Research Summary

The report provides an in-depth analysis of five Layer 2 (L2) solutions: Scroll, Starknet, Base, Arbitrum, and Mode. It highlights their recent performance, key metrics, and unique features, offering insights into their growth, user engagement, and transaction volumes.

Key Takeaways

Scroll’s Rapid Growth

- Developer Ecosystem Expansion: Scroll experienced a 453% growth in its developer ecosystem in 2023, making it the fastest-growing L2 solution. This growth is attributed to its simple DevX, focus on developer education, and collaboration with Ethereum Foundation contributors.

- Increasing User Engagement: Scroll’s returning contract deployers surged by 460%, indicating robust developer retention. Additionally, Scroll reached a weekly transaction count of over 1.7 million in mid-February 2024.

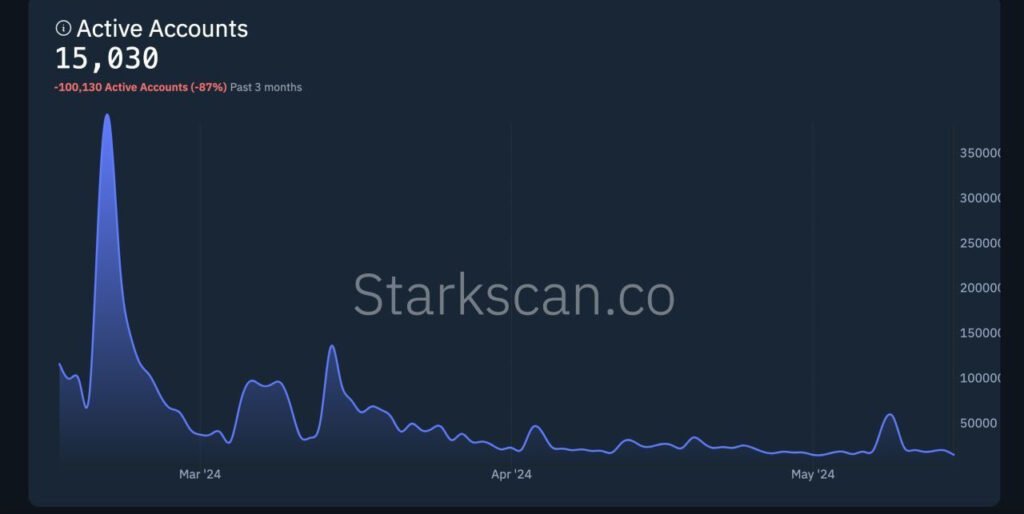

Starknet’s Airdrop Impact

- Token Distribution: Starknet distributed over 586M $STRK tokens to more than 1 million addresses, leading to a significant increase in chain activity. Over 50% of eligible addresses have claimed their tokens, with Starknet mainnet users showing the highest claiming rate at 95%.

- TVL Boost: The $STRK airdrop led to a notable increase in Starknet’s total locked volume (TVL), with $STRK becoming the main asset of Starknet’s TVL at $1.1 billion USD.

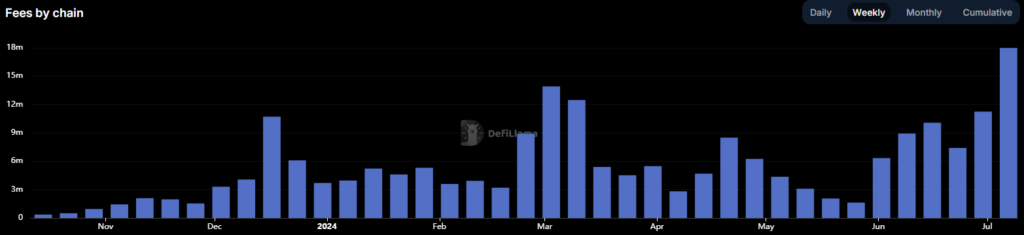

Base’s Transaction Growth

- Transaction Count Increase: Base, an Optimism-powered L2 rollup launched by Coinbase, has seen its transaction count double year-to-date (YTD), while transacting addresses have increased by 40% over the same period.

- Sequencer Profit: The increase in on-chain usage has driven Base’s monthly sequencer profits to 5-month highs, maintaining a profit margin of approximately 20%.

Arbitrum’s Dominance in ETH Assets

- ETH Asset Holdings: Arbitrum One holds $9.5B worth of native ETH and $364M worth of ETH LSTs, making it the largest L2 Chain for ETH assets. It is home to 55% of the wallets holding ETH in L2s and has a 77% market share for ETH held.

- CEX Inflows: Arbitrum One consistently has the most amount of incoming monthly native ETH transfers from centralized exchanges (CEXs), holding almost four-fifths (78%) of the total native ETH inflow from CEXs as of February 2024.

Mode’s TVL Milestone

- TVL Achievement: Mode Network, a modular DeFi L2 based on the OP Stack, recently exceeded $110 million in total value locked (TVL) with over 130,000 addresses that bridged to the network.

- Active Addresses and Transactions: Mode Network has daily active addresses ranging between 13k and 20k, and daily transactions ranging between 110k and 170k. Additionally, between 1.5k and 2k new addresses bridge to the network daily.

Actionable Insights

- Explore Scroll’s Developer Ecosystem: Given Scroll’s rapid growth in its developer ecosystem, it may be beneficial to explore its developer resources and collaborations.

- Monitor Starknet’s User Engagement: Starknet’s high user engagement following the $STRK airdrop suggests a strong community. Monitoring this engagement could provide insights into user behavior and the impact of token distributions.

- Assess Base’s Transaction Growth: Base’s significant growth in transaction count and sequencer profits indicates a robust platform. Assessing these metrics could provide a better understanding of its performance and potential.

- Investigate Arbitrum’s ETH Dominance: Arbitrum’s dominance in ETH assets and inflows from CEXs suggests a strong position in the L2 space. Investigating these metrics could provide insights into its market position and user trust.

- Research Mode’s TVL Growth: Mode’s recent milestone in TVL and its daily active addresses and transactions indicate a growing platform. Researching these metrics could provide a better understanding of its growth trajectory and user engagement.