Research Summary

The report discusses the recent market trends in the cryptocurrency sector, with a focus on Bitcoin’s price volatility and the impact of rumors about the SEC’s approval of the first spot Bitcoin ETF. It also highlights the emerging trend of risk-on sentiment onchain and the performance of new coins like JOE and BLOX. The report further explores the Flooring Protocol, a platform that enhances accessibility and liquidity in the NFT market through fractionalisation. Lastly, it discusses the intensifying competition in the yield-bearing dollar market, with a focus on MakerDAO’s sDAI, Frax Finance’s sFRAX, and Mountain Protocol’s USDM.

Key Takeaways

Bitcoin Market Volatility and the Impact of Rumors

- Bitcoin’s Price Fluctuation: The report discusses a recent incident where a tweet about the SEC’s approval of the first spot Bitcoin ETF led to a 10% increase in Bitcoin’s price, from $27.7k to $30.7k. However, the price dropped back to its original level within an hour after it was revealed that the news was fake.

- Market Reaction: Despite the false news and subsequent price drop, the market quickly started trending upwards again, indicating resilience and a potential bullish sentiment among investors.

Emerging Risk-On Sentiment Onchain

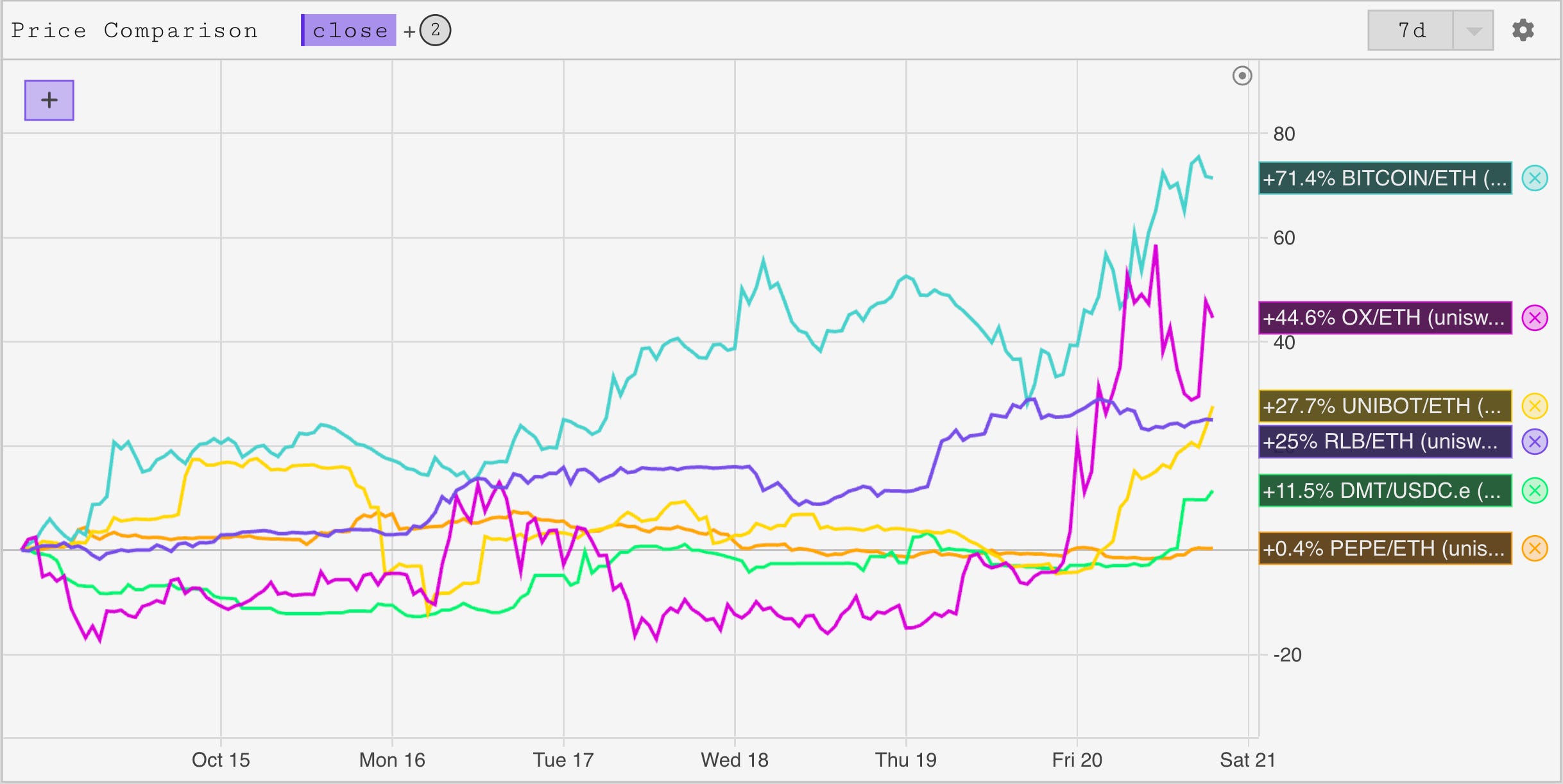

- Risk-On Sentiment: The report notes a growing risk-on sentiment onchain, which could be dependent on the wider market’s performance. The closer we get to the ETF approval deadline in January, the more risk is expected to flow into the system.

- New Coin Performance: New coins like JOE and BLOX have seen sustained price action, indicating a potential increase in onchain activity.

Flooring Protocol and NFT Fractionalisation

- Flooring Protocol: The Flooring Protocol is a platform that enhances accessibility and liquidity in the NFT market through fractionalisation. It allows NFT holders to convert their assets into micro-tokens known as μTokens.

- Innovative Mechanisms: The Flooring Protocol offers two types of deposits, one into a regular pool and one into a safebox, allowing users to retain the premium on their rare NFTs. The protocol has amassed a TVL of around $8m in just a few days.

Competition in the Yield-Bearing Dollar Market

- Yield-Bearing Dollar Products: The report discusses the increasing competition in the yield-bearing dollar market, with products like MakerDAO’s sDAI, Frax Finance’s sFRAX, and Mountain Protocol’s USDM.

- Market Dominance: Despite new entrants like Mountain Protocol, crypto-native providers remain dominant in the yield-bearing dollar market.

Actionable Insights

- Monitor Bitcoin Market Trends: Given the recent price volatility and the potential impact of rumors, it’s crucial to closely monitor market trends and news related to Bitcoin and other cryptocurrencies.

- Investigate the Potential of New Coins: With new coins like JOE and BLOX showing sustained price action, it could be worthwhile to explore these and other emerging coins for potential opportunities.

- Explore NFT Fractionalisation: The Flooring Protocol’s innovative approach to NFT fractionalisation presents an opportunity to enhance accessibility and liquidity in the NFT market. This could be an area worth exploring for potential benefits.

- Consider Yield-Bearing Dollar Products: With the increasing competition and proliferation of yield-bearing dollar products, it could be beneficial to consider these products as part of a diversified investment strategy.