasing new, potentially overpriced launches. Sophistication in evaluating new tokens is crucial, with a focus on understanding the supply/demand dynamics and distinguishing between realistic valuations and those with dislocated phantom markets.

- Consider the Impact of Market Dynamics on Projects: Founders are aware of the impact of market dynamics on their projects and are adjusting fundraising and launch strategies in response to trends such as memecoin over-performance and new token launch under-performance. Understanding these dynamics can provide insights into the potential success of a project.