Research Summary

The report discusses Manta Pacific, a new Ethereum Layer 2 (L2) solution. It highlights Manta’s unique approach, its recent fundraising success, and the launch of its incentivized bridging program, New Paradigm. The report also discusses the impact of this program on the value of STONE, a native token, and the potential returns for investors.

Key Takeaways

Manta Pacific’s Unique Approach

- Modular L2 Solution: Manta Pacific is a new Ethereum L2 solution that uses a zkEVM execution environment, leveraging the Polygon CDK and Celestia for data availability. This unique approach is expected to be highly economical and reduce gas costs for end users.

Fundraising Success

- Significant Investment: Manta Pacific raised $25 million at a $500 million valuation in July. This significant investment indicates strong market confidence in Manta’s potential.

New Paradigm Incentivized Bridging Program

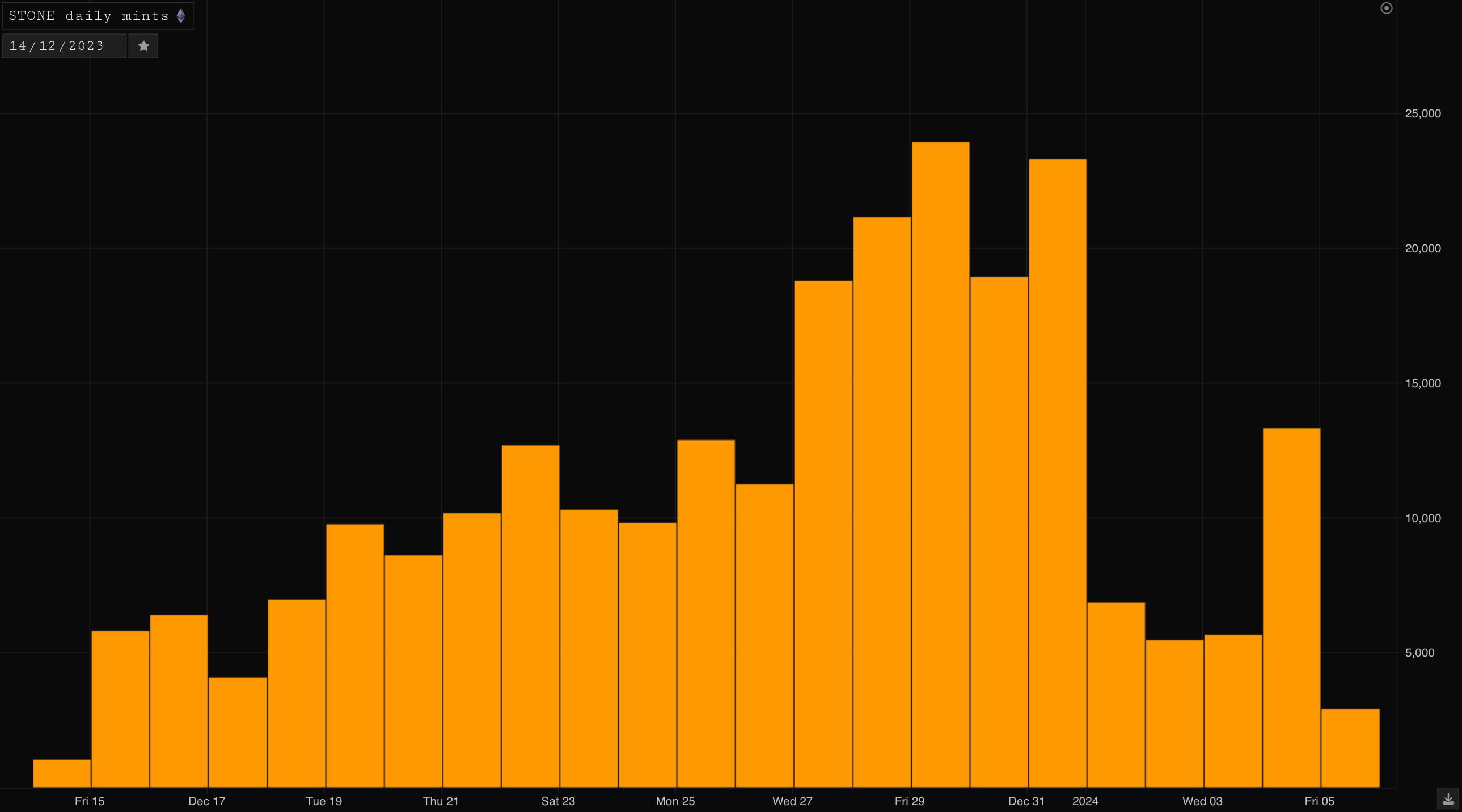

- Impressive Inflows: Manta Pacific launched an incentivized bridging program called New Paradigm on December 14th. The program has seen impressive inflows, with over 250kΞ and $125 million bridged, totaling almost $700 million in bridged value.

Impact on STONE Value

- Depreciation and Stabilization: The New Paradigm program has led to the depegging of STONE, a native token. Users have been bridging ETH to Manta, getting STONE, swapping it for ETH, and repeating the process to earn Box Piece NFTs. This has led to a depreciation in STONE’s value, which has now stabilized around 0.93Ξ.

Potential Returns for Investors

- Expected Realised APR: The report suggests that the expected realised APR from buying STONE at a discount and holding to maturity is roughly 28%, based on current prices and assuming the airdrop to be on January 31st. This could be an attractive proposition for investors, depending on Manta’s valuation and future New Paradigm inflows.

Actionable Insights

- Monitor Manta Pacific’s Progress: Given its unique approach and significant investment, it would be beneficial to keep a close eye on Manta Pacific’s development and market performance.

- Consider the Potential of New Paradigm: The New Paradigm program has seen impressive inflows and has had a significant impact on STONE’s value. It would be worth considering the potential of this program and its impact on the broader market.

- Evaluate Investment in STONE: With the expected realised APR from buying STONE at a discount and holding to maturity being roughly 28%, it could be worth evaluating the potential returns from investing in STONE.