Research Summary

The report from Ouroboros Research provides an in-depth analysis of various crypto investment opportunities, focusing on Ethena, Wormhole, Fluid vaults, and EigenLayer. It also discusses the potential of Hyperliquid’s new product and Pendle’s growth fueled by LRT and Ethena.

Key Takeaways

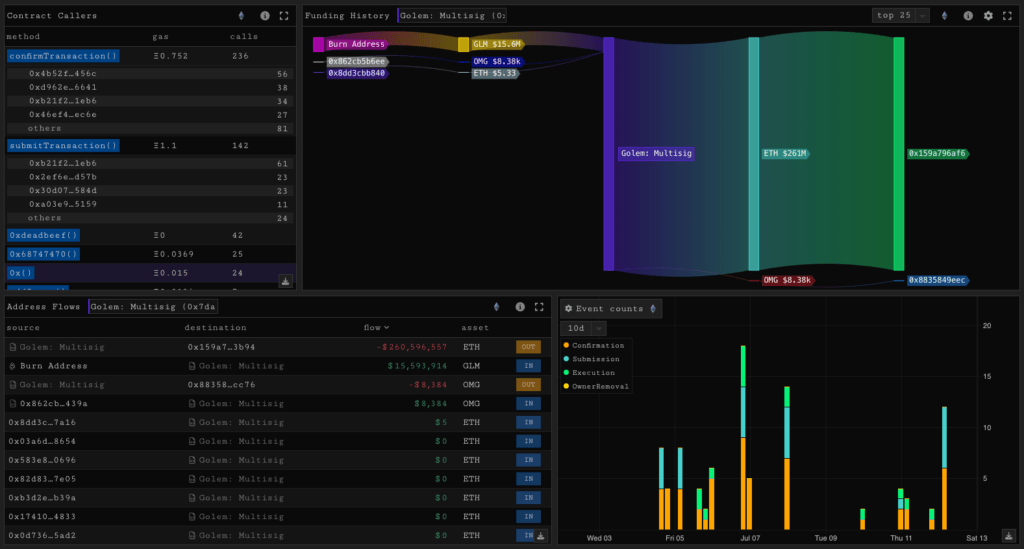

Ethena and Wormhole Airdrops

- Ethena’s ENA Performance: Ethena’s ENA has performed well since the airdrop, trading at $21b FDV. The project plans to allow users to lock up 50% of ENA value to boost their Sats earning rates by +50%.

- Wormhole’s Weak Trading: Despite rumors of a Monad airdrop, Wormhole’s W has traded weakly at $8b FDV.

Fluid Vaults and EigenLayer

- Fluid Vaults’ Success: Fluid vaults filled up quickly following a governance proposal to increase capacity. Borrow rates are now 36%, but the report suggests this is still one of the best LRT farms.

- EigenLayer’s TVL Growth: EigenLayer has attracted $14.7bn or 4.1m ETH in TVL, representing 3.4% of ETH’s total supply. The report provides a calculator to estimate the fair value of each point.

Hyperliquid’s New Product

- On-Chain Spot Order Book Product: Hyperliquid announced it will support native spot trading and launch two permissionless standards. It is also launching PURR, the first coin using the new infrastructure.

Pendle’s Growth

- Pendle’s TVL Growth: Pendle’s TVL has grown exponentially, largely driven by LRTs and Ethena. The report suggests that as the 90+% in TVL worth of Pendle Pools expire, new pools will be spun up.

Actionable Insights

- Monitor Ethena and Wormhole: Keep an eye on Ethena’s ENA and Wormhole’s W for potential investment opportunities.

- Consider Fluid Vaults and EigenLayer: Evaluate the potential of Fluid Vaults and EigenLayer based on their recent performance and growth.

- Explore Hyperliquid’s New Product: Research the potential of Hyperliquid’s new product and its first coin, PURR.

- Watch Pendle’s Growth: Monitor Pendle’s growth, particularly its TVL, for potential investment opportunities.