Research Summary

The report provides a comprehensive recap of the cryptocurrency market in November, highlighting key events, best-performing coins, and potential coins to watch. It discusses significant developments such as Binance’s $4bn fine, the launch of BlackRock’s Ethereum ETF, and the success of $BLUR’s season 2 drop. The report also covers the performance of various coins including $TIA, $MEME, $PYTH, $FLIP, and $VRTX, and discusses the impact of several conferences and launches on the market.

Key Takeaways

Impact of Major Events on the Crypto Market

- Binance’s Settlement with DOJ: Binance’s agreement to pay a $4bn fine to the DOJ and the stepping down of CEO CZ was seen as a positive development for the market. The resolution of the case, which was less severe than anticipated, allows Binance to continue operating without endangering customer funds.

- Launch of BlackRock’s Ethereum ETF: The filing for an Ethereum ETF by BlackRock led to a surge in ETHBTC from 0.052 to 0.058, indicating increased investor interest in Ethereum.

- Performance of New Coin Launches: Several new coins launched in November, including $TIA, $MEME, $PYTH, $FLIP, and $VRTX, all of which performed well and experienced at least one price pump. This suggests that the current market environment is rewarding new coin launches.

- Impact of Conferences on Coin Performance: Events such as Ripple’s Swell conference and Near’s NEARCON conference influenced the performance of $XRP and $NEAR respectively, with prices typically rising before the event and falling afterwards.

- Effect of Hacks on the Market: Several medium-scale hacks occurred in November, affecting exchanges like Poloniex and Huobi and the HECO bridge. These incidents highlight the ongoing security risks in the crypto market.

Performance of Key Cryptocurrencies

- Outperformance of $SOL: $SOL significantly outperformed the market, despite concerns about selling pressure from FTX. This performance suggests that investors may be reallocating from the Ethereum ecosystem to $SOL.

- Performance of AI Coins: AI coins like $RNDR, $AGIX, $OCEAN, $FET, $AKT, $CTXC, and $PAAL performed well in November, likely due to increased attention following the OpenAI drama.

- Performance of Memecoins: Memecoins like $PEPE and $GROK experienced significant price movements, with $GROK reaching a $150M market cap in 10 days. This suggests that investor interest in memecoins remains high.

- Performance of $ETH and Ethereum Ecosystem: $ETH and the Ethereum ecosystem underperformed overall, likely due to market focus on the $BTC spot ETF. However, the performance of $ETH is expected to improve following the ETF approval.

