Research Summary

The report discusses recent governance actions in the crypto space, focusing on Synthetix’s decision to share 20% of base fees with v3 perp integrators, Aragon DAO’s legal action against the Aragon Association, and PancakeSwap’s introduction of veCAKE tokens.

Key Takeaways

Synthetix’s Fee Share Increase

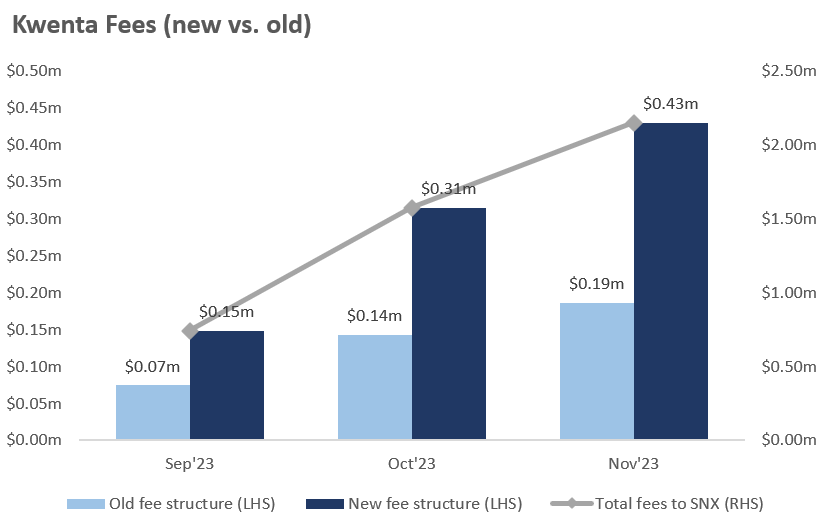

- Revenue Boost for Integrators: Synthetix’s decision to share 20% of base fees with v3 perp integrators, up from the previous 5-10%, is expected to significantly increase integrator revenue. Kwenta, currently the only proxy with a token, is expected to see its fee share from Synthetix more than double.

- Uncertain Transmission to Tokenholders: Despite the higher fees, it remains unclear how much of the fee share will be passed on to tokenholders. Kwenta currently only issues inflationary staking rewards to tokenholders, but discussions are ongoing about distributing incentives from Synthetix to Kwenta stakers.

Aragon DAO’s Legal Action Against Aragon Association

- Precedent Against DAO Grifting: If Aragon DAO’s legal action against the Aragon Association is successful, it could set a precedent against “DAO grifting,” where teams of failed projects continue to draw high salaries from project treasuries despite slowed or halted development.

- Unclaimed Funds: The Association plans to claim any unclaimed portion of the funds from the shuttering of ANT, which could amount to between $69m and $88m, including the $11m the Association plans to retain for “obligations.”

PancakeSwap’s Introduction of veCAKE

- Increased Voting Power: PancakeSwap’s introduction of vote-escrowed CAKE (veCAKE) tokens allows CAKE holders to lock their tokens to receive veCAKE, which they can use to vote for pools to receive additional rewards. Longer lockups are rewarded with more voting power.

- Liquid Derivative of veCAKE: StakeDAO has released a liquid derivative of veCAKE called sdCAKE, which allows users to receive native veCAKE yield and incentives while exiting with no lock period.

Actionable Insights

- Monitor Synthetix’s Fee Sharing: The increase in Synthetix’s fee sharing with v3 perp integrators could have significant implications for integrator revenue and tokenholder returns. Stakeholders should monitor how these changes are implemented and their impact on the market.

- Follow Legal Developments in Aragon DAO Case: The outcome of Aragon DAO’s legal action against the Aragon Association could set a precedent for governance in the crypto space. Stakeholders should keep an eye on the case and consider its potential implications for their own governance structures.

- Assess Impact of veCAKE Introduction: The introduction of veCAKE by PancakeSwap could change the dynamics of voting and rewards in the platform. Stakeholders should assess the impact of this change on their strategies and consider the potential benefits of participating in the veCAKE system.