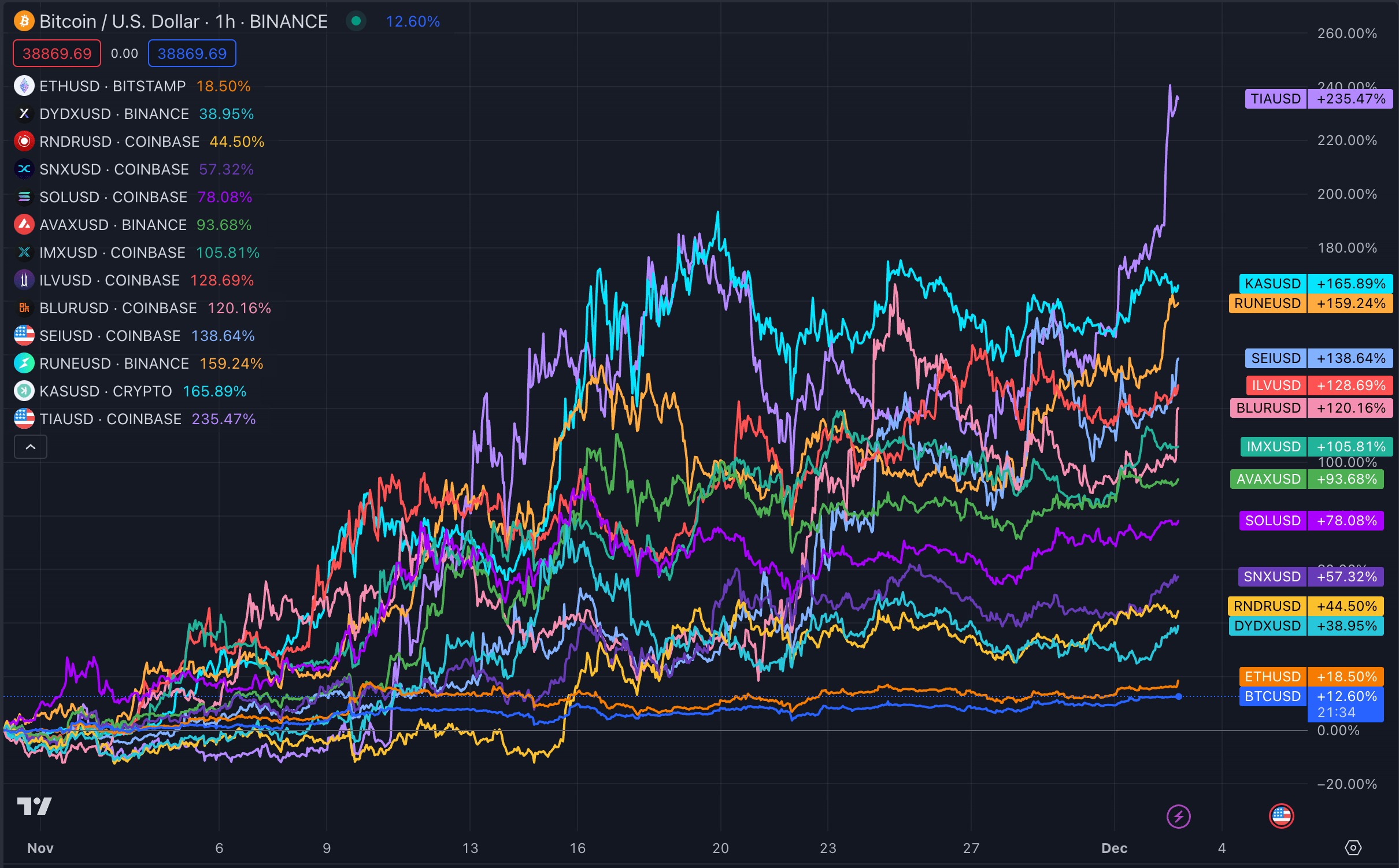

Best-Performing Coins in November

- Top Performers in the Top 100: The best-performing coins in the top 100 over 30 days included $TIA, $TAO, $KAS, $RUNE, $SEI, $BLUR, $ILV, $IMX, $AVAX, $KCS, $SOL, $SNX, $GMT, $RNDR, and $DYDX.

- Top Performers Among Smaller Coins: Among smaller coins, the best performers over 30 days included $BONK, $ORDI, $SUPER, $USTC, $FTT, $PRIME, $SFUND, $BEAM, $ATLAS, and $RON.

Coins to Watch

- Potential Long-Term Position in $BLUR: The success of $BLUR’s season 2 drop and the launch of Blast, an L2 with native yield, led to a price surge in $BLUR. Given its role as a proxy coin for the NFT market, $BLUR could be a good long-term position.

- Performance of $DOGE: $DOGE experienced a typical “up before / down after” pattern following the launch of SpaceX’s Starship, but began to rise again at the end of the month. This suggests that $DOGE, as the “Elon coin”, could be influenced by future developments related to Elon Musk.

- Performance of $DYDX: Despite a major supply unlock on December 1st, the price of $DYDX was not significantly affected, suggesting potential for future performance.

Actionable Insights

- Monitor the Impact of Major Events: Major events such as legal cases, ETF filings, and new coin launches can significantly impact the crypto market. Investors should closely monitor these events and their potential effects on coin prices.

- Consider the Influence of Conferences and Launches: Conferences and launches can influence coin prices, often leading to a rise before the event and a fall afterwards. Investors should be aware of upcoming events and their potential impact on coin performance.

- Assess the Performance of Different Coin Categories: Different categories of coins, such as AI coins, memecoins, and alt L1s, can perform differently in the market. Investors should consider the performance of these categories when making investment decisions.

- Consider Long-Term Positions in Successful Coins: Coins that have experienced success, such as $BLUR, may be good candidates for long-term positions. Investors should research the potential of these coins for long-term growth.

- Watch for Potential Outperformers: Some coins, such as $SOL, have significantly outperformed the market and may continue to do so. Investors should keep an eye on these potential outperformers